Risk sentiment lingers, but caution stemming from escalating death toll keeps risk assets under consolidative price activity.

Summary: Global equities continue to trade on a positive note over cues from the US, but gains were limited as price action across key assets displayed consolidative tone. Some level of profit booking was also observed before consolidative momentum stabilized in the market.

Given various support measures taken by major central banks across the globe, major indices and stocks are unlikely to see sharp declines similar to the recent past. However, sharp recovery is also unlikely in the immediate future regardless of investor sentiment in the market, as escalating death toll keeps market bulls under considerable pressure.

In the forex market, major currencies paired against US Greenback gained ground as USD continued to weaken over declining safe-haven demand and liquidity infusion measures taken by the US Fed in local and international markets.

Precious Metals: Rare metals are trading positive in the global market, with the price of gold and silver climbing higher in the early Asian session. However, the momentum from USD’s broad-based weakness ebbed shortly, and the only caution lingered in the market resulting in the price of rare metals consolidating near weekly highs.

Crude Oil: Crude oil price remains mostly flat, albeit displaying slight dovish tone in global commodity markets as demand to supply scenario doesn’t show any major improvements. For now, both Brent and WTI futures trade rangebound around the $23.50-$26 handle while traders await US weekly stockpile data.

DXY: USD index, which measures the strength of US Greenback against six major global currencies, continues to remain on the defensive. The value of the index has declined below the 102 handle as safe-haven demand surrounding USD weakened in the global market. Further, QE measures from US Feds also acted as a factor affecting USD demand in the global market resulting in USD’s slow easing in the global forex market.

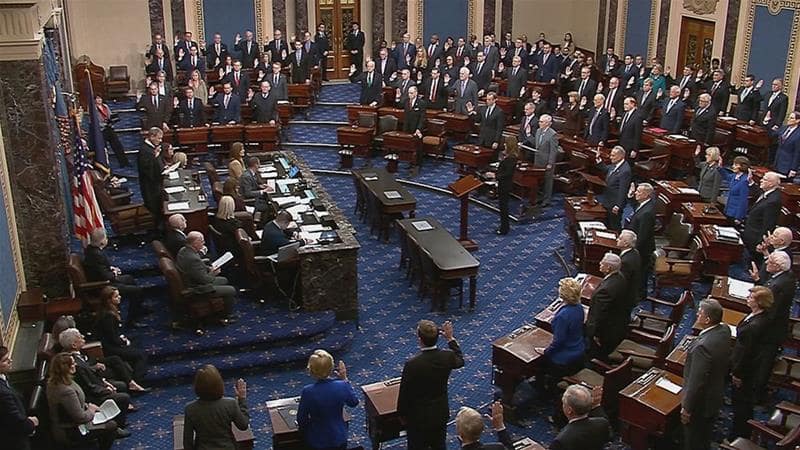

On The Lookout: In the European market, while the topic of issuing a joint debt instrument continues to remains highly discussed, there doesn’t seem to be any concrete progress towards issuing the bonds. US senate finally seems to have come to an agreement on a 2 trillion USD support package, and the vote for the same is set to take place today. The economic support bill seems to include direct payments to US families and an increase in unemployment insurance while also seeing 150 billion USD allocated to the healthcare system and 500 billion USD allocated in support of larger companies. On the economic calendar schedule, the US market will see the release of EIA crude oil inventory data and Core durable goods orders data.

Trading Perspective: Broad-based risk sentiment and cues from the international market suggest Wall Street is likely to see positive price action today. President Trump’s decision to re-open the US economy by Easter also helped improve risk sentiment to some extent as this is a sign that quarantine won’t be for long, resulting in less loss for firms across various sectors. However, US Futures, which were trading in the international market, mostly displayed consolidative tone, which suggests Wall Street is unlikely to see record-level gains or sharp rebound in the trading session today.

EUR/USD: The pair is trading positive in the global market as risk sentiment improved over the news of progress in the US economic support bill and Trump’s comments. Further, USD’s weakness underpins EURO bulls to some extent helping maintain stronghold above 1.08 handle for now. Traders now await US macro data and senate vote for short term profit opportunities.

Please feel free to share your thoughts with us in the comments below.