eToro Review:

The top social trading CFD broker with more than 10 million global users

BRIEF INTRODUCTION

eToro, incorporated in January 2007, is a global leader in social trading with millions of registered users accessing a massive range of innovative investment tools and products offered by the CFD broker. Established to make OTC trading in forex and CFDs accessible to a large number of individuals, eToro introduced its exclusive web and mobile trading application, “WebTrader” in 2009-2010. From a humble beginning, the top forex broker grew and a few months later launched OpenBook, the world’s first social trading platform using the innovative CopyTrader feature. In 2015, eToro integrated the WebTrader with OpenBook, allowing retail clients to monitor positions of fellow traders via the social trading platform and seamlessly execute orders. In 2016, eToro introduced CopyPortfolios, which were driven by machine learning languages to cover top traders/assets within a predetermined strategy to generate exceptional returns in most market conditions.

For clients uncertain if eToro is legit, our in-depth review underscores the licenses received by the top social trading forex broker by multiple tier-1 agencies in Europe and Australia.

Here are the regulators governing eToro-

- eToro (Europe) Ltd., a Financial Services Company with license # 109/10- Authorized and regulated by the Cyprus Securities Exchange Commission (CySEC).

- eToro (UK) Ltd, a Financial Services Company in the UK with license FRN 583263- Authorized and regulated by the Financial Conduct Authority (FCA).

- eToro AUS Capital Pty Ltd., an Australian Financial Services firm with license 491139- Authorized by the Australian Securities and Investments Commission (ASIC).

In addition to the above, the ASIC-regulated forex broker has money transmitter licenses across 11 cities in the US.

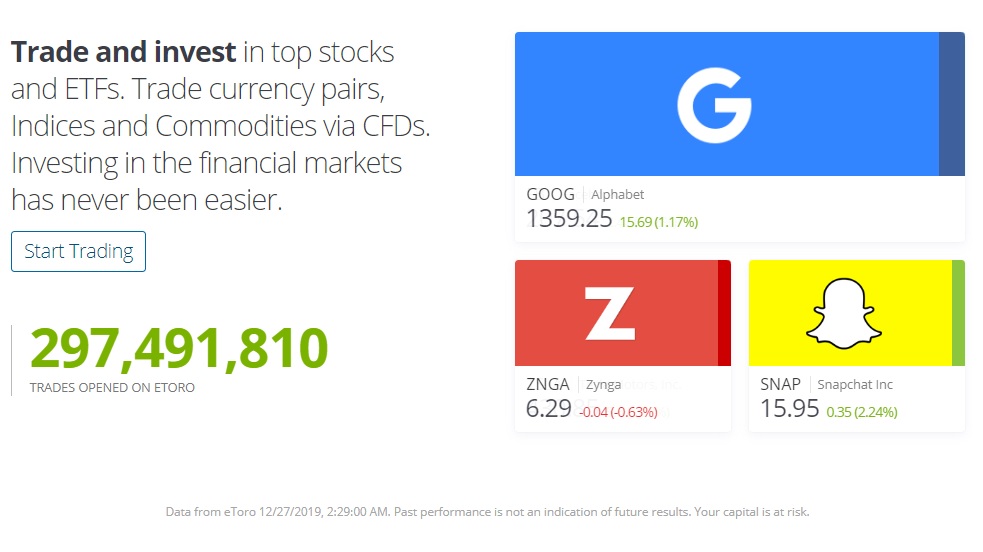

The top multi-asset CFD broker offers a massive range of cryptocurrencies and equities and has more than 10 million global users from 140 countries accessing its platform. The stats on the broker’s website on 27th December 2019 indicated close to 300 million trades on the platform, a substantial volume for any forex broker.

You can join the eToro club and enjoy the privileges offered by the top forex broker, including premium analytical tools, investment support, credit line and invitations to VIP events. While eToro does not charge a minimum deposit on any of the memberships, there is a $25 fee on fund withdrawals.

RANGE OF MARKETS

Clients registering with the CFD broker can access more than two thousand global markets spread across five asset classes- FX, stocks, indices, commodities, and cryptocurrencies. Besides, traders can diversify their crypto portfolios to include 14 popular digital currencies pit against commodities, currencies, and the other cryptos.

Unlike most forex brokers who only offer CFD trading, clients of eToro can also invest in some of the underlying financial instruments like stocks, cryptocurrencies, and ETFs. These are non-leveraged products and to invest in them, clients have to deposit the entire value of the financial asset or the fund. Also, clients cannot initiate short positions, and those who wish to do so can switch to leveraged CFD trading. Besides, clients signing up with the ASIC-regulated broker in Australia are only allowed to trade CFDs in the underlying financial instrument/s.

Tabled below are the range of markets under the various asset classes

| Asset class | Products |

| Forex | 47 |

| Commodities | 13 |

| Indices | 13 |

| Stocks | 1840 |

| Cryptocurrencies | 98 |

In addition to the above-mentioned products, clients can invest/trade CFDs in 145 ETFs comprising of iShares, SPDR, and some of the other well-known funds. When it comes to equities, clients can trade CFDs or invest in shares of more than 1800 listed-companies on 17 global stock exchanges across the US, Europe, the Middle East, and Asia.

TRADING PLATFORMS

eToro offers only its proprietary trading terminal to all clients, accessible as a web and mobile application. You can connect to the client area and eventually the terminal by filling out your personal details and sending them to the CFD broker. Once connected, you will find the eToro platform a welcome change in comparison to some of the other trading terminals, including the ones offered by reputed forex brokers. In our review of the forex trading platforms at eToro, we carried out an in-depth study of the web and mobile trading applications from a demo account. The findings include the robust features of the platforms and the drawbacks.

eToro WebTerminal-

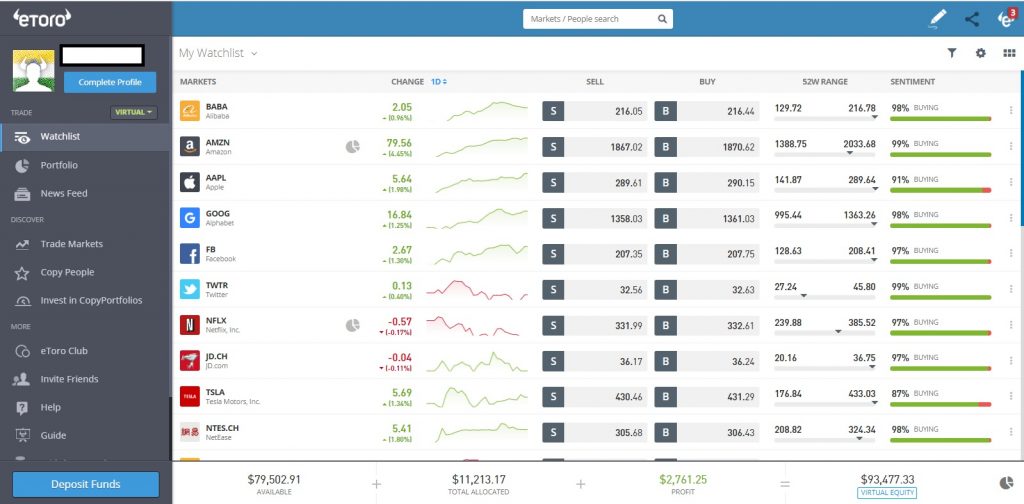

At first sight, the terminal is unlike the other web applications that are generally offered by some of the top forex and CFD brokers. The dashboard comprises the menu which is broadly divided into account activity, trading features, and other miscellaneous groups.

The first few menu dropdowns relate to account activity, where you can view the watchlist, monitor the performance of your portfolio, and connect to the newsfeed from the eToro community. The next few menu buttons involve client trading activity and broadly cover featured markets, major market movers, and the option to monitor and/or copy trades/portfolios of successful investors. The latter half of the menu covers marketing/ promotional activities, online assistance to a range of topics and FAQs, the choice to deposit/withdraw funds, and manage your default terminal settings.

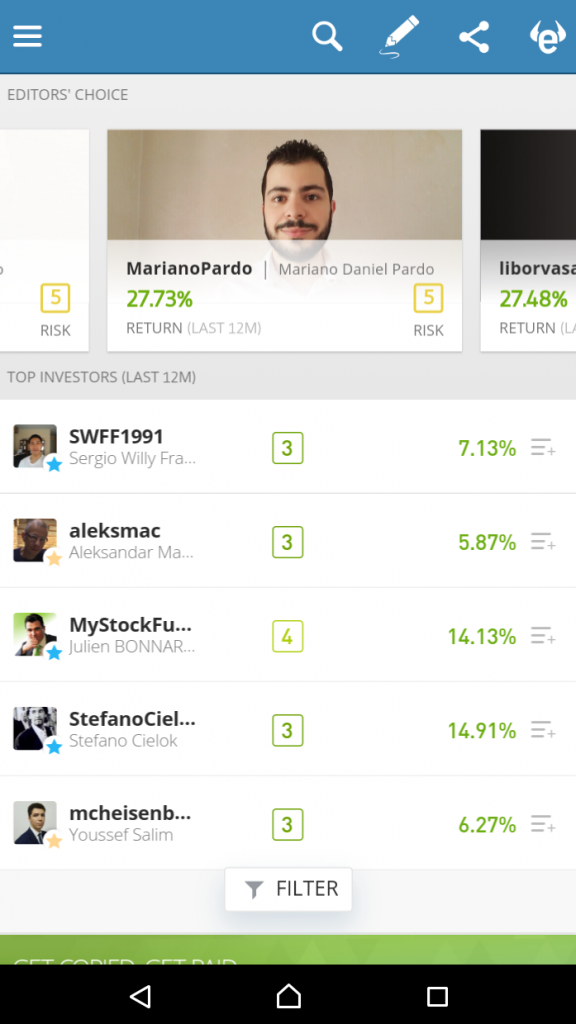

When it comes to chart analysis, the CFD broker provides access to Procharts, which comes with five chart types and 66 chart studies. Besides, you can access the 13 drawing tools, including Doodle and Pitchfork. However, the major benefit of the terminal is the social trading feature. Here, beginners can select traders from more than 100 countries, view their performance, drawdowns, and copy trades based on individual risk profiles. Also, clients looking to copy the entire portfolio of successful investors can find tons of collections based on different risk-reward metrics.

On the other side, successful traders and investment managers can earn additional income by sharing their strategies, trading stats, equity curve, and other useful info with prospective followers. Besides, portfolio managers can display trading stats of their asset holdings, highlight all the investment parameters and allow members to copy their portfolios for a fee.

Additional features-

- You can choose your local currency from 18 options.

- The order types on the terminal include the GTC- Market and pending orders.

- You can place one-click orders.

- Pre-define your trading parameters from the settings menu.

- Deposit/ withdraw funds from the dashboard.

- Clients have the choice to hedge positions.

- Option to place price alerts.

- You can access charting tools from Procharts with 60+ chart studies.

- Clients can view up to six charts at a time.

- Access the quick interactive guide to acquaint with the features of the platform.

- You can post, view, respond and share tweets of the other community members.

Some of the drawbacks-

- Tedious to operate the drawing tools.

- The eToro platform does not support automated trading.

eToro Mobile trading platform-

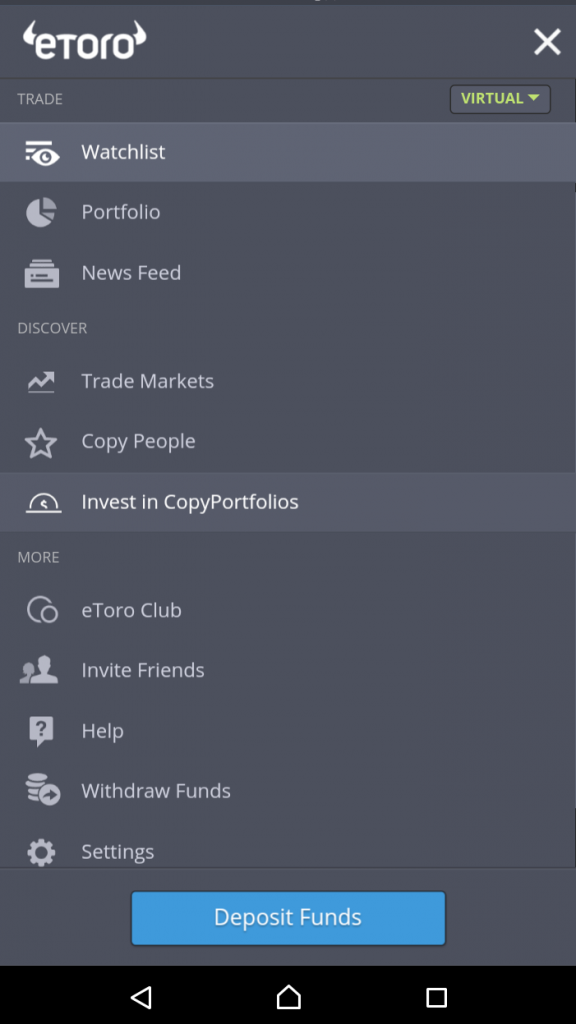

eToro’s mobile terminal is accessible across Android, handheld Apple devices, and is downloadable from the Android Playstore or the Apple Appstore. To review the mobile trading platform offered by the best social trading CFD broker in Australia, we tested the demo application on an Android device and found it to be very similar to the web terminal in many ways. The menu button is on the top left corner of the platform with access to all the key features like portfolio, newsfeed, products, social trading, and the option to deposit/withdraw funds. You can access all the product offerings by the CFD broker, go to the default watchlist or create your own, copy portfolios, and the best performing traders, deposit/withdraw funds, invite friends, etc.

However, when it comes to the ease of operating the app, we were disappointed. For starters, the application was very slow and it doesn’t matter if you are trying to go from one menu option to the other or only trying to change the default settings, the app takes time to load. The charts were flickering and we could not view them. The one-click exit orders on the web terminal were not very prominent in the mobile app.

But when it comes to the speed of order execution, we did not face any issues. The orders went through seamlessly without any interruption, one of the few positives of the app.

Summary of the features-

- Create multiple watchlists and view them in two modes.

- View your portfolio at the click of a button.

- The order types on the terminal include the GTC- Market and pending orders.

- Speedy order execution. You can also place one-click orders.

- Option to hedge your positions.

- Pre-define your trading parameters from the settings menu.

- Deposit/ withdraw funds from the dashboard.

- Clients have the choice to hedge positions.

- Option to place price alerts.

Some of the drawbacks-

- Not very user-friendly.

- Unable to view the charts.

TRADING CONDITIONS - Spreads, margins, and orders -

In our extensive review of the trading conditions prevailing at the CFD broker, we analyzed the spread, margins, and the order execution at eToro. Before evaluating the trading conditions at one of Australia’s best CFD broker, you should know that eToro does not charge a deposit, commission, or trading fees other than the spread. Besides, the CFD broker does not charge management, ticket, or rollover fees for clients opening non-leveraged long positions with eToro Europe Limited and eToro UK Limited. While this does not apply to short leveraged trades, the forex broker charges clients for holding overnight CFD positions, in addition to the weekend rollover fees.

Spread-

The spread charged at eToro varies across asset classes and is more or less in line with those charged by the other top CFD brokers. For a clearer picture of the lowest spread offered by the forex broker, take a look at the following table where we have highlighted the minimum and maximum spread for the various asset classes.

| Asset class/ Trading instrument | Minimum spread | Maximum spread |

| Forex | 1 pip | 50 pips |

| Commodities | 2 pips | 1200 pips |

| Indices | 4 pips | 1200 pips |

| Stocks | 0.09% one side | 0.09% one side |

| Cryptocurrencies | 0.75% | 5% |

| ETFs | 0.09% | 0.09% |

Margins-

Since eToro functions in a multi-regulatory environment, the margins are broadly in line with the protocols governing the top forex broker. While clients registering with the CFD broker in Europe and the UK are subject to higher margins, the margin requirements are much lower for ASIC regulated forex brokers. So, if you are comparing the best CFD brokers in Australia, look for someone with a good reputation, a large number of products, great trading tools, and regulated by ASIC.

Global clients signing-up with the top forex broker will come under the CySEC registration which categorizes clients into Retail or Professional. Retail clients have to pay higher margins compared to their professional counterparts. But on the flip side, professional clients lose the ESMA protection and recourse to a Financial Ombudsman in the event of a dispute with the forex broker. Besides, professional clients also do not come under the negative balance protection offered to retail clients in Europe and the UK, although eToro has pledged to absorb the losses in the event a client’s account goes below zero.

Tabled below is the max. leverage for the various asset classes under ESMA

| Leverage for retail clients under the European Securities and Markets Authority (ESMA) | |

| Asset class | Max. leverage/Margins |

| Forex- major pairs | 30:1/3.33% |

| Forex minor pairs, gold, | 20:1/ 5% |

| Commodities | 10:1/10% |

| Indices- major, minor | 20:1, 10:1 |

| Stocks | 5:1/20% |

| Cryptocurrencies | 2:150% |

Professional clients in the UK and Europe receive leverage of up to 400:1 in particular instruments in addition to lower margins on the other products. For customers carrying out CFD trading in Australia, the forex broker offers maximum leverage of 400:1.

Order types and execution-

The order types at eToro include Good till Canceled (GTC)- Market and Pending Orders. The orders can also be placed during the weekend when the markets are closed. All order types include the Stop Loss/Take Profit (SL/TP).

When it comes to the speed of order execution, we did not notice any lag or delay, and all the orders went through immediately. However, placing entry orders is a tad bit tedious if you don’t enable the one-click order placement option, although you can exit open positions at the click of a button.

EDUCATION

In comparison with the other CFD brokers, eToro has a few useful readily-available educational resources on its website. Besides the blog and the daily market insight, the Australian forex broker has 18 chapters of educational material related to fintech, investments, copy trading, and the fundamentals of research.

However, if you log in to the eToro dashboard, you can access Live newsfeed, and like/share, or comment on the posts put up by bloggers and investors. Also, click on “GUIDE” to take a tour of the eToro platform, or hit the “HELP” button to connect to the support, from where you can access numerous interactive trading courses.

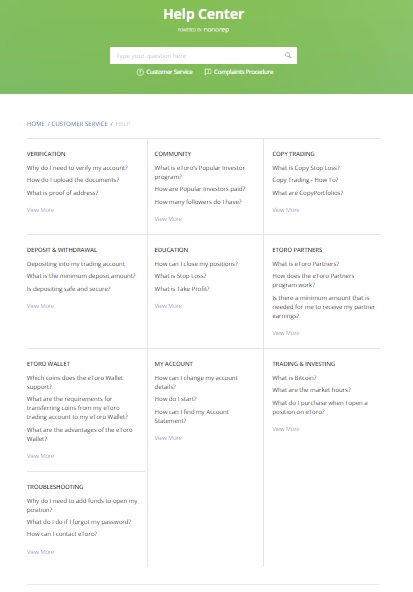

CLIENT SUPPORT

When it comes to client support, the CFD broker may not be the best in the industry in comparison with the other forex brokers. While the website is accessible in 20 languages, the help center is mostly limited to the frequently asked questions. The CFD broker does not have the 24/5 live chat support that most of the other forex brokers do, even the smaller ones. The best way to get in touch with eToro besides calling the broker’s registered office is to raise a ticket via the help center on the website.

SUMMARY

Following an in-depth review of the top CFD broker, our understanding of eToro is that the social broker is very different when you compare them with your regular multi-asset online forex brokers. Go through the eToro website or log-in to the demo trading platforms and you will know exactly what we’re talking about. The similarities include CFD trading in multiple asset classes, overseen by tier-1 regulatory agencies, several funding methods, and the option to trade in leveraged and non-leveraged products. However, when it comes to dissimilarities, eToro is mostly for clients interested in social trading, since there’s nothing much in the platforms or the tools besides the copy trading and copy portfolio features. The platform only has the basic analytical tools, does not support automated trading, and is not very user-friendly. Besides, the broker does not offer a downloadable desktop terminal that is generally the feature of most forex brokers, even the smaller ones. In addition, not everyone can afford the kind of equity required to be a part of the eToro club, especially the $250,000 Diamond membership.

That said, the CFD broker is a good choice for experts interested in earning additional income by sharing their strategies and for inexperienced traders enthusiastic to learn without taking big risks. Also, profitable traders stand to benefit in the form of cash rewards from the trading contests organized frequently by the forex broker. The bottom line, you can register with the best social CFD broker if you are a professional trader looking to earn from your expertise or if you are a fresher trying to learn from specialists. If you are neither of the two, you are sure to find better options.