ACY Securities Review:

A detailed analysis of the products-services of the ASIC-regulated ECN broker

BRIEF INTRODUCTION

ACY Securities, founded in 2013 as ACY Capital, is a multi-asset STP-ECN retail CFD broker operating from New South Wales, Australia. Following its acquisition of Australia’s leading FX dealer- Synergy Financial Markets (Synergy FX) in September 2018, the top CFD broker re-branded as ACY Securities in March 2019.

The ASIC regulated forex broker’s primary offering comprises more than 60 financial products in the forex, commodities, cryptocurrencies, and the stock indices space. Besides that, ACY allows clients access to the Offshore Chinese Yuan (CNH) that broadly represents the business transactions of the Renminbi outside the country’s borders. Domestic and foreign investors use the currency, which is funded by the People’s Bank of China and the Hong Kong Monetary Authority for trading.

Clients can register with ACY Securities from either of the three account types- stpECN, zeroECN, or pureECN, with a minimum initial deposit of $100, $2,000, and $20,000 correspondingly. When it comes to trading conditions, the CFD broker’s smallest trade size comprises of the micro lot (0.01), the spread for the major FX pairs begins with 0 pips, and the leverage ranges from 50:1-500:1. Besides, clients can choose from a range of seven base currencies, access the large variety of educational resources, participate in trading contests, and partner with one of Australia’s lowest spread CFD brokers.

In our extensive review of the top forex broker, we analyze the trading products, platforms, conditions, educational resources, customer support, and the probable reasons that make ACY Securities a good forex broker.

ABOUT BROKER REVIEW

Individuals registering with ACY Securities can trade 60+ CFDs from four asset classes- Forex, commodities, cryptocurrencies, and stock indices. The ASIC-regulated forex broker offers a selection of three ECN account types, with the primary difference in the spread and the commission. While the top CFD broker does not charge a commission on the stpECN account, clients registering for the zeroECN and the pureECN accounts have to pay a commission of $6 and $5 per RT correspondingly.

For a clearer picture of the breakup of the various financial instruments under the four asset classes, refer the table below-

| Asset class | Number of products |

| Forex | 41 |

| Cryptocurrencies | 05 |

| Commodities | 08 |

| Stock indices | 12 |

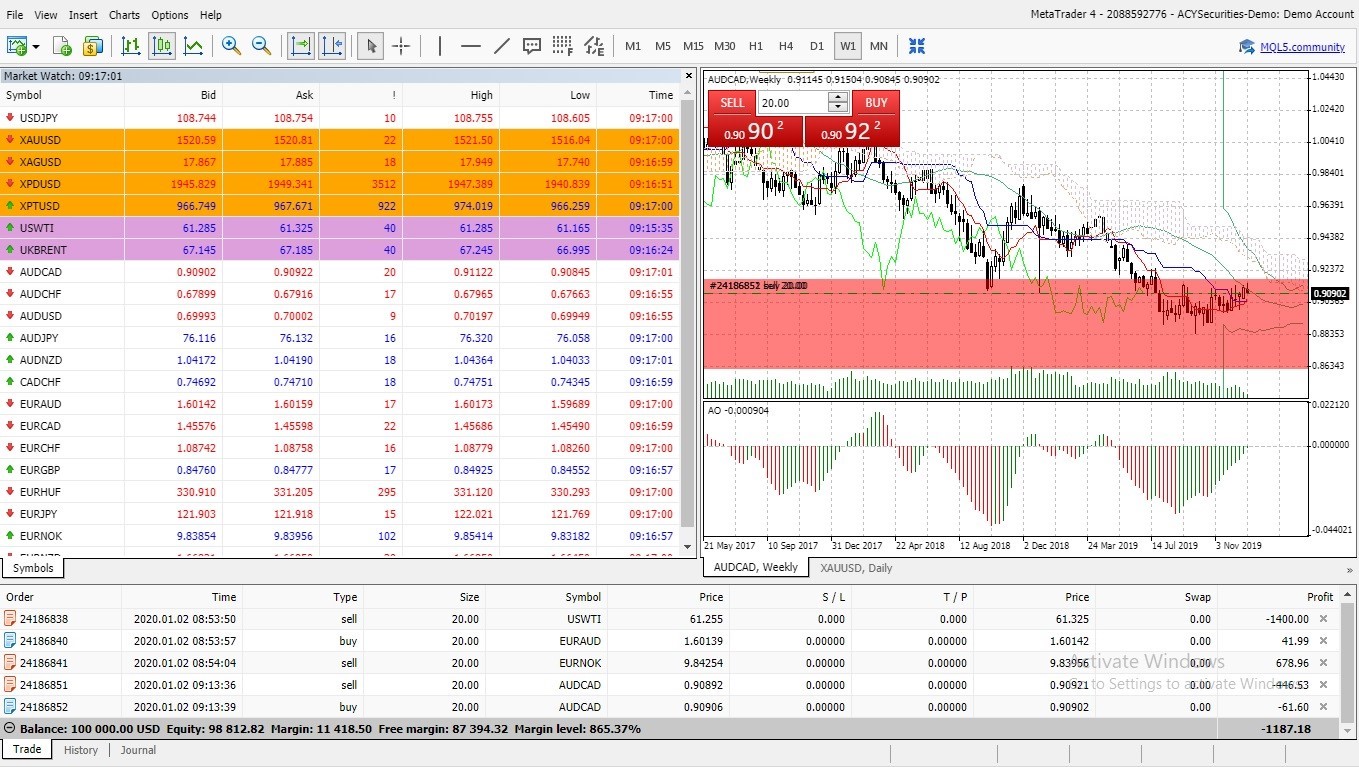

TRADING PLATFORMS

ACY Securities is a MetaTrader broker, offering clients the MT4 platform across desktop, web, and mobile devices. Although the website also mentions the MetaTrader 5 platform, the forex broker is yet to present them to clients. The MT4 comes with a user-friendly interface, supports all the major operating systems, and is suitable for all categories of clients- Manual to automated traders. Clients can trade CFDs in forex, stocks, indices, cryptocurrencies, and derivatives.

In our review of the forex broker, we not only analyzed one of the best globally renowned CFD trading platforms, but we also highlighted the features and some of the drawbacks of the ACY MT4 terminals.

Beginning with the desktop platform- ACY Securities has not made any inclusions to the standard MT4 offering from MetaQuotes. The default workspace comprises the watchlist, charts, the navigator tool, and the terminal. You can monitor and trade in 41 forex pairs covering the majors, minors, the USD/CNH, and exotic currencies, six commodities, eleven top global stock indices, five cryptocurrencies, and the FTSE-China A50 index. However, the CFD broker offers slightly fewer products for clients opting for the zeroECN-account.

Primary features-

- The desktop platform is available in 39 languages.

- Multiple order placement panels with the option to place one-click orders.

- Order types include market orders, immediate orders, and pending orders with the SL/TP function.

- The platform comes with three basic charts and nine-time frames- From one minute to one month.

- Clients can access the readily available 30 in-built technical indicators and 24 graphic objects.

- News headlines.

- Market depth panel with the choice to place one-click orders.

- Facility to place price alerts.

- The platform supports automated trading.

- You can download technical indicators and trading robots.

- Connect with the mql5 IDE development environment.

Drawbacks-

- The forex broker has not included additional tools besides the ones offered by MetaQuotes.

- Manual zoom-in/zoom-out of charts compared to some of the other terminals which use the mouse scroll button.

- Besides the news headlines, the broker does not offer real-time fundamental data.

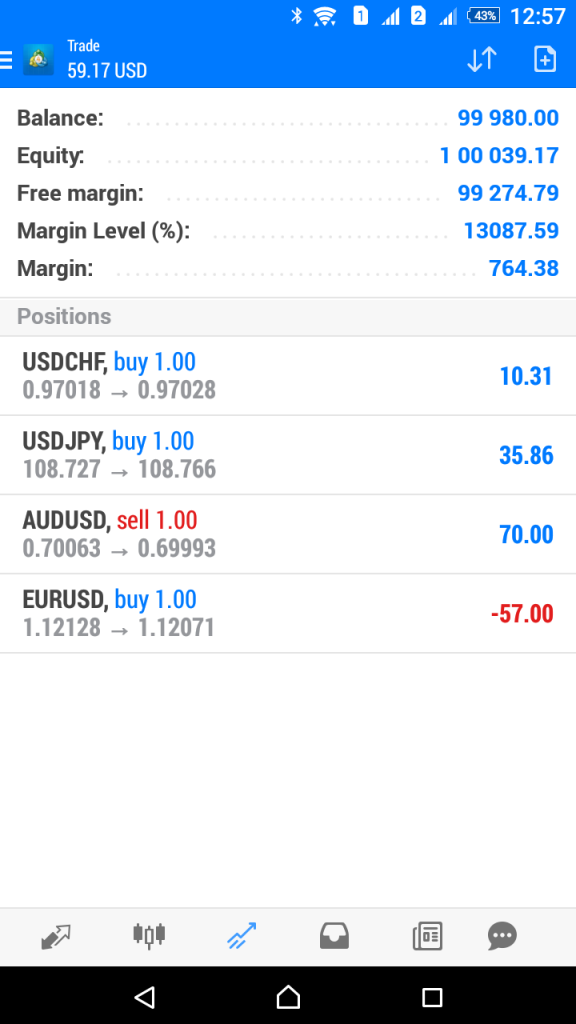

The MT4 web application is a slightly lower version of the desktop application. The platform supports 39-languages, can be accessed quickly without having to download the software and is compatible with Windows, Linux, and Mac operating systems. You can access and trade on the entire range of financial instruments offered by the broker from the watchlist and chart panels. The trading features include all the tools that are currently available on the desktop platform, excluding expert advisors (EA), price alerts, and the market bulletin. Also, the platform is standalone and does not sync trades with the desktop or the mobile application.

The ACY MT 4 mobile trading application for Android and Mac handheld devices lets you trade forex and CFD instruments anytime, anywhere. The mobile app and the desktop terminals have a lot in common when it comes to the user interface, besides syncing your trades. The workspace comprises individual panels accessible from the menu at the bottom of the device and supports all the trading instruments offered by the CFD broker. The terminal comes with similar order types and execution modes as the desktop platform, an equal number of chart types, time frames, technical indicators, analytical objects, market news. Besides, you also have a free chat facility to communicate with the other traders from the mql community.

On the drawbacks, the platform does not support EAs, while the drawing tools are missing from the app.

Summary of our review of the trading platforms by the Australian forex broker- Although ACY Securities provides the world’s most advanced platform, the absence of add-ons when it comes to trading tools and strategies is a significant drawback.

TRADING CONDITIONS - Spreads, margins, and orders -

Our review of the trading conditions at ACY Securities threw up some interesting facts. While the spread is mostly dependent on the account type, the margins, the order size, kind, and execution are standard for all clients.

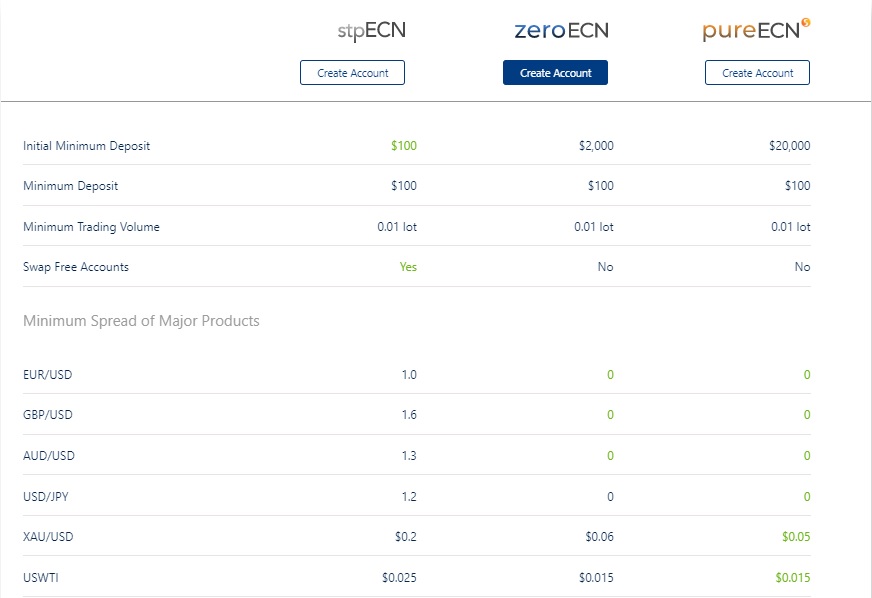

Before going into the details of the spread, we’ll quickly run you through the various account types offered by the Australian forex broker, the minimum initial deposit, and how they affect some of the trading conditions.

Individuals listing with ACY Securities have the choice of three account types-

| Account type | Minimum initial deposit | Swap-free |

| stpECN | $100 | Yes |

| zeroECN | $2,000 | No |

| pureECN | $20,000 | No |

While the broker does not charge a commission on any of the product offerings for stpECN account holders, clients opening either of the other two trading accounts have to pay a commission to trade FX and commodities. For certain products like precious metals, the CFD broker has included a spread and commission for zero and pure ECN account holders. In the case of cryptocurrencies and stock indices, ACY Securities charges a spread on some instruments and commissions on the others.

The commissions are in the base currency of the trading account and broadly comprise of the AUD, CAD, EUR, GBP, JPY, NZD, and the USD.

Following are the account types and the spread/commission for the various financial instruments-

| Spread/Commission | stpECN | zeroECN | pureECN |

| Minimum spread- Forex | 1 pip | 0 pip | 0 pip |

| Minimum spread- Cryptocurrencies | 0.00140 points | 0.00140 points | 0.00140 points |

| Minimum spread- Indices | 0.5 points | 0 | |

| Minimum spread- Commodities | 0.001 points | 0 | 0 |

| Commission (RT)- Forex | 0 | $6 | $5 |

| Commission (RT)- Metals | 0 | $6 | $5 |

Leverage/Margins-

The top Australian CFD broker comes under the regulations of the Australian Securities and Investment Commission (ASIC) and is allowed to provide higher leverage when compared to the watchdogs monitoring forex brokers in the EEA countries. In keeping with the guidelines of the regulators in Australia, the trading margins at ACY Securities range from 0.2% in FX to 2% in cryptocurrencies.

Orders-

The minimum order size for the various financial instruments remains the same for all the account holders and starts with the micro lot (0.01) for FX pairs. Likewise, the order types also stay the same with the Australian forex broker offering the choice of instant, market, and pending orders across their MT4 platforms. When it comes to liquidity, the forex broker is associated with 46 liquidity providers, including 16 global banks providing over 10,000 price updates every minute. Besides, the no dealing-desk CFD broker offers direct access to its Equinix servers in New York and Asia for efficient, transparent, and ultra-quick order execution.

EDUCATION & SUPPORT

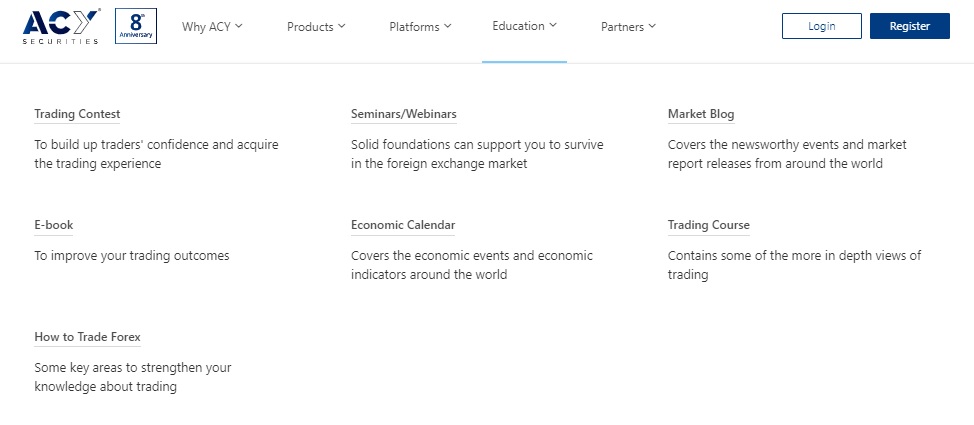

ACY Securities has quite a few free resources when it comes to educating clients on the various aspects of forex and CFD trading. All the educational content can be accessed on the website or from the client area.

Some of them include the E-book on forex trading, online trading courses, blog comprising of in-house forex, global market news, and market analysis. Besides, clients based in Sydney can schedule a one on one meeting with the broker while the others can get in touch via telephone and request a customized learning package. You can also participate in the top forex broker’s forex seminars/webinars on technical analysis, trend studies, and indicators, which could assist you in improving your trading skills when it comes to making informed decisions.

CLIENT SUPPORT

When it comes to client support, ACY Securities has a multilingual helpdesk comprising of the phone, email, and live chat. Besides, clients can also use the contact form to reach out to the broker.

While ACY Securities has emphasized 24/5 support, in our review of the CFD broker, we found that the live chat was not active on January 1st, 2020. Nonetheless, our interaction with the support team via the live chat has been a pleasant experience, with the initial response time at < 10 seconds. We also received quick and precise replies to the questions asked, an indication that the support team is knowledgable about the markets, and the forex broker’s products and services to efficiently manage client queries.

Tabled below are the various support options provided by the broker-

| Phone | International | +61 2 9188 2999 |

| Taiwan | 02 5594 4927 | |

| [email protected] | ||

SUMMARY

ACY Securities is a part of the ACY Capital Group who set up shop in 2013 and includes ACY Securities and ACY Capital. ACY Securities is an STP/ECN broker with a small range of product offerings across few asset classes, one of the few drawbacks when compared to the other forex brokers. The other is the lack of free trading tools and live fundamental news for clients signing up with the broker.

But, if you are willing to ignore the few negatives, ACY Securities is one of the best forex brokers in Australia, offering the globally renowned MT4 platform, competitive spread, decent margins, and low commission. Also, the CFD broker provides liquidity from 16 global banks, ensuring efficient and speedy order execution on all the ECN accounts.

The forex broker’s regulation by the Australian Securities and Investment Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC) mandates stringent capital requirements and investor protection for clients residing in Australia. Besides, the rigorous financial regulatory system ensures the segregation of client funds, regular accounting, audits, security, and adequate risk management measures to protect client deposits. Also, the top forex broker is a member of the Australian Financial Complaints Authority (AFCA), an external disputes resolution agency and has partnered with AON to provide professional indemnity insurance to clients up to $2,500,000 per claim.

With its advanced trading platform, excellent customer support, a variety of educational resources, trading contests, and partnership programs, ACY Securities is undoubtedly one of the best retail forex brokers in Australia.