BRIEF INTRODUCTION

Pepperstone, founded by Owen Kerr and Joe Davenport, is an FX and CFD broker based out of Melbourne, Australia. The firm was launched in 2010 to transform the online FX broking industry by offering high-speed order execution, low trading costs, and superior customer support. Over the years, the Australian forex broker expanded into one of the biggest in the world, offering a range of over 150 trading instruments across forex and CFDs in shares, stock/currencies indices, commodities, and cryptocurrencies. The CFD broker is globally renowned, has a client base of close to 60,000 traders, and processes a daily average of about $12.50 billion in trading volumes.

When it comes to regulation and licenses, the Australian Securities and Investments Commission (ASIC), and the UK’s Financial Conduct Authority (FCA) oversee the functioning of the Australian forex broker. The regulations by the world’s top agencies make Pepperstone one of the safest forex and CFD brokers when it comes to investor protection and the safety of client deposits. Besides, clients worried about the security of their funds will also be glad that the broker maintains all client deposits in segregated accounts in tier-I banks.

Clients opening an account with Pepperstone can choose from the two account types with the opportunity to migrate to the premium client services, access to raw spreads, high-speed order execution, multiple funding methods, and three trading platforms. Besides, Pepperstone runs an active trader program for high-volume traders and a client referral package, aimed at rewarding existing clients.

RANGE OF MARKETS

In our extensive evaluation of the CFD broker, Australia, we evaluate the range of markets covered by the top forex broker. Besides, we weigh the trading conditions, including spreads, margins, order types and the minimum order size, manually analyze the web, desktop, and mobile trading platforms offered by the broker, the educational material provided by Pepperstone, the various client support options, and the quality of the team handling the live chat.

In our ASIC regulated forex broker review, we have maintained a neutral outlook of the CFD broker to certify prospective clients and readers receive a fair appraisal of one of the best forex brokers in Australia. Our forex broker review not only highlights all the fundamental features offered by the broker in terms of products and services but also includes the drawbacks.

Range of markets covered by Pepperstone forex-

Clients opening an account with Pepperstone can trade in over 150 products across five asset classes, a significant portion comprising of FX and CFD in shares. The product mix includes-

- 60 + currency pairs consisting of majors, minors, crosses, and exotic currencies.

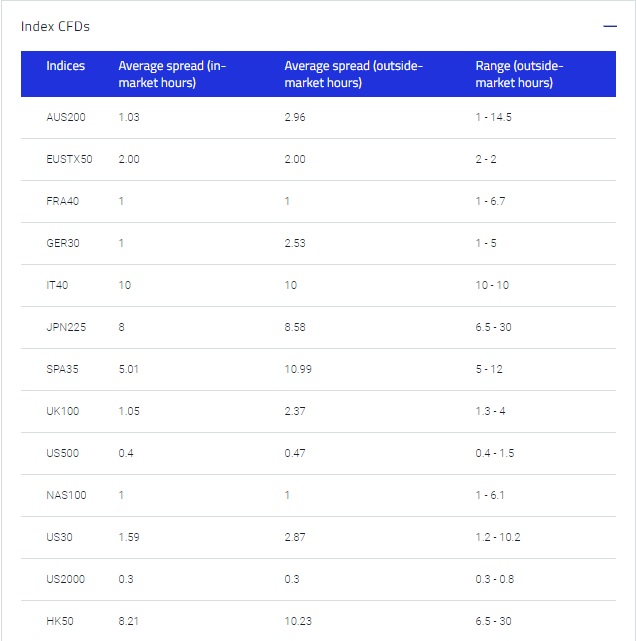

- Fourteen -global stock index CFDs from the Asia Pacific, Europe, and the US.

- The US dollar index.

- Sixty US stock CFDs.

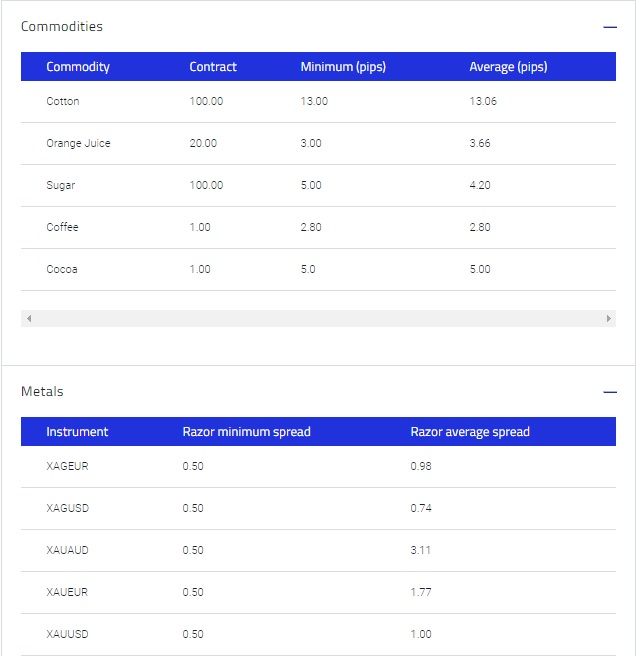

- Thirteen commodities, including precious/base metals, energy, and softs.

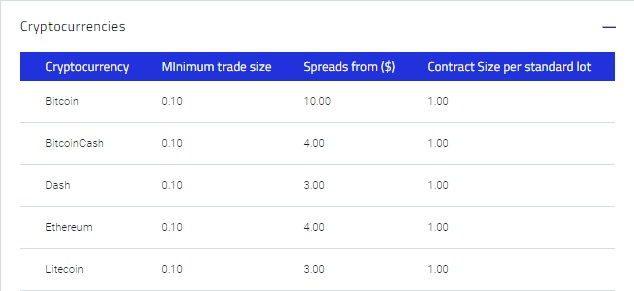

- Five major cryptocurrencies.

TRADING PLATFORMS

Pepperstone offers three trading platforms, all freely accessible by clients across the web, desktop, mobile, and tablet applications. The trading platforms include

- MetaTrader 4- The Australian forex broker’s MT4 offering comprises of the MT5 for Windows, Mac OS, Android, and iOS.

- MetaTrader 5- Likewise, the CFD broker offers MT5 for Windows, Mac OS, Android, and iOS.

- cTrader- Pepperstone offers four cTrader terminals: The cTrader Web, cTrader, cTrader Mobile, and cTrader Automate.

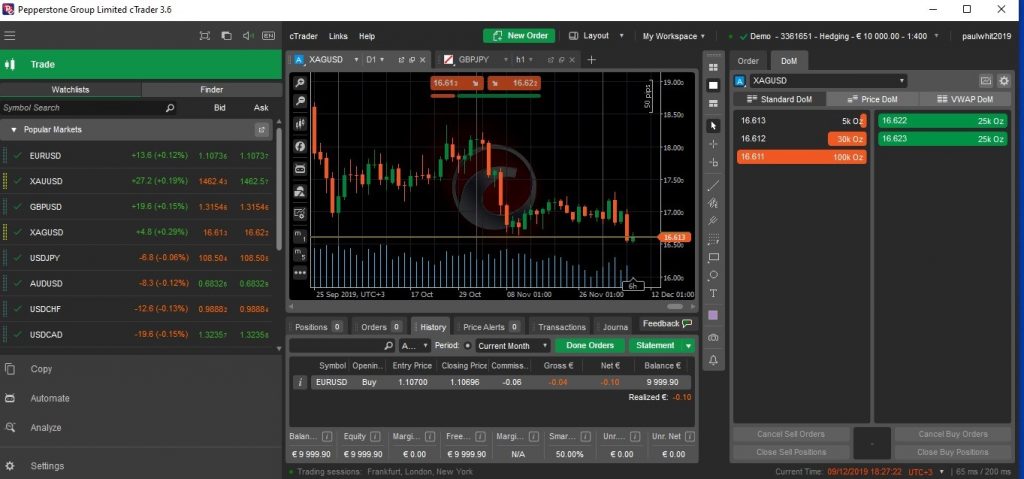

As part of our review of the top forex broker, we analyzed the cTrader desktop platform, the MT5 web version, and the MT4 mobile app.

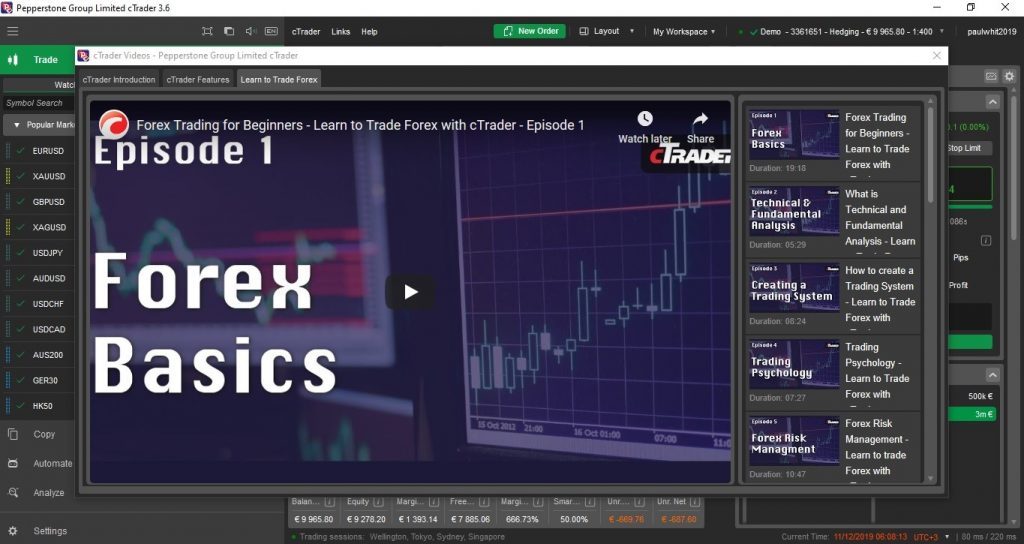

cTrader desktop platform-

We reviewed the cTrader version 3.6, the winner of the best FX trading platform for 2018, at the Finance Magnates Summit Awards in London. The default terminal is accessible in 22 languages and comprises a watchlist, chart, trade, and the market depth window.

If you are using the cTrader terminal provided by Pepperstone,

- You can trade in six major FX pairs, ten minors, fourteen crosses, and thirty exotic currency pairs.

- Gold, Silver, Platinum, and Palladium.

- Execute trades in spot energy instruments comprising of Natural gas, WTI, and Brent crude oil.

- Access the fourteen stock indices from Asia-Pacific, Europe, and the US.

- Bitcoin, Ethereum, Litecoin, and Dash.

- Carry out futures trading on the US dollar index, and soft commodities like Coffee, Cotton, Cocoa, Sugar, etc.

The cTrader menu also has the option to copy, automate, and analyze the performance of your trades.

The cTrader Copy brings strategy providers and investors looking to copy trades of successful analysts on the same platform. If you are a successful trader and wish to generate a steady income by broadcasting your trading strategies to followers, you can do so on the cTrader desktop terminal. On the other hand, investors who do not want to spend time analyzing the markets can access the strategies of professional traders, choose whom to follow, and start copying trades. All you have to do is launch the cTrader Copy, select a strategy provider, and start copying trades.

The cTrader Automate is a built-in application to develop your trading robots or indicators and automate trades. It has a few sample Bots and indicators, along with the codes. If you are familiar with the programming language, you can edit the script, backtest, and optimize the strategies before taking them to the live markets.

Additional features of the cTrader desktop-

- Multiple order placement options with the ability to place one-click orders.

- High-speed order execution.

- Hotkeys to set your personal preferences.

- Order types include market, limit, stop, stop limit, along with SL/TP orders.

- Activate charts and market depth panels from the watchlist window.

- The application comes with four chart types and 26-time frames.

- Email/price alerts and notifications.

- Market sentiment indicator.

- Detach individual panels from the main workspace.

- Access a massive range of charting tools, including drawing, custom indicators, and oscillators.

Drawbacks-

- Pepperstone does not offer real-time news via the cTrader.

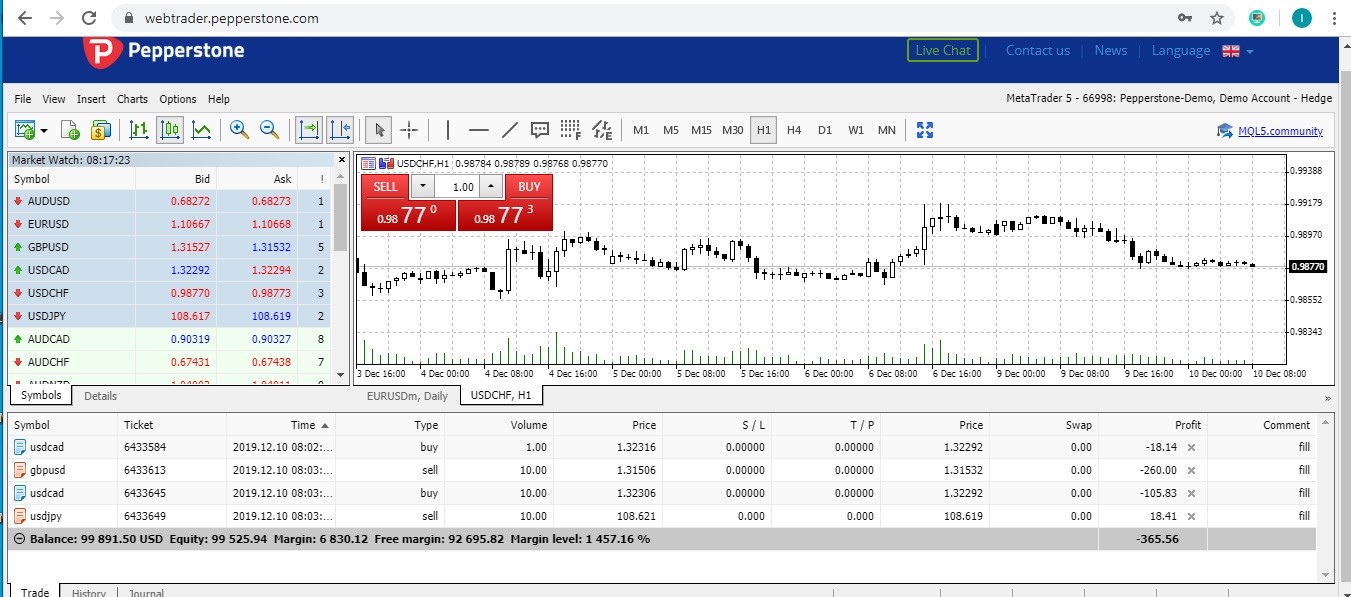

Review of the CFD broker’s MT5 Web platform-

The MetaTrader 5 is a multi-asset platform for trading Forex, CFD’s, exchange-traded products, including futures. The platform comes with advanced trading functions and excellent tools to carry out fundamental and technical analysis. MetaTrader 5 supports automated trading where clients can use trading robots and signals, although the web version does not support this feature. The web platform is accessible across all browsers and equips traders with a vast arsenal of analytical tools to carry out comprehensive price analysis and forecasting.

The default web terminal is accessible in 11 languages and comprises a watchlist, chart, and trade window, from where you can view your trades, P/L, and account balance.

If you are employing the MT5 web platform, the forex and CFD broker offers the full range of trading instruments, including stock CFDs, available only on the MT5 platforms. So, clients can access all the trading instruments on the cTrader plus also more than 60 stock CFDs.

Features of the MT5 Web-

- Multiple order placement options with the ability to place one-click orders from the chart panel.

- High-speed order execution.

- Order types include market, limit, stop, stop limit, and multiple GTC categories.

- All orders come with the SL/TP option.

- Activate charts from the watchlist window.

- The web terminal has three chart types with nine-time frames, from one minute to one month.

- Access a good number of indicators and oscillators.

- Connect with the MQL5 community of traders.

Drawbacks-

- The MT5 web application does not support automated trading.

- A lower number of language options compared to the 41 offered by the MT5 desktop version.

- It does not include price alerts and real-time news.

- Non-availability of custom indicators.

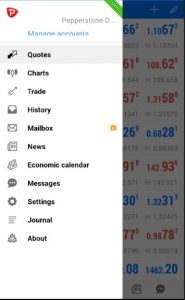

Forex trading review of the MT4 Mobile App-

Pepperstone offers all clients access to the MT4 mobile app for Android and iOS. Clients can trade all the asset classes and products offered by the broker except futures and share CFDs. We tested the app from an Android device and have highlighted the key features in our review below.

The Android app can be downloaded from the Playstore and comes as six separate windows: Marketwatch, charts, account info and positions, account balance, news, and chat access to the mql5 community.

The Pepperstone MT4 mobile application supports-

- Six major FX pairs, ten minors, ten crosses, and thirty-five exotic currencies.

- Gold, Silver, Platinum, and Palladium.

- Spot energy instruments comprising of Natural gas, WTI, and Brent crude oil.

- Eleven global stock indices.

- Bitcoin, Bitcoin Cash, Litecoin, and Dash.

The key features include-

- Three basic chart types with nine-time frames.

- 30-chart indicators and oscillators.

- One-click order placement.

- Option to trade from the watchlist and chart panels.

- Includes market, limit, stop, trailing stop, and SL/TP orders.

Drawbacks-

- It does not include the option to add custom indicators.

- No real-time news.

TRADING CONDITIONS - Spreads, margins, and orders -

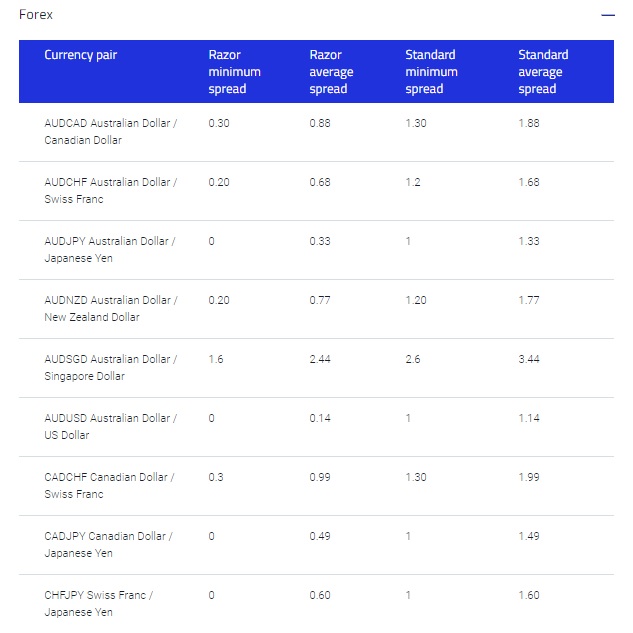

Pepperstone is one of the few Australian forex brokers offering awfully low variable spreads, starting from zero pips for clients signing up for the Razor Account. However, the least average spread displayed on the website is 0.13 pips. Besides, our review of the spread on the demo trading platforms also endorses Pepperstone claims of one of the lowest spread forex brokers. For clients setting up the Standard Account, the minimum spread starts from 1 pip for the major FX pairs, while the least average spread was for the EURUSD pair at 1.13 pips.

On the flip side, the CFD broker also charges a commission on transactions carried out from the Razor account, which starts at A$ 3.50 per side for a standard lot size of 100K and from $0.02 per share for equity CFDs. Pepperstone does not charge brokerage on the other asset classes. Besides, clients opening the Standard Account are also exempt from paying commissions, as the broker charges higher spreads on these accounts.

Illustrated below are the spreads offered by the forex broker for various asset classes

When it comes to the margins offered by the CFD broker, it mostly depends on the regulator. For clients signing up with the Australian forex broker under the license of ASIC, the margins offered at Pepperstone start as low as 0.2 % or leverage of 500:1 for major FX pairs and some commodities. For stock index CFDs, clients can trade with margins from 0.5%, while the margin requirement for CFD trading in cryptocurrencies is 20%.

On the other hand, clients coming under the FCA regulations are subject to higher margin requirements with a maximum leverage of

- 30:1 in the major FX pairs.

- 20:1 in non-major currencies, gold, and major indices.

- 10:1 in commodities other than gold and non-major equity indices.

- 5:1 in individual equities.

- 2:1 in cryptocurrencies.

The order types offered by the forex and CFD broker include Market order, Limit order, Stop order, Trailing stops, and Good till canceled (GTC). All the orders can be clubbed along with the stop loss/take profit (SL/TP) order.

EDUCATION

Pepperstone offers an assortment of online resources, webinars, and trading guides for both beginners and experienced traders. Individuals can access the educational resources from the website, the CFD broker’s forum, or directly from the trading platforms.

Newbies can access tons of information on the various terms linked to the forex markets, learn about fundamental, technical, and price action analysis, automated trading, and risk management. Besides, interested traders can register for the upcoming webinars organized by the forex broker from time to time, access a range of video courses on forex trading, MetaTrader 4, and the economic calendar. Also, individual traders looking to learn technical analysis can download the Autochartist pattern recognition software from the secure client area and subscribe to daily/weekly market reports offered by the broker.

CLIENT SUPPORT

Pepperstone CFD broker offers client support via email, phone, and 24/5 live chat. Besides, the support link on the website caters to a host of information on opening and managing your account, platforms and tools, trading conditions, funding methods, and frequently asked questions.

As part of the review, we interacted with the broker’s live support, and have highlighted our feedback below-

"The initial response time was about a minute, pretty slow in comparison to the other CFD brokers."

"The chat response time varied from 20 seconds to more than a minute, way below the prescribed standards set by the company."

Following are the various support channels to get in touch with Pepperstone forex

| Pepperstone Australia | |

| Phone- Australia | 1300 033 375 |

| Phone- Outside Australia | +61 3 9020 0155 |

| Phone- London | +44 800 0465473 |

| [email protected] | |

| Pepperstone Partners | |

| [email protected] | |

| [email protected] | |

SUMMARY

Our CFD broker review of Pepperstone forex threw up some interesting facts.

For one, the Australian broker covers a wide range of markets across continents, offering clients an array of trading features, including scalping, hedging, and automated trading.

Secondly, clients can fund their accounts in ten base currencies, comprising of the USD, AUD, GBP, EUR, CAD, JPY, CHF, NZD, SGD, and the HKD. Besides, the CFD broker’s minimum account opening balance of A$200 is not very high in comparison with the other renowned forex and CFD brokers.

Third, the nine-year-old forex broker offers a range of CFD products across all the major asset classes and could pose a challenge to some of the top forex brokers in the industry in terms of trading conditions.

Fourth, the choice of three trading platforms across all the browsers, operating systems, and mobile devices is highly competitive when compared to those offered by the other forex brokers.

Fifthly, Pepeprstone’s regulations by tier-I agencies in Australia and the United Kingdom offer adequate investor protection. While the FCA covers investors to the extent of £85,000, even if the forex broker fails, clients signing up with ASIC regulated forex brokers do not receive any such guarantee. However, the CFD broker has adopted quite a few policies to ensure the security of client funds such as;

> Holding client deposits in tier-1 banks

> Limiting the maximum trade size to 100 lots.

> Negative balance protection offered to UK clients.

> Mandatory close out of positions if client margins drop below 50% (only for UK clients).

> Swift execution of trades.

The drawbacks include a lack of real-time news on any of the platforms and the slow response time of the Live chat support. Other than that, Pepperstone is an excellent no-dealing desk broker offering ultra-fast trade execution and almost zero latency. Besides, they are one of the lowest spread forex brokers with a wide range of product offerings, superior market coverage, and provide robust investor security.