After a busy weekend digesting developments on the pandemic, investors were waiting for a breakthrough on the massive congressional spending package to combat the fallout from the coronavirus pandemic.

After the Senate Democrats blocked the multi-trillion package, there was little progress on the negotiations, leading to another day of losses on Wall Street.

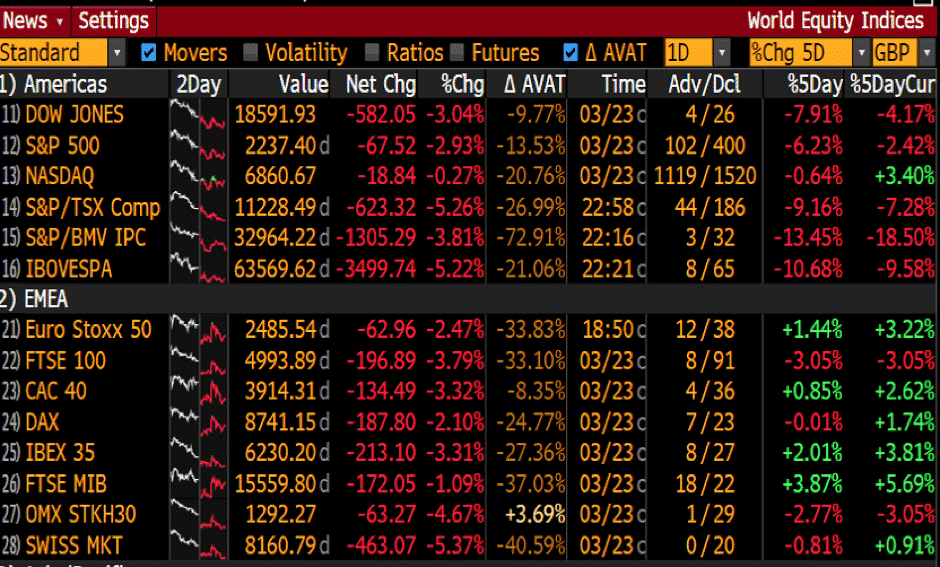

World Equity Indices (% Change)

As more countries are rolling massive stimulus package to stem the crisis, investors are not convinced that the fiscal and monetary intervention measures are enough to provide economic support for the global economy.

- Dow Jones Average Industrial lost 582 points or 3.04% to 18,592.

- S&P500 fell by 68 points or 2.9% at 2,237.

- Nasdaq Composite ended 19 points or 0.3% lower at 6,861.

- The purchase of Treasury securities and agency mortgage-backed securities in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions and the economy.

- The establishment of loan facilities to support credit flowing to large employers

- The establishment of a third facility, the Term Asset-Backed Securities (TAFT) to support credit flowing to consumers and businesses.

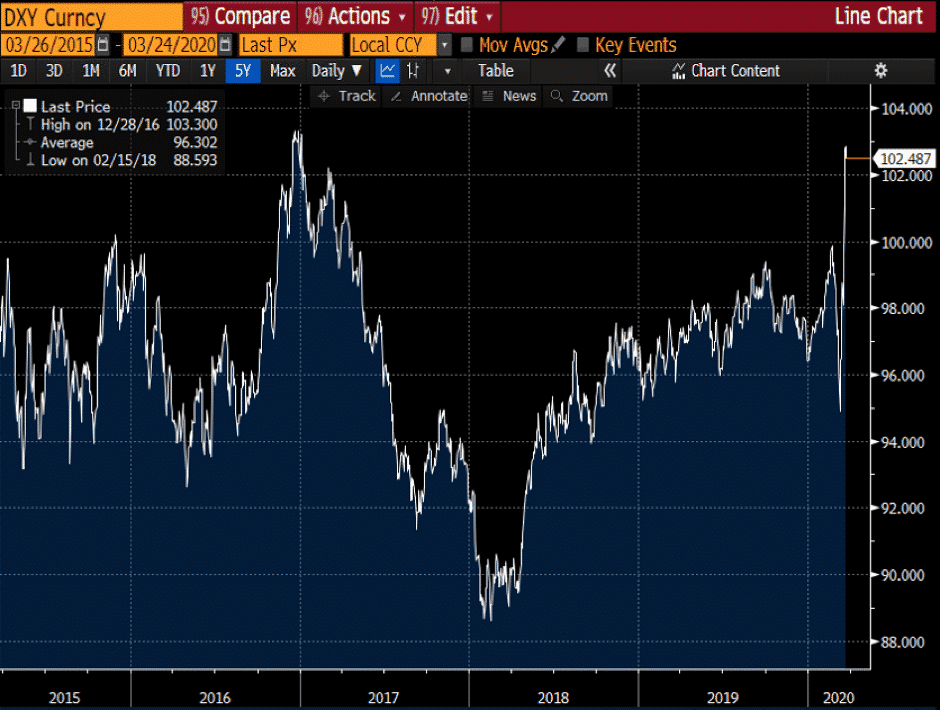

The US dollar index which tracks the performance of the greenback against a basket of currencies is consolidating gains around the 102 level.

After falling to multi-year lows, the Aussie dollar was firmer yesterday and was among the best performers against the US dollar. However, the Antipodean is left at the broader sentiment amid an empty economic calendar and will likely remain under pressure, given the rising number of virus cases and the quarantine measures crippling the economy. As of writing, the AUDUSD pair is trading at 0.5870.

The oil market continues to remain under extreme pressure, dragged by a simultaneous demand and supply shock. WTI was firmer on Monday on the Fed’s measures but the outlook stays gloomy. As of writing, both Brent Crude and WTI are trading in the vicinity of $27 and $23.

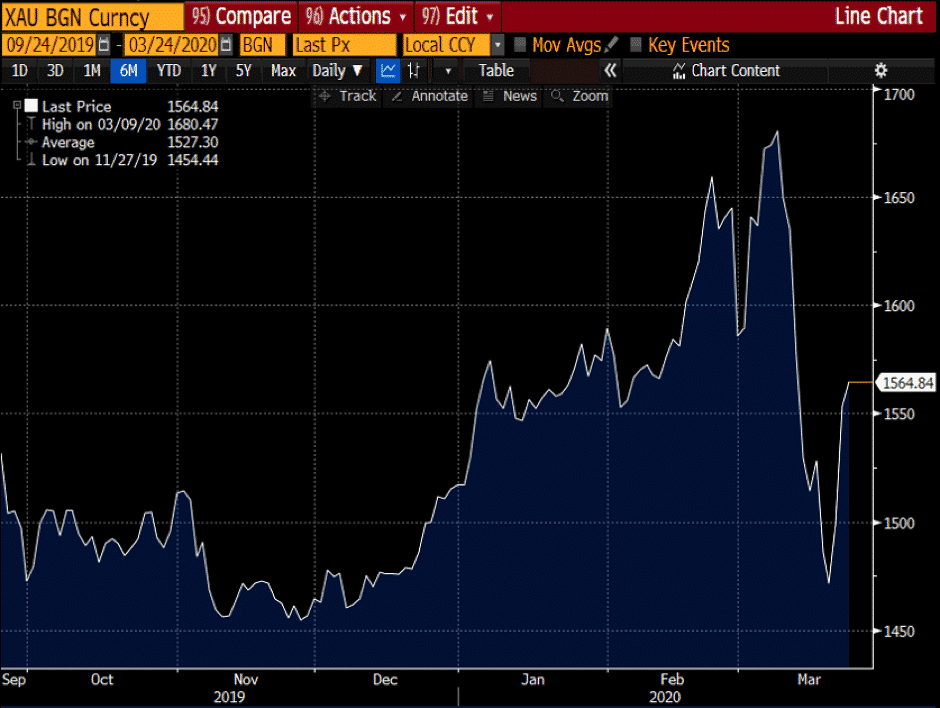

The Federal Reserve pumping more liquidity into the financial markets has also helped the Gold to edge higher. In such a liquidity crisis, gold was being liquidated to meet liquidity/cash requirements.

The Federal Reserve pumping more liquidity into the financial markets has also helped the Gold to edge higher. In such a liquidity crisis, gold was being liquidated to meet liquidity/cash requirements.

When the Fed reassured investors that they will keep supporting the economy as long as needed, the precious metal regained its haven status. The XAUUSD pair claimed back the $1,500 level lifted by the Fed measures and a weaker US dollar. As of writing, the pair was currently trading at $1,564.

|

|

Indicative Index Dividends – Wednesday 25 March 2020

|

|

Index

|

Dividend

|

Index

|

Dividend

|

|

ASX200

|

0.317

|

WS30

|

0

|

|

US500

|

0.01

|

US2000

|

0.015

|

|

NDX100

|

0

|

CAC40

|

0

|

|

STOXX50

|

0

|

ESP35

|

0

|

|

ITA40

|

0

|

FTSE100

|

0

|

|

DAX30

|

0

|

HK50

|

2.958

|

|

JP225

|

0

|

INDIA50

|

0

|