Markets.com Review:

The FTSE-250 company offers 2000+ products across multiple asset classes and trading platform

BRIEF INTRODUCTION

Markets.com, founded in 1999 is a global brand owned by Safecap Investments Limited, a prominent online forex and CFD broker from Cyprus. The other global subsidiaries in the UK, Australia, and Africa operate under the TradeTech Group, a constituent of Playtech Plc (LON: PTECH), the gambling software developer publicly listed on the FTSE-250. If you compare forex brokers with the same distinction, you are still likely to find quite a few differentiators between Markets.com and the others.

Markets.com comes under multiple supervisory agencies, including the

- Financial Conduct Authority (FCA)- UK.

- Cyprus Securities and Exchange Commission (CYSEC)- Cyprus.

- Australian Securities and Investments Commisson (ASIC).

- Financial Sector Conduct Authority (FSCA)- South Africa.

- BVI Financial Services Commission (FSC)- Global.

When it comes to the safety of client funds, all client deposits are in segregated accounts, separate from the CFD broker’s operational capital and protected from debtors. Also, clients registering with Markets.com in Europe and the UK are under the protection of the Investor Compensation Scheme (ICS) and stand to receive compensation if the forex broker goes under administration. The top CFD broker provides negative balance protection, irrespective of the country of residence, the subsidiary with which clients open their trading account or the governing authority.

You can access 2200 plus CFD products offered by the forex broker across six asset classes, with clients having the option to choose either the proprietary or the MetaTrader platform. Besides, the top forex broker offers leverage of up to 300:1, low spreads, a first deposit bonus of 20-35%, and 24/5 customer support.

Markets.com is a top-rated forex broker in Australia. In our review of the ASIC regulated broker, we cover the product offerings, trading platforms/ conditions, client education, the various support channels, and the reasons to consider Markets.com as your CFD broker.

RANGE OF MARKETS

Markets.com has over 2200 CFD products comprising forex, stocks, indices, commodities, cryptocurrencies, and bonds. Besides the six asset classes, individuals can also trade/invest in CFD forward contracts, IPOs, Exchange-traded funds (ETFs), and blends- exclusive themes selected by Markets.com. Clients can access most of the trading instruments only from the CFD broker’s exclusive trading platform. However, if you prefer the MetaTrader platforms, you will have to contend with a smaller number of instruments at your disposal but can employ automated strategies, lacking in the proprietary terminal.

Highlighted below are the product offerings from Markets.com-

| Forex- | Cryptocurrencies- | |||

| Major currencies | 7 | Spot | 5 | |

| Minor FX pairs | 28 | Futures | 1 | |

| Exotic currencies | 22 | Total | 6 | |

| Total | 57 | |||

| Bonds- | ||||

| Indices- | US | 2 | ||

| Cash | 11 | UK gilt | 1 | |

| Futures | 22 | German bond | 1 | |

| Total | 33 | Total | 4 | |

| Commodities | ||||

| Cash | 20 | |||

| Futures | 2 | |||

| Total | 22 | |||

Shares-

You can trade more than 1500 share CFDs covering about 9 sectors and listed on all the major exchanges from Asia-Pacific, Europe, the UK, South Africa, and the United States.

ETFs-

Clients can invest/ trade 53 ETFs tracking various SPDR funds, ProShares, funds tracking gold miners, commodities, country’s, currencies, and some of the major stock indices.

Blends-

Clients can invest in a portfolio of stocks/cryptocurrencies based on 19 different themes selected by the top CFD broker. Some of them include Cannabis blend, Brexit winners/losers blend, e-commerce blend, Buffett blend, social media blend, etc.

TRADING PLATFORMS

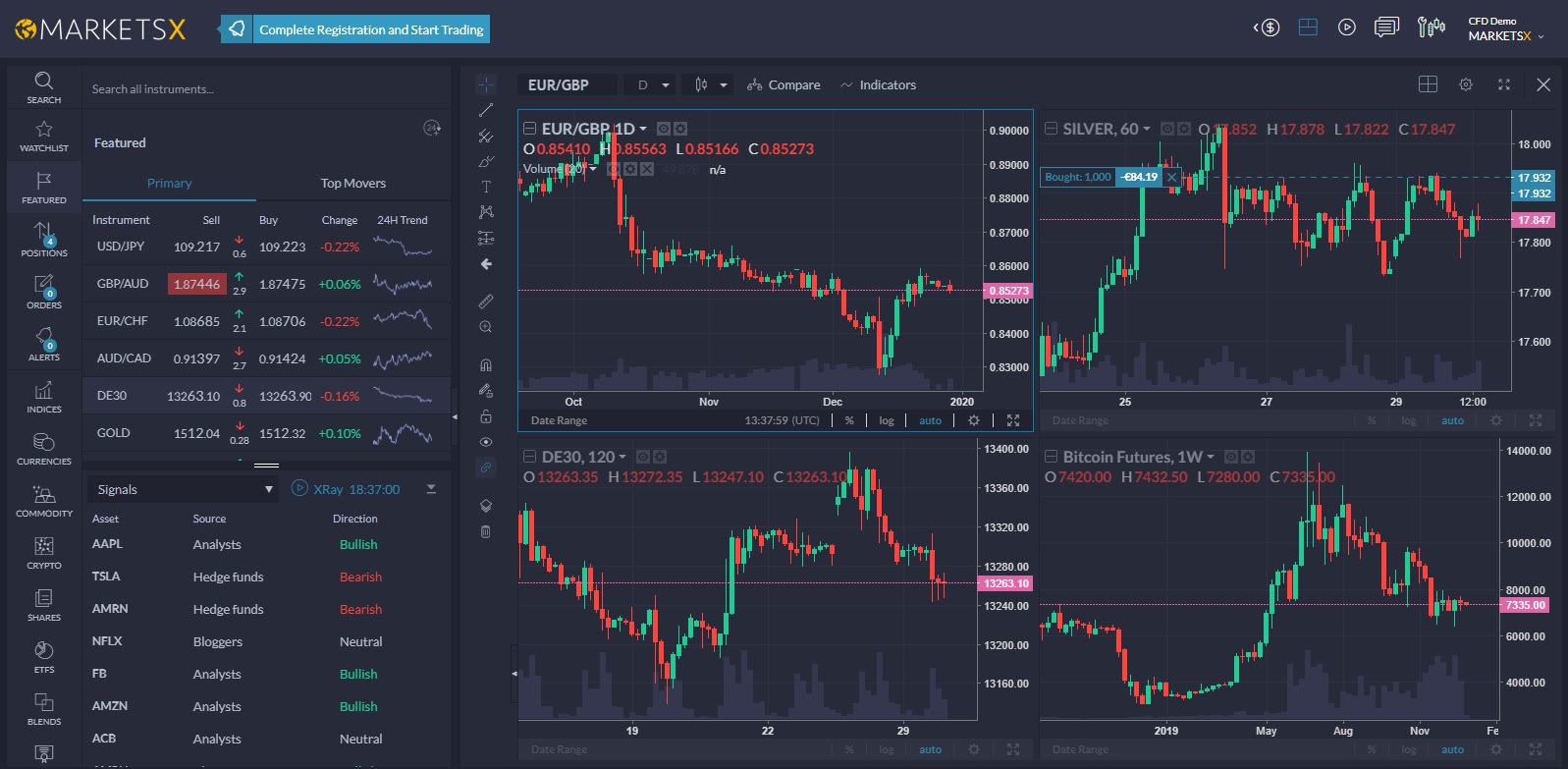

At Markets.com, clients can access the best of CFD trading from multiple terminals comprising of the proprietary MarketsX- Web and mobile application, MetaTrader 4, and MetaTrader 5. While the flagship platform comes with several in-built features and trading tools, the broker also offers a lower spread for clients using this platform. Besides, if you’d like to access all the trading instruments on offer and if you’re not very keen on automated trading, then you would prefer the flagship platform to the MetaTrader.

In our review of the forex brokers, Australia, we analyzed the trading platforms in detail and underlined our findings below.

The proprietary web trading platform-

To connect to the proprietary MarketsX web terminal, you have to register with the top forex broker, which is a simple and speedy process. All you have to do is enter your email address, select a password, and hit the “create account” button. Your registration is complete and you will be taken to the client area which also includes the web platform. The default workspace comprises of two panels- The MarketWatch and Charts. The menu on the left lets you access each of the asset classes separately, while you can also monitor your positions, orders, and alerts from here.

The watchlist is split into two and is accessible in two modes- The primary and the top movers. In the primary mode, you can access all the trading instruments, while in the top movers, you can view all the big winners and losers for the day. You can also activate charts by clicking on any of the symbols in the watchlist panel, execute one-click orders, keep an eye on the market sentiment indicator, rollover date, trade size, and leverage.

Below the watchlist is the secondary panel which comprises of four dropdowns-

- Trading signals from hedge funds, bloggers, and analysts.

- Financial news from Dow Jones.

- Financial market commentary from forexlive.com.

- Xray.

The multi-chart panel can be activated from the watchlist or the layout settings. Clients can access 11-chart types with 10-time frames- From one minute to one month, and up to eight charts at a time. The panel includes several drawing tools, 81 technical indicators, and the option to include multiple charts and compare them from a single window. Within the chart panel, you can also access numerous stats, events with trade opportunities, currency converter, news alerts, related instruments, orders, and open positions.

Key features-

- One-click order entry.

- Option to place opposing/hedge positions.

- Consensus-based trading signals from analysts, hedge funds, bloggers, and insiders.

- Clients can access numerous technical indicators and in-built analytical tools.

- Monitor live news from Dow Jones and forexlive.

- Market sentiment indicator.

- You can place price and event alerts.

- Compare multiple charts from a single window.

- Live webinars integrated into the trading platform.

The MetaTrader desktop application-

If you wish to auto-execute your trades, connect to the globally renowned MT4 or MT5 platforms, the additional offering from the top CFD broker. Unfortunately, we were not able to review the platforms or custom features due to restricted access. Only individuals completing all the registration formalities can access the demo or the live MT4/MT5 platform/s.

The MarketsX mobile app-

The MarketsX mobile application is a counterpart to the web-based platform and is accessible on Android and iOS devices. The mobile app comes with most of the features of the web-based platform, including all the trading instruments, a majority of trading tools, fundamental and technical research, and chart analysis. Besides, the trading spread for users is also lower in comparison with the broker’s MetaTrader offering for handheld devices.

On the flip side, the drawing tools were missing from the mobile app and the watchlist did not sync across the platforms.

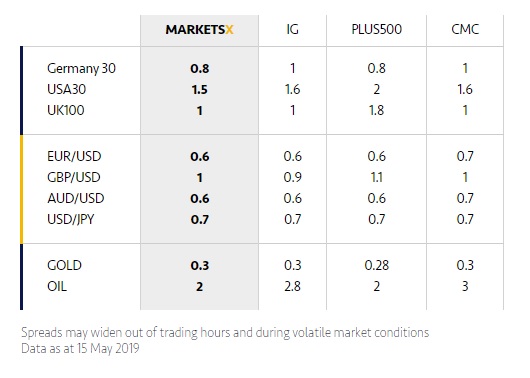

TRADING CONDITIONS - Spreads, margins, and orders -

In our extensive review of the top forex broker, we analyzed the trading conditions including the spread, margins, and orders. Besides, we also compared the spread by the CFD broker with some of the other top forex brokers to give you a clearer understanding of the trading conditions at Markets.com.

Beginning with the spread- Markets.com offers variable spreads for clients using the in-house and MetaTrader platforms. While the spread on the exclusive MarketsX platform starts at 0.6 pips for the EUR/USD pair, the CFD broker charges 2.8 pips spread for the same product on the MT4/MT5 platform, a considerable difference.

Tabled below are the spreads for some of the financial instruments offered by Markets.com

| INSTRUMENT | SPREAD | INSTRUMENT | SPREAD | |

| AUD/USD | 3.5 PIPS | GER 10 Y BOND | 0.06 EUR | |

| EUR/USD | 2.8 PIPS | US T NOTE- 10 YEAR | 0.06 USD | |

| GBP/USD | 7.9 PIPS | ADOBE | 0.27 USD | |

| NZD/USD | 5.6 PIPS | APPLE | 0.28 USD | |

| USD/CAD | 3 PIPS | BASF | 0.35 EUR | |

| USD/HUF | 73 PIPS | HENKEL | 0.3 EUR | |

| USD/RUB | 75 PIPS | CHINACOAL | 0.02 HKD | |

| EUR/RON | 250 PIPS | BHP BILLITON | 142 ZAR | |

| GBP/ZAR | 640.6 PIPS | PROSHARES ULTRA SILVER | 0.08 USD | |

| GOLD | 0.59 USD | EWZ | 0.10 USD | |

| SILVER | 0.024 USD | ENERGY SELECT SECTOR SPDR | 0.35 USD | |

| COPPER | 0.0055 USD | CANNABIS BLEND | 0.04 USD | |

| HEATING OIL | 0.0020 USD | BREXIT WINNERS BLEND | 0.15 PNC | |

| BRENT CRUDE | 0.05 USD | ECOMMERCE | 0.29 USD | |

| COFFEE | 0.35 USD | UK HIGH STREET BLEND | 0.13 PNC |

Comparative spreads by Markets.com and some of the top forex brokers

Source: Markets.com

In our review of the demo platforms, we found that the lowest spread offered by the forex broker was 0.5 pips for the EUR/USD pair on the proprietary web platform. However, we could not verify the lowest spread on the MT4/MT5 demo platform since the terminal is accessible only after the broker verifies all the info filled out in the client registration.

When it comes to margins, the CFD broker generally sets them according to the internal policy of the firm. However, in some instances, the margins are subject to the limit placed by the regulators.

In the UK and Europe, ESMA rules restrict the margins offered to retail clients to a minimum of 3.33%. In other words, the maximum leverage offered to retail clients by a majority of forex brokers is capped at 30:1 for the major FX pairs. Likewise, retail clients trading CFDs in cryptocurrencies have to maintain a minimum margin of at least 50%.

On the contrary, since the ASIC regulations are more relaxed, clients trading with forex brokers in Australia, including Markets.com are subject to lower margins. Retail clients can trade FX with margins as low as 0.20- 0.34%, while the margins for cryptocurrencies range between 20-50%.

Markets.com offers maximum leverage of 300:1 (0.33% margins) for clients trading forex in Africa, Australia, and BVI, with 20% margins reserved for clients trading CFDs in cryptocurrencies. However, if you are residing in the UK or Europe, the CFD broker offers maximum leverage of 30:1 (3.33% margins) for clients trading forex, while for CFDs in cryptocurrencies, the leverage drops to 2:1 (50% margins). Experienced clients willing to let go of some of the advantages of the CySEC and the FCA regulations for higher leverage can sign-up as professional clients. The margins for these clients vary between 0.25% in forex to 10% in cryptocurrencies.

Orders types and execution-

The order types on all the trading terminals of the ASIC-regulated forex broker comprise of the GTC- Market and pending orders with the option to include Stop loss/take profit (SL/TP). What this means is, the orders will remain in the terminal until you cancel them or the contract expires (in the case of forwards/futures).

Besides, you can place orders from the watchlist and the chart panels, although the exclusive terminal supports one-click orders only from the watchlist section. The order execution speed was also good and there was no lag or delay in the order placement.

On the flip side, the top CFD broker restricts demo account holders from placing trades after a while to ensure they complete the registration process, a needless barrier.

EDUCATION

Markets.com does not have much to offer in terms of educational resources on its website. Besides the CFD trading terminologies, the other topics assist clients with the features of the trading platform or provide answers to the frequently asked questions (FAQs).

However, clients signing-up with the forex broker for a demo or live account can access loads of information in terms of fundamental analysis, advanced charting, and real-time market sentiment indicators. Also, the top CFD broker in association with Acuity provides fundamental insight into asset classes, trading signals from multiple sources, and live news.

CLIENT SUPPORT

In terms of client support, the CFD broker’s helpdesk is accessible in seven languages, including English. You can also go to the support center on the website for answers to some of the general queries. The other method to get in touch with the support team is to fill out a contact form and send it to the CFD broker.

However, for quick resolution of your queries, it’s best to get in touch with the 24/5 helpdesk comprising of a dedicated phone line and the live chat support.

As part of our review of the top forex broker, Australia, we interacted with the Live support team to gauge the quality of the client helpdesk and the response time. While the initial response time was <10 seconds, we were also impressed with the speed and the quality of the responses to the questions posed by us.

Phone support |

+442031500380 |

SUMMARY

Markets.com is a globally-recognized multi-asset market-making forex broker offering a range of CFD products across multiple asset classes and trading platforms. The parent of the CFD broker, Playtech is an FTSE-250 company with 303.79 million outstanding shares and a market cap of about £1.23 billion (As of 31st December 2019).

Markets.com is not only one of the best forex brokers in Australia for its range of product offerings, trading tools, research, and trading platforms, the CFD broker is also one of the safest in the industry. The forex broker maintains all client deposits in segregated accounts, marks all the orders with a guaranteed stop-loss (GSL), and enables the compulsory stop-out process if losses exceed 50% of the margins. Besides, the regulation by multiple agencies across Europe, Australia, Africa, and BVI, along with negative-balance protection to all clients is a positive move in comparison with the other top forex brokers.

Clients registering with Markets.com have the option of two account types- Premium and Professional. With the minimum deposit at $250 or a currency equivalent, you can access the immense trading opportunities offered by the broker. The leverage is in line with what most forex brokers offer, the order execution is swift, and the broker does not charge commissions. However, when it comes to trading costs, Markets.com is expensive, especially if you are using the MetaTrader platforms.

So, unless you are an algorithmic trader who is very specific about your trading costs, Markets.com is one of the best CFD brokers in the industry.