HYCM Review:

A comprehensive analysis of the 40+ old multi-asset CFD broker

BRIEF INTRODUCTION

HYCM is the trading name of Henyep Capital Markets Group, the holding company of Henyep Capital Markets (UK) Limited, HYCM (Europe) Ltd, Henyep Capital Markets (DIFC) Limited, HYCM Ltd, and HYCM Limited. Incorporated in 1977, the HYCM Group is one of the oldest in the industry, offering more than 300 financial products across five asset classes plus Exchange-traded funds (ETFs). The product offering, accessible from three account types, including the Raw spread account, is delivered across the cutting edge MT4 and MT5 platforms. When it comes to the trading spread, the top CFD broker offers fixed, variable, and raw spreads from 0.2 pips with max leverage of 200:1.

The subsidiaries of HYCM are operating in several regions and come under the regulations of the financial supervisory authority of the respective country, making HYCM one of the most extensively regulated FX broker.

The watchdogs and licenses governing HYCM include-

- Henyep Capital Markets (UK) Limited- Authorized and regulated under the Financial Conduct Authority (FCA) with reference number 186171.

- HYCM (Europe) Ltd- Authorized and regulated under the Cyprus Securities and Exchange Commission (CySEC) under license number 259/14.

- HYCM Ltd- Authorized and regulated under the Cayman Islands Monetary Authority under reference number 1442313.

- Henyep Capital Markets (DIFC) Limited- Authorized and regulated by the Dubai Financial Services Authority with license number 000048.

- HYCM Limited- is an International Business Company registered in Saint Vincent and the Grenadines with registration number 25228 (IBC 2018).

If you are looking for an experienced, multi-regulated broker, then you should undoubtedly register with HYCM and get a feel of the CFD trading facilities offered by one of the top forex CFD broker’s in the industry.

RANGE OF MARKETS

At HYCM, the CFD trading instruments include more than 300 products, comprising forex, commodities, cryptocurrencies, indices, stocks, and ETF’s. While the products offered by one of the best CFD brokers include prices from the underlying spot markets, clients can also trade in a variety of futures CFD contracts in commodities and stock indices.

Clients can access financial products from either of the three account types- Fixed, Classic, or Raw. While the products available for CFD trading can vary depending on the kind of account registered with the broker, the MT5 platform has a broader range of instruments compared to the MT4.

In our CFD broker review, we briefly analyze each of the asset classes separately before tabling the range of products listed under them.

Underlined below is a quick description of the asset classes and the ETFs available for trading-

- Forex- Trade in a variety of major, minor, and exotic currencies with the top forex broker. HYCMs forex offering also includes multiple lot sizes- starting from the micro-lot to the standard lot.

- Commodities- HYCM’s range of commodities CFDs include precious metals, energy, and softs, with gold and silver pitted against the euro as well. Following is the breakup of the commodities under various categories

- Precious metals- Gold, silver, Platinum, and Palladium.

- Energy- Natural gas, Brent and WTI crude oil.

- Soft commodities- Coffee, Sugar, Cocoa, and Cotton.

Besides CFD trading in the underlying spot market prices, you can also access futures CFD contracts in most of the commodities.

- Cryptocurrencies- The digital currency offering from HYCM comprises ten cryptocurrencies, including the likes of Bitcoin, Ethereum, Litecoin, and Ripple.

- Indices- The top CFD broker offers a mix of spot and futures CFD contracts on some of the major global stock indices trading in the Americas, Europe, and Asia. The break-up includes 12 spot indices and 16 index futures.

- Shares- Clients can access more than 60 share CFDs listed on the American and European stock exchanges. Some of the key names include Apple, Facebook, Google, Tesla, Citigroup, Deutsche Post, Volkswagen, Allianz, and Uber.

- ETFs- The Exchange-traded fund offering from HYCM includes all the major trusts like ProShares, VelocityShares, SPDR, and iShares. These products are, however, available only on the MT5 platform.

| Financial Instrument | Number of products on MT4 | Number of products on MT5 |

| Forex | 46 | 69 |

| Commodities | 15 | 17 |

| Cryptocurrencies | 05 | 14 |

| Indices | 16 | 28 |

| Stocks | 09 | 61 |

| ETFs | – | 20 |

TRADING PLATFORMS

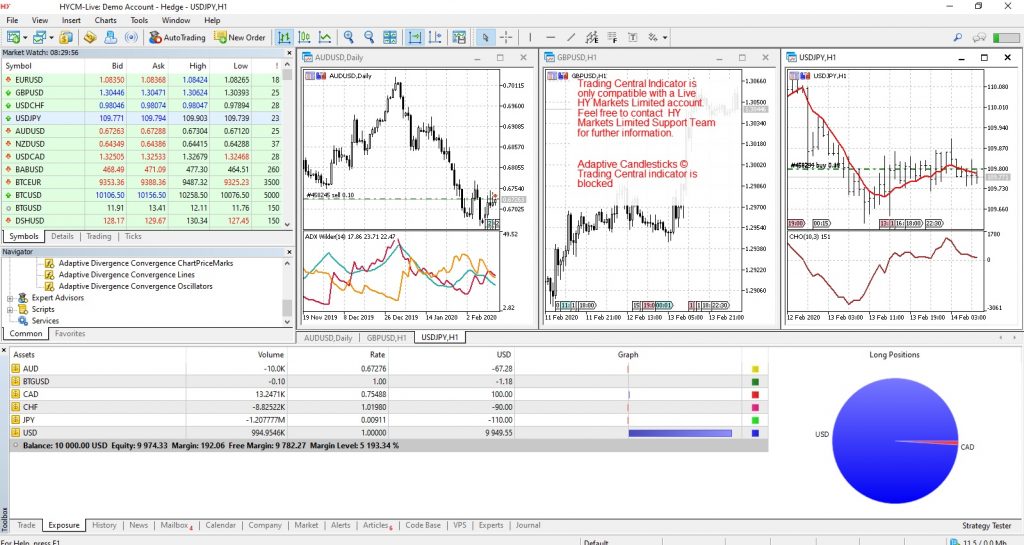

HYCM is a MetaTrader CFD broker, offering all clients the choice of MT4 and MT5 platforms across computers and mobile devices. In our review of the top CFD broker, we analyzed the HYCM MetaTrader 5 platforms from a Classic demo account and recorded all the essential functions and trading features, including the broker’s custom offerings below.

The HYCM MetaTrader 5 desktop trading terminal-

The default MT5 is a multi-asset trading software that supports exchange and CFD trading from the two order accounting modes- The netting option for exchange-traded instruments and the hedging model for forex CFD trading. The default workspace includes the market watch, charts, navigator, and toolbox. The watchlist supports 46 column headers, although a majority of them do not support CFD trading. The chart types include the line, candlestick, and the bar in 21-time frames, from one minute to one month. The live charts support 38 technical indicators and 44 analytical tools, advancing your technical analysis options.

Besides, the CFD trading terminal accepts all types of orders besides giving you access to the MQL5 development environment from where you can build custom technical indicators, trading robots, and other trading applications.

Some of the key features of the HYCM MT5 desktop platform-

- Access 244 trading instruments from one of the best globally-renowned CFD brokers.

- The multi-lingual platform supports 52 global languages, including English.

- Monitor the watchlist in two-modes- Symbols and Trading.

- You can open up to 100 charts on the platform.

- The order execution is complete in the blink of an eye.

- Access market-depth and the live time & sales action.

- Monitor the live global economic calendar in multiple time-zones.

- Ability to place price alerts.

- As part of HYCM’s custom offering, you can download the Trading Central plugins and access a range of technical analysis tools, although they are accessible only with a live account.

- You can go to one of the largest trading app store and purchase ready-to-use trading robots and indicators.

- Traders can also order trading robots from professional developers.

- Operate your trading robots 24/7 from the in-built Virtual Hosting service.

The HYCM MetaTrader 5 web trading terminal-

The web terminal is similar to the desktop version except for a lower number of analytical and drawing tools plus the unavailability of the automated trading feature. The default workspace includes the market watch, charts, and toolbox. The watchlist supports only five-column headers, and clients can choose to place market and pending orders from the panel, or drag and drop symbols into the charting window to monitor real-time charts and carry out technical studies.

The chart types include the line, candlestick, and the bar in nine-time frames, from one minute to one month. The live charts support 31 technical indicators and 22 analytical tools, far lower than the desktop terminal.

Some of the key features of the HYCM MT5 web platform-

- You can access 236 trading instruments on the web application, slightly lower than that available on the desktop platform.

- The multi-lingual platform supports 41 global languages, including English.

- Supports all the major order types, including instant, market, pending, stop, trailing stop, fill or kill, and the SL/TP.

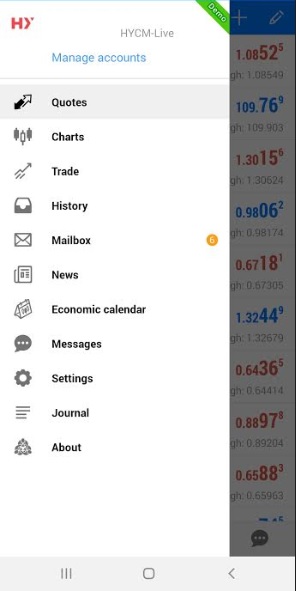

The HYCM MetaTrader 5 mobile trading application-

The MT5 mobile trading app provides round the clock access to the CFD and exchange-traded markets from your smartphone or tablet. The handheld application supports Android/ iPhone devices and can be quickly downloaded and installed from the Apple App Store or the Google Playstore.

The App supports most of the features available on the desktop terminal except for some drawing tools and the automated trading facility. The technical analysis tools include 30 indicators and 24 graphic objects, with an integrated chat feature.

For our top CFD broker review, we analyzed the MT5 app from an Android device and have highlighted all the key features of the HYCM MT5 mobile platform-

- The terminal supports the netting and hedging accounting systems.

- You can monitor three chart types in nine-time frames.

- The app also has the in-built market depth feature, besides supporting all kinds of trading operations.

- You can place all the order types, including pending and trailing.

- The terminal features alerts and push notifications.

- Monitor your open positions, go to the History tab to view your earlier trades, or use the SL/TP order to close profitable positions or to minimize losses.

TRADING CONDITIONS - Spreads, margins, and orders -

In our CFD broker review, we analyzed the trading conditions, comprising the spread, margins, and orders at HYCM. Let’s take a look at each one of them individually, but before that, a quick understanding of how the account types play an important role in defining the trading conditions, especially the spread.

The top forex broker provides clients the option of three account types besides the VIP, Islamic, and Corporate accounts. All the account types come with negative balance protection, and the top CFD broker has given clients the choice of funding the trading account in five base currencies.

Here’s a brief description of the three primary account types-

- Fixed Account- These have a fixed spread, starting from 1.8 pips and zero commission. The minimum initial deposit is $100, the minimum trade size is 0.01, and is also available as an Islamic Account. The one drawback is that clients are not allowed to access Expert Advisors (EA’s)

- Classic Account- These have a variable spread, starting from 1.2 pips and zero commission. The minimum initial deposit is $100, and the minimum trade size is 0.01. It is available in the Islamic Account format, and clients can also access Expert Advisors (EA’s).

- Raw Account- These come with a Raw Spread, starting from 0.2 pips and a commission of $4 per round transaction in FX. The minimum initial deposit is $200, and the minimum trade size is 0.01. It is available in the Islamic Account format, and clients can also access Expert Advisors (EA’s).

Based on the account types, the top CFD broker offers three kinds of spread- Fixed, variable, and raw. The fixed spread is the widest of the three, while the bid-ask range for the Raw Account is the least for FX and spot commodities. However, the forex broker charges a commission of $4 and $5 per round transaction in the two asset classes correspondingly. For all the other products, the spread on the Variable and Raw Accounts are the same.

A quick analysis of the spread plus commission on the Raw Account and HYCM would easily qualify as one of the lowest spread CFD brokers in the industry.

When it comes to margins, they largely depend on the financial instrument and the regulations governing the forex broker. HYCM, also regarded as one of the best CFD brokers in the industry, offers the lowest margins to clients signing up with HYCM Ltd, authorized and regulated by the Cayman Islands Monetary Authority. Retail clients registering with HYCM Capital Markets (UK) and HYCM Europe Ltd have the highest margins or the least leverage due to the stringent regulatory guidelines on the margins offered to retail clients.

For FX major and minor pairs, HYCM uses the dynamic leverage model for clients accessing the MT4 platform. So clients can leverage up to 500:1 when compared to the max leverage of 200:1 on the MT5 trading terminal.

In the following table, we have highlighted the leverage for all the financial instruments offered by the broker under various subsidiaries. To convert leverage to margin, use the following formula

Margin = (1/leverage) * 100

| ASSET CLASS | HYCM LTD (CIMA) | Henyep Capital Markets (UK) Ltd (FCA) | HYCM (Europe) Ltd (CySEC) | |

| MT5 | MT4 | MT4 & MT5 | MT4 & MT5 | |

| FOREX (MAJORS) | 1:200 | 1:500 (Dynamic) | 1:30 | 1:30 |

| FOREX (MINORS) | 1:200 | 1:500 (Dynamic) | 1:20 | 1:20 |

| FOREX (EXOTICS) | 1:100 | 1:20 | 1:20 | |

| CRYPTOCURRENCY | 1:20 | 1:2 | ||

| COMMODITIES (SOFT) | 1:50 | 1:10 | 1:10 | |

| COMMODITIES (ENERGY) | 1:67 | 1:10 | 1:10 | |

| INDICES (US) | 1:100 | 1:20 | 1:20 | |

| INDICES (EU) | 1:100 | 1:20 | 1:20 | |

| INDICES (INDIA, CHINA) | 1:33 | 1:10 | 1:10 | |

| INDICES (OTHER) | 1:100 | 1:10 | 1:10 | |

| PRECIOUS METALS (GOLD) | 1:133 | 1:20 | 1:20 | |

| PRECIOUS METALS (OTHERS) | 1:67 | 1:10 | 1:10 | |

| STOCKS (US) | 1:20 | 1:5 | 1:5 | |

Coming to order execution, HYCM pledges superior liquidity and high-speed order execution, with the average order execution speed recorded at 12 milliseconds. HYCM is a market-making broker and acts as the sole execution venue or the counterparty to every transaction executed by the client. Clients are allowed to hedge positions, but the CFD broker does not permit scalping.

Following are some points of HYCM’s order execution policy for retail and professional clients,

- The execution risks include slippage, delays in order placement due to technical failure/ malfunction, and price gaps.

- The CFD broker promptly records all orders executed on behalf of clients.

- Carries out comparable client orders sequentially.

- In the event of a difficulty in carrying out orders promptly, the forex broker immediately informs clients of the issue.

When it comes to the order types, the MT4 and MT5 terminals support a range of orders- from instant, market to pending. Clients can execute one-click, market, limit, stop, trailing stop, and the SL/TP orders from multiple panels within the workspace.

EDUCATION

When it comes to educational resources, the forex broker in Australia provides a massive collection of online material to assist beginners and experienced traders alike. The informative content is in addition to a large number of trading features on their MT4 platforms.

Here are some of the contributions of the AxiTrader CFD broker towards educating clients on the forex and CFD markets.

Basics for beginners – These cover online reading material for beginners to get started with forex trading. Besides answering some fundamental questions on forex, the Basics also includes instruction videos of practice accounts, links to in-depth education, technical analysis, trading platforms like MT4, etc. The other topics covered under Basic knowledge include forex glossary, basics of CFDs and Indices, and slippage.

Online Training – If you are not very familiar with how to use your MetaTrader 4 platform, the video tutorials provided by the CFD broker should undoubtedly help you. The free downloadable ebooks include tips to use charts, entry/exit strategies, position-sizing, system monitoring, and lessons on the forex markets. The other resources comprise technical analysis with a link to the broker’s blog and the education center where you can watch videos on trading strategies, technical indicators, etc.

CLIENT SUPPORT

HYCM offers quite a few resources when it comes to educating beginners and experienced traders. The educational undertakings of the CFD broker broadly comprise-

- Knowledgebase- Here, the top CFD broker has designed several ebooks, informative financial articles, a forex course for beginners, MT4 videos/ tutorials, and trading strategies, all of which are tailor-made to enhance your trading skills. Some of the topics covered under this category include capital management, ebooks on forex, commodities, CFDs, and futures, market analysis, technical analysis, and trading psychology.

- Webinars and Workshops- The webinars organized once a week help prepare traders for the forthcoming sessions by analyzing key market-moving events ahead of time. The topics covered in the online classroom workshop include breaking down market sentiment, organizing for the key events, and Q&A sessions.

- Live seminars- These are one-day live programs aimed at assisting individuals to understand the habits and techniques followed by professional traders. The event, organized by HYCM’s chief currency analyst, is by invitation-only.

SUMMARY

HYCM provides 24/5 customer support via live chat, social media, email, and telephone, although the email and telephone lines may not be available on all the subsidiary websites of the top CFD broker. Besides live chat, users can access the HYCM sites in 13 languages or find answers to some of the common questions under the FAQ section.

As part of our review of one of the best CFD brokers, we interacted with the live chat team several times but did not find anything exceptional about the quality of support, even if we compare CFD brokers with lesser experience. For a start, there were occasions where the live chat was not functioning on weekdays, and even when they were, the initial response time was close to a minute. Added to that, the time taken to respond to questions about the CFD broker’s offering was anywhere between 0.30 seconds to two minutes, reasonably slower to the other forex brokers. We believe that HYCM has to catch up to improve the experience of the client helpdesk if it has to meet the standards set by the other top CFD brokers.

Illustration of the various support channels to get in touch with HYCM, one of the oldest and best CFD broker in the industry