FBS Review:

The Cyprus-regulated CFD broker with millions of registered customers

BRIEF INTRODUCTION

FBS, incorporated in 2009, is the trading name for Tradestone Limited, a Cyprus-based online STP/ECN broker, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC), with license number 331/17. As a CFD broker providing services to global clients and based in No.1 Orchid Garden Street, Belmopan, Belize, C.A, FBS operates under the name FBS Markets Inc, regulated by the International Financial Services Commission (IFSC), Belize with license IFSC/60/230/TS/19.

According to FBS, categorized as one of the best CFD brokers, over 14 million clients are currently registered with them, even as they open 7,000 + trading accounts every day. If true, this could be a record of sorts that could quickly catapult FBS as the top CFD broker in terms of the account opening speed. Also, on average, the top CFD broker’s clients request withdrawals every 20 seconds, while 80 percent of clients are with FBS for years. Also, the helpdesk resolves client issues in about 30 seconds- FBS could have exaggerated that one a bit. Besides, the primary source of income for about 50% of the CFD broker’s customers is the profit earned from the markets.

FBS has received more than 40 International awards for various categories, such as

- Best forex broker Asia- 2018.

- Best customer service broker- Asia, 2016

- Best safety of client funds- Asia, 2015.

- Best International forex broker.

- Best investor education.

- Best forex brand, Asia 2015.

- Best FX IB program- China 2017.

- Best copy trading application- Global 2018.

- The Most transparent forex broker- 2018.

Coming to the trading conditions, the FBS forex broker pledges high-speed order execution and offers retail clients the choice to trade from a range of FX, metals, energy, and index instruments from two account types- The Standard and Cent. Clients can access all the markets from the top CFD broker’s computer and mobile-based MT4, MT5 platforms. Besides, FBS also has its proprietary FBS Trader, a mobile trading app available for Android and Apple smartphone users.

In terms of trading resources, the top forex broker provides quite a few, including market analytics, trading tools, and forex education- comprising webinars, forex guidebook, video lessons, and the forex glossary.

With over ten years in the markets, supporting their clients 24/7, and a presence in close to 200 countries, a CFD broker comparison would certainly place FBS among the best forex brokers currently offering “Over the Counter” FX CFD trading.

RANGE OF MARKETS

In comparison with other CFD brokers, FBS offers a small range of products across four asset classes- forex, precious metals, crude oil, and stock indices. You can trade 31 FX pairs, four metals, and six CFD futures contracts- comprising the top two varieties of crude oil, and four indices.

All the products are available for trading from any of the CFD broker’s trading accounts-

For clients in Europe, FBS offers the Standard and Cent accounts. You can register for an account with a minimum deposit of €100 and €10 correspondingly.

For global clients regulated by IFSC, the CFD broker offers a variety of the Cent, Micro, Standard, Zero Spread, and ECN account type. The minimum deposits range from $1 for the Cent to $1000 for the ECN Account.

Clients signing-up for the Islamic or swap-free accounts cannot employ the swap-free option for exotic currencies, futures trading in indices, and crude oil. Besides, the forex broker charges a commission for clients using the MT5 platform.

Tabled below are the range of products under the various assets and market segments.

| Asset class/Market segment | Product description | Number of products |

| Forex majors and crosses | 28 | |

| Forex exotics | USDMXN,USDRUB, USDTRY | 03 |

| Precious metals | Gold, Silver, Platinum, Palladium | 04 |

| Commodities futures | WTI, Brent crude oil | 02 |

| Index futures | Dow mini, S&P 500, Nasdaq, and DAX | 04 |

TRADING PLATFORMS

FBS, also considered one of the best CFD trading brokers, provides a range of MT4 and MT5 platforms for all computers and mobile devices. Besides, the CySEC-regulated broker also gives clients the option of using the proprietary mobile platform- the FBS Trader.

In our review of the trading platforms offered by the FBS forex broker, we physically analyzed the MetaTrader-5 web, desktop, and the FBS exclusive mobile trading terminal from a demo account. Here is our review

The MT5 desktop platform-

The MetaTrader 5 is a multi-asset trading platform from MetaQuotes that allows users to trade forex, financial instruments trading on exchanges and futures contracts. The platform offers advanced financial trading functions and excellent fundamental and technical analysis tools. Clients can also execute automated trading on the MetaTrader 5 by employing the readily-available trading robots and signals or creating their own.

If you are using the desktop application, you can access 134 trading instruments provided by the FBS forex broker, and as stated by the broker on the site, the order execution is in the blink of an eye.

On the flip side, the top CFD broker has not included any custom features in the MetaTrader desktop application, and the news articles from third-party sources were outdated by more than a month, very disappointing indeed. Even without the custom trading tools, the platform has several readily-accessible trading features that make it one of the top trading terminals for forex and CFD trading.

Some of the primary features of the MT5 desktop trading terminal-

- The multi-lingual platform supports 41 global languages, including English.

- You can access two order accounting mode: The netting mode for exchange-traded markets, and the hedging method for Forex and CFD trading.

- MetaTrader 5 provides an advanced Market Depth feature that comprises a tick chart with time & sales data.

- The Stop Loss and Take Profit options are there to help secure profits and minimize losses.

- The terminal equips traders with the full arsenal of analytical tools to carry out detailed price analysis and forecasting.

- The MetaTrader 5 charting includes 21 time-frames, from one-minute to one-month.

- You can open up to 100 charts and monitor all the available financial instruments.

- MetaTrader 5 comes with more than 80 technical indicators and analytical objects for detailed price analysis.

- You can download additional indicators, purchase, or order them from the MetaTrader 5 services, such as the CodeBase, the market of applications, and the Freelance services.

- Lastly, the MT5 provides a built-in market of trading robots, a freelance database of strategy developers, copy trading, and the virtual hosting service (VPS).

The MT5 web terminal-

The web platform allows you to access FX, exchange, and futures markets from any browser or operating system. Most of the features of the MT5 desktop platform are directly accessible from the web without the need to download or install the application. All you have to do is, log in to your account and start trading in a couple of clicks. The MT5 offers a perfect solution for traders unable to install the desktop or mobile application due to issues with the firewall in a work environment or for any other reasons. The other key feature is the accounting modes that support both the exchange-traded netting of trades and the CFD trading mode of hedging positions.

Some of the primary features of the MT5 web trading terminal-

- Just like the desktop platform, the multi-lingual trading terminal supports 41 global languages, including English.

- Trade all CFD instruments offered by the broker.

- The platform is accessible across all browsers, including Windows, Linux, and Mac.

- The terminal comes with the full set of order types, including pending and stop orders.

- You can execute a range of trading operations, including one-click order placements from multiple panels in the workspace.

- Access the advanced market depth feature with one-click trading.

- The platform supports the three basic chart types in nine-time frames- One minute- one month.

- Access the full range of 30 technical indicators and 24 graphical objects to carry out in-depth technical analysis.

• It provides reliable data protection where all transmitted information is securely encrypted.

The FBS Trader-

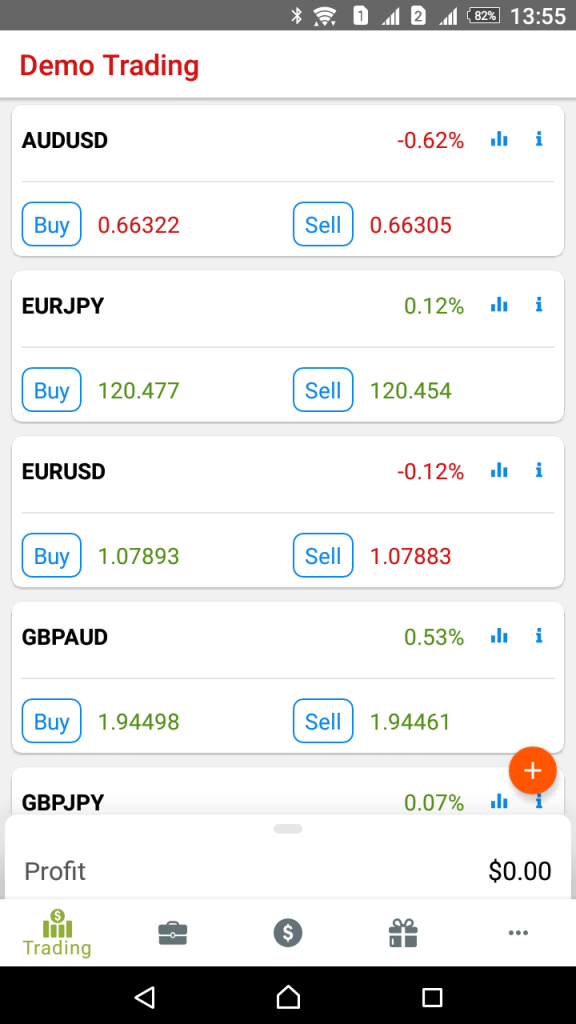

The FBS mobile trading app gives you access to only the cash/spot market instruments offered by the top CFD broker. You can access the app using multiple security features like fingerprint, pin, and password, although the top CFD broker is not very particular if clients follow the security parameters for a demo account. We were able to skip all the login protocols and directly connect to the mobile app from a Gmail account. Once logged in, we found the app very simple and lightweight, with all the main trading parameters separated as individual panels, and accessible via the menu at the bottom of the workspace.

Since it’s a simple application, you can only monitor a few activities on the handheld trading terminal. In our CFD broker review, we tested the app on an Android device and have underscored all the features plus the negatives below.

Key highlights of the mobile trading app-

- You can monitor the watchlist, charts from the same panel.

- The software supports two chart types in nine-time frames.

- The INFO button beside the chart icon gives you a detailed description of the instrument, including the price range for the period and the swap rates.

- The app includes the market, pending orders, and clients can also include the stop loss/take profit option.

- You can trade FX from the micro lot size (0.01 or 1000), while the minimum lot size for equities is 1.

- In the orders panel, you can view active, closed orders, and exit positions one by one.

- Deposit/withdraw funds and view your transactional history.

- Update your profile, login history, margins, and choose your leverage from 1:1- 1000:1

- Instantly switch from the demo to a real account.

Some of the negatives of the FBS Trader-

- The default watchlist panel comprises of a small number of trading instruments with the option to include a few of your favorite scrips. However, once you reach the max limit of 15-products, you can add additional scrips only after deleting some of the existing ones, a major, major drawback.

- The mobile app is not in sync with the MT terminals. So, users looking to alternate their trading activities between the computer and the mobile app will not be able to do so.

- The app does not support derivatives, so users cannot trade in the CFD futures contracts offered by the top forex broker.

- Chartists are sure to be disappointed since the FBS has not included any indicators in the app. Besides, there are no drawing tools, and you cannot even expand the charts.

- Finally, the app may be useful if you are placing a couple of trades every once in a while. However, if you are a regular trader, the MT4 or MT5 mobile terminals would be more suitable for you.

TRADING CONDITIONS - Spreads, margins, and orders -

In our extensive review of the top CFD broker, we analyzed the trading conditions comprising the spread, margins, order types, and the speed of order execution by FBS. The trading conditions, especially the bid-ask range and orders are related to the account type, the policy and the trading platform offered by the forex broker, while the margins depend on the following three conditions-

- The financial instrument you are trading-

Highly volatile CFD trading products, financial instruments that tend to gap, and those with low liquidity attract higher margins compared to the ones that are low to moderately volatile and highly liquid. Therefore, CFD trading in cryptocurrencies, stocks, indices, and a few commodities draw higher margins compared to the major FX pairs and commodities like gold.

- Regulators governing the CFD broker-

Financial market regulators generally do not interfere in the margins offered by FX brokers to retail clients. However, there are a few overriding agencies, including the likes of CySEC and FCA, where the minimum margins are a part of the guidelines, and CFD brokers registered with them have to comply or face penalties.

- Risk policy and comparative margins of the other CFD brokers-

The best CFD brokers compile the trading risk and compare the margins of the other CFD brokers, before arriving at the lowest possible margins that they can offer retail clients.

Margins are a double-edged sword- While higher margins curtail traders from generating larger volumes, they also protect them during adverse market conditions.

The following table illustrates the trading conditions at FBS for global clients coming under the regulations of

The International Financial Services Commission (IFSC)

| ACCOUNT COMPARISON | CENT ACCOUNT | MICRO ACCOUNT | STANDARD ACCOUNT | ZERO SPREAD ACCOUNT | ECN ACCOUNT |

| Initial deposit | From 1$ | From 5$ | From 100$ | From 500$ | From 1000$ |

| Spread | Floating spread from 1 pip | Fixed spread from 3 pips | Floating spread from 0.5 pip | Fixed spread 0 pip | Floating spread from -1 pip |

| Commission | 0$ | 0$ | 0$ | From 20$/lot | 6$ |

| Leverage | Up to 1:1000 | Up to 1:3000 | Up to 1:3000 | Up to 1:3000 | Up to 1:500 |

| Least margins | 0.1% | 0.33% | 0.33% | 0.33% | 0.2% |

| Max open positions/ pending orders | 200 | 200 | 200 | 200 | No trading limits |

| Order volume | From 0.01-1 000 cent lots | From 0.01-500 lots | From 0.01 to 500 lots | From 0.01-500 lots | From 0.1-500 lots |

| (with 0.01 step) | (with 0.01 step) | (with 0.01 step) | (with 0.01 step) | (with 0.1 step) | |

| Market Execution | From 0.3 sec, STP | From 0.3 sec, STP | From 0.3 sec, STP | From 0.3 sec, STP | ECN |

Source: FBS

An overview of the trading conditions offered by the top CFD broker throws up mixed views. The account opening charges are reasonable, while the margins, when compared to the other CFD brokers are shallow for all the account types, excluding the ECN account. Traders subscribing to these low-margin accounts are subjecting themselves to high-risk trading, despite the forex broker curtailing the max open positions to 200 lots, again on the higher side.

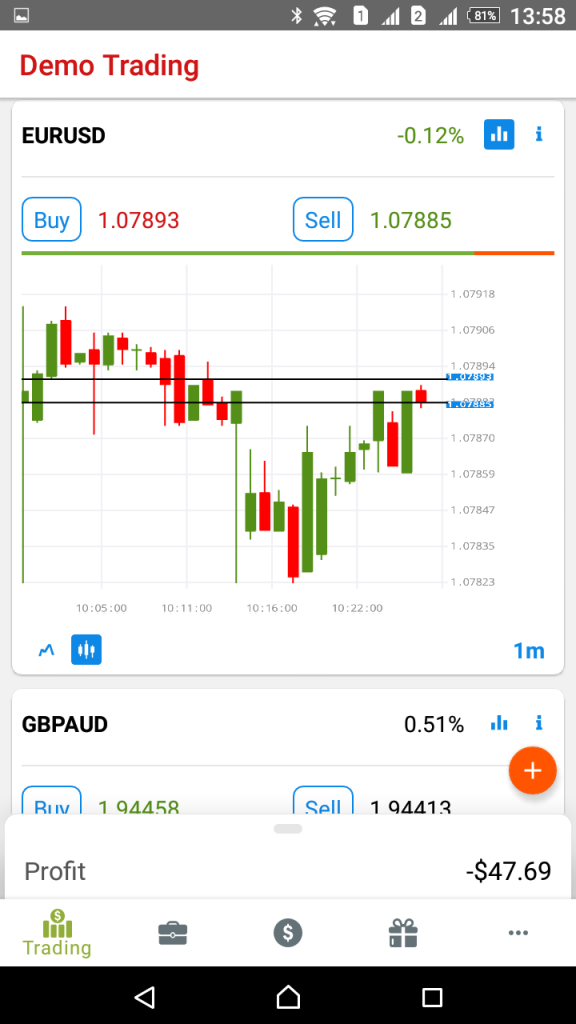

When it comes to the spread, they are expensive for the Micro, Zero Spread, and the ECN Accounts. For the Standard Account, though the forex broker claims a variable bid-ask range starting from 0.5 pips, in our review of the CFD demo trading platform, we found the EUR/USD pair oscillating between 0.8-1.0 pip most of the time.

The order size at FBS largely depends on the account type. For the Cent Account- the order size varies from 0.01- 1000 cent lots, while for the other account types excluding the ECN account, they range between 0.01- 500 lots. The order size for the ECN Account is 0.1-500 lots. According to the top CFD broker, the order execution speed for all the account types starts from 0.3 seconds.

On the order types, the MT platforms support all types of orders, including the instant, market, pending, trailing, and the SL/TP orders. Besides, clients can place one-click orders from multiple panels in the workspace.

EDUCATION

In the context of educational resources, the FBS CFD broker provides several trading tools and educational materials to support all categories of traders.

The trading tools include the global economic calendar, trading calculator, and the currency converter. The economic calendar is available in multiple timeframes and split into currencies and stocks. You can also filter the data to your requirements by choosing the time frame, region/s, and the likely impact of the release.

The trading calculator, on the other hand, is used to determine your margin levels based on inputs like the account type, trading instrument, lot size, leverage, and the price.

An illustration of the trading calculator

When it comes to customer education, the top CFD broker provides quite a few resources like the forex books and guidebook for all classes of traders- from beginners to experienced. There are some interesting topics covered, like trading divergences, harmonic patterns, Elliott wave analysis, Heiken Ashi and Renko charts, techniques for position sizing, fundamental analysis, risk management, and lots more. Under forex books, you can view some of the top selection of books and subscribe to them via Amazon.

The other educational resources include tips for traders, a glossary of forex terms, numerous video lessons on trading, MT4, forex terminologies, risk management, FBS promotions, seminars, and webinars.

CLIENT SUPPORT

Residents of Europe and the UK can get in touch with the top CFD broker via phone, email, and live chat, while global clients have the option of the live chat and callback request. While the website is accessible in 12 languages, the callback is only available in English. Besides, if you have questions about the products and services offered by FBS or are looking for any other info, you can go to the FAQ section, where you will find tons of answers on subjects ranging from registration & verification to loyalty programs.

We also reviewed the Live chat and found the initial response time a little slow when you compare other forex brokers. We were third in the queue, and it took more than a minute for the support staff to reach us. Also, the speed of responses to our questions was sluggish. According to our review, this is one area where the broker needs to show some improvement.

Tabled below are the various client support channels in case you wish to get in touch with FBS

| Phone | +357 25313540 |

| [email protected] | |

| Fax | +357 25313541 |

| https://www.facebook.com/fbseurope | |

| Telegram | https://t.me/fbsonlinetrading |

| https://twitter.com/FBS_news | |

| Youtube | https://www.youtube.com/user/FBSforex |

| https://www.instagram.com/FBS_forex/ |

SUMMARY

FBS is a no dealing desk (NDD), STP/ECN broker based out of Limassol, Cyprus. If you are a trader looking for a legit broker and are in the process of carrying out a CFD broker comparison, then you will find several reasons that make to trade with FBS. Here are some of them-

- FBS is an A-book STP/ECN no-dealing desk broker. So, the CFD broker does not take the opposite side of your trade. Instead, all your orders are passed on to the market and filled by liquidity providers.

- FBS is under some of the best supervisory agencies governing forex CFD brokers.

- The CFD broker provides numerous resources in terms of market analytics and free educational material.

- Regarded as one of the best CFD brokers in the industry, FBS supports multiple funding methods.

- The top forex broker has won several accolades, including for the most transparent broker, the best CFD broker for securing client funds, investor education, and customer service.

- Compared to other forex brokers, FBS provides a wide choice of advanced trading tools and market analytics, including Forex TV.

Clients concerned about the safety of their deposits can be sure that the CFD broker’s tier-I regulations will shield them from any unauthorized activity by FBS. Clients registering with FBS in Europe also come under the stringent MiFID II framework, besides the Investor Compensation Fund (ICF), which protects investors up to €20,000 if the broker goes under administration. Also, FBS pledges to secure client deposits from going into a negative balance, with in-built margin calls and stop out levels integrated into all the platforms.

However, there are a few areas where we found the broker wanting, and they include the range of products, thin margins, and the quality of customer support.

Summarizing the pros and cons, the positives outweigh the negatives by a considerable boundary, making FBS forex an excellent broker for retail clients to consider.