FXTM Review:

The European CFD broker with one of the lowest spreads in the industry

BRIEF INTRODUCTION

ForexTime (FXTM) is an online retail forex and CFD broker operating since 2011. The Cyprus- based group is a global leader in CFD trading with over 2-million clients from 150 countries. Spread across Europe, Asia, Africa, the Middle East, and Latin America, FXTM is one of the best CFD brokers in the industry, offering more than 250 products in forex, commodities, indices, and shares.

Clients registering with the forex broker can access all the products from the world’s most appreciated desktop and web-version of the MetaTrader 4, although FXTM has also pledged to provide all clients the option of the MT5 shortly. Besides, clients using Apple and Android smartphones have the option of MT4 and FXTM’s proprietary application- the FXTM Trader.

When it comes to the safety of client funds, multiple regulators govern the CFD broker in the country of operations, including-

- ForexTime UK Limited- Authorized and regulated by the Financial Conduct Authority (FCA).

- ForexTime Limited- Regulated by the Cyprus Securities and Exchange Commission (CySEC).

- ForexTime Limited- Licensed by the Financial Sector Conduct Authority (FSCA) of South Africa.

- Exinity Limited- Regulated by the Financial Services Commission of the Republic of Mauritius as an Investment Dealer.

The CFD broker maintains all client deposits in segregated accounts, meets stringent capital adequacy, and is subject to regular financial audits as part of the procedure of the monitoring authority. Besides, the forex broker is a member of the Financial Services Compensation Scheme (FSCS), which compensates UK residents if the firm ceases trading, slips into insolvency, or is unable to meet obligations.

In our review of the forex broker, we analyzed the range of products, trading terminals, including the MT4 and the exclusive mobile app, trading conditions covering the spread, margins, and orders. Besides, the forex review also involves the distribution of the currency products under major, minor, and exotic pairs, educational plus trading resources, and the quality of trade execution.

RANGE OF MARKETS

The product range at FXTM includes 250 financial instruments across forex and CFDs in commodities, indices, and shares. For International clients, the CFD broker also provides the choice of trading CFD in cryptocurrencies.

FXTM provides a selection of six live and demo trading accounts, catering to all categories of investors using diverse trading strategies. Likewise, the forex broker’s product offering also varies across account types.

Here’s a quick summary of the account types at FXTM and the range of products under each category. FXTM offers three Standard, and three ECN accounts for retail clients registering with the broker-

The Standard account types comprise of the Standard, Cent, and Shares account. The dissimilarities are mostly on the leverage, minimum deposit, spread, trading instruments, max volumes per trade, and max number of orders.

The ECN account types include ECN, ECN Zero, and FXTM Pro. The primary difference consists of additional trading platforms, trading instruments, and maximum volume in lots per trade.

Tabled below are the account types, the minimum deposit, and the range of products

| Account type | Trading Platform | Minimum deposit | Trading Instruments |

| Standard | MT4 | $/€/£ 100 | Forex: Majors, Minors, Exotics- 59.

Spot Metals- 5, Spot CFDs- 14. |

| Cent | MT4 | $/€/£ 10/ ₦2,000 | Forex: Majors, Minors- 25. Spot Metals- 2 |

| Shares | MT4 | $/€/£ 100 | Share CFDs: 170+ |

| ECN Account | MT4 | $/€/£ 500 | MT4: Majors, Minors, Exotics- 48.

Spot Metals- 3. |

| ECN Zero | MT4 | $/€/£ 200 | MT4: Majors, Minors, Exotics- 48.

Spot Metals- 3. |

| FXTM Pro | MT4 | $/€/£ 25,000 | MT4: Majors, Minors, Exotics- 43.

Spot Metals- 2. |

TRADING PLATFORMS

FXTM offers only the MetaTrader 4 across all computers and mobile devices. While some of the forex broker’s subsidiary websites also make a mention of the MT5 offering, FXTM confirmed that for now, all registered clients- Demo and Live, would have access only to the MetaTrader 4 platform. When we compare the range of platforms offered by some of the other top forex brokers, FXTM is undoubtedly at a disadvantage.

Clients can start trading from any of the six account types- Standard, Cent, Shares, ECN Zero, ECN, and the FXTM Pro, with the option of swap-free trading. The difference between the accounts is the spread, leverage, minimum deposit, and product offering. For instance: Only clients signing-up for the Shares account can access 170 + shares trading on the NYSE and NASDAQ.

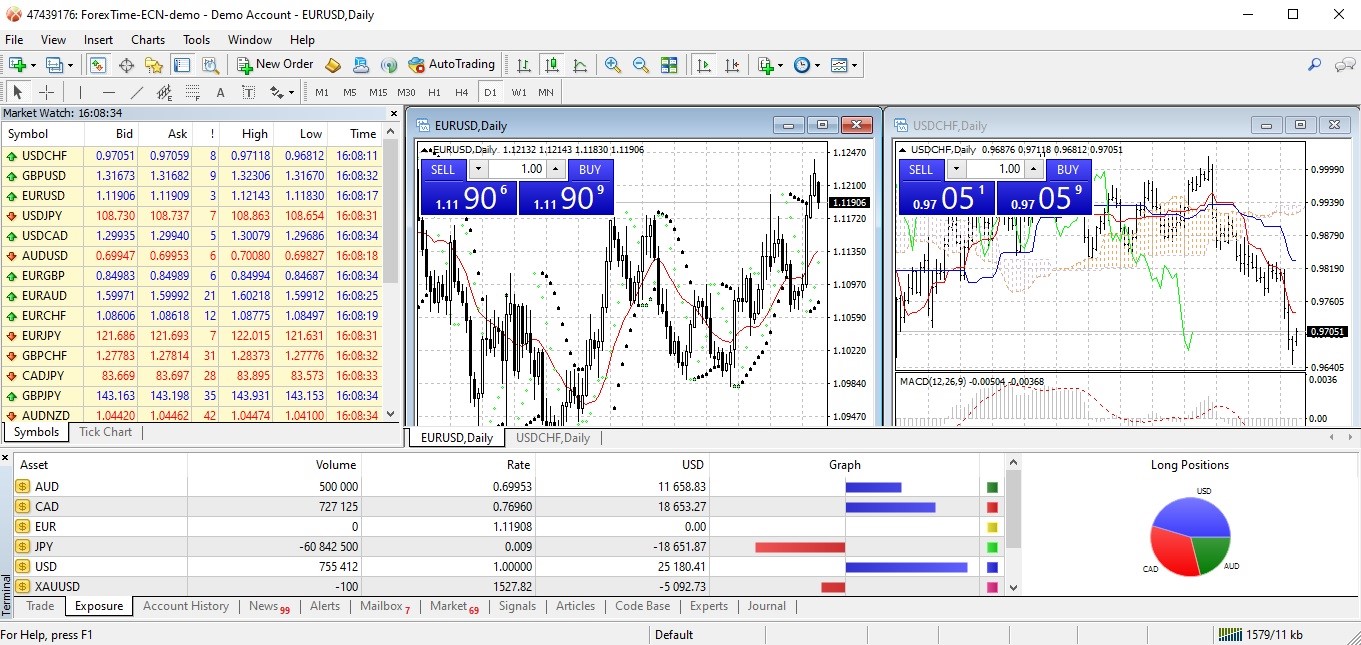

In our extensive forex review of the trading platforms at FXTM, we studied the MT4 web and desktop application along with the top forex broker’s trademark FXTM Trader App, from an ECN demo account.

FXTM desktop application-

Following our review of the MT4 desktop trading terminal, we were disappointed that the top CFD broker has not included any major custom indicator to the existing tools in the MT4 platforms. The platform supports Windows, Linux, and macOS, with clients having the option of manual and automated trading. The platform meets high-security standards with data encryption between the client and the server, speedy order execution, and one-touch orders from multiple panels.

Following are some of the major highlights of the MetaTrader 4 desktop platform offered by FXTM-

- Clients can trade in 48 FX pairs, precious metals and energy, eleven global stock indices, and the Nigerian naira versus the greenback and the euro.

- Instant order type comprises the one-click order function.

- When it comes to charts, each instrument is accessible in nine-time frames.

- The technical tools include 30 in-built indicators and 24 graphic objects.

- Ability to place trading alerts.

- Live market news.

- Clients can access custom indicators from FXTM like the pivot point indicator, spread indicator, day bar info indicator, pivot SR levels, and the pip value calculator.

- The automated trading feature allows clients to trade with the assistance of trading robots (EAs).

- You can download EAs and technical indicators free of cost from the MT4 code-base.

- Build, test, and optimize your trading robot from the MQL4 IDE development environment.

- Clients can log in to the MQL community free of cost and interact with developers and traders.

When compared to some of the other forex brokers, including the small-time players, FXTM has not invested much into including additional features on to the MetaTrader platform. There are no major custom indicators or third-party technical analysis tools like Autochartist, expert analysis, or trading ideas. Instead, all the broker provides is the pivot point strategy, market news from various sources, and a few indicators.

FXTM Web platform-

Here again, FXTM has not incorporated any major changes in the standard features of the platform. The MT4 web terminal is accessible on almost all the browsers with transmitted information securely encrypted. Clients can trade directly via a browser, access all the MetaTrader order types and execution modes, including the one-click trading feature.

Clients using the web terminal can trade 48 FX pairs, precious metals and energy, eleven global stock indices, and the Nigerian naira versus the greenback and the euro.

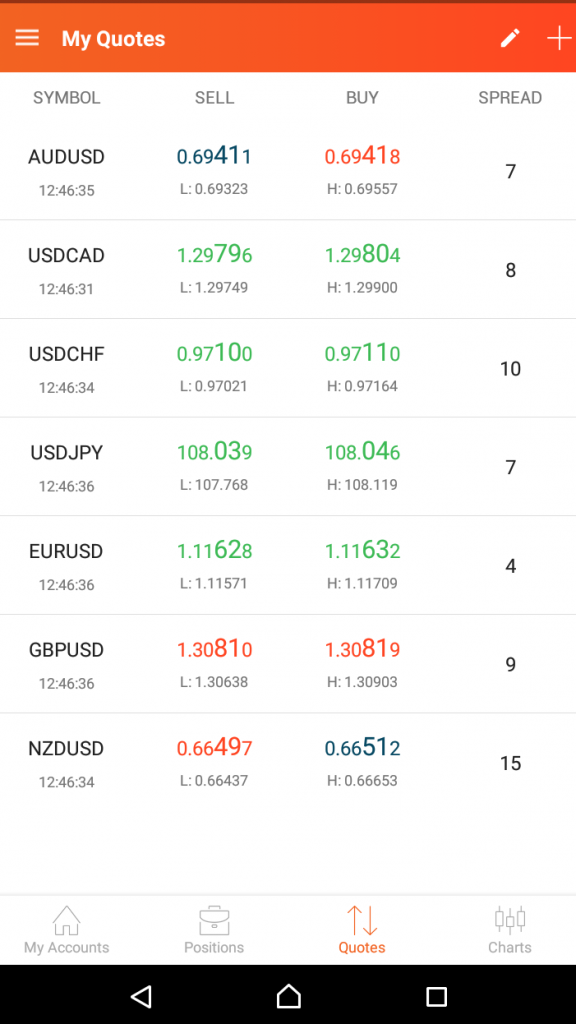

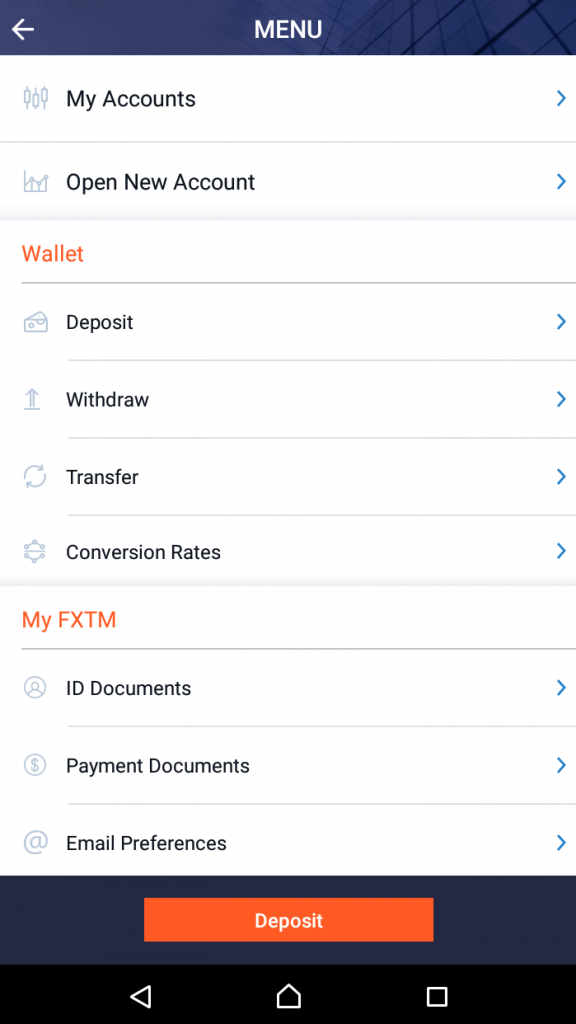

FXTM Mobile app-

The FXTM Trader, the proprietary mobile app of one of the best forex broker, is available on both the Android and Apple’s iOS and is downloadable from the Google Play Store or the Apple App Store. For our review, we took a look at the Android mobile app from a demo account, analyzed all the features, and delivered our verdict below.

At first sight, the application looks very simple and straightforward. The key features comprise real-time streaming quotes, charts, trading dashboard, accounts overview, and access to MyFXTM- All of it from the menu button at the bottom of the workspace. Clients can trade 250+ financial instruments offered by the forex broker, monitor charts along with your favorite technical indicator, track positions, and place pending or the instant one-click orders. One of the best features of the app is that all trades are in sync with the MT4 platforms, allowing clients to enter/exit positions from multiple devices.

Some of the significant features-

- The mobile app is accessible across a range of handheld mobile devices.

- The app supports one-click orders with high-speed trade execution.

- You can quickly access the MyFXTM area from where you can monitor all your trading activities.

- Deposit and withdraw funds easily.

TRADING CONDITIONS - Spreads, margins, and orders -

In our review of the trading conditions at FXTM, we analyzed the spread, margins, and orders at the leading forex broker. While the trading conditions largely depend on the account type, we found them to be extremely competitive in comparison with some of the other top CFD brokers. However, there is always a catch, as is the case with the other forex brokers too. For trading accounts with the lowest spread, the CFD broker either charges a commission or large deposits. On the other hand, the top forex broker does not charge commissions if the spreads are high.

In the following illustration, we have tabled the account type along with the minimum deposit, spread, and the corresponding commission.

| Account type | Minimum deposit | Minimum spread | Commission |

| Standard Account | $/€/£ 100 | 1.3 pips | No |

| Cent Account | $/€/£ 10 / ₦2 000 | 1.5 pips | No |

| Shares Account | $/€/£ 100 | 0.1 pip | No |

| ECN Account | $/€/£ 500 | 0.1 pip | $2 per standard lot |

| ECN Zero Account | $/€/£ 200 | 1.5 pips | No |

| FXTM Pro Account | $/€/£ 25,000 | 0 pips | No |

When it comes to trading margins, retail clients residing in the UK and EU are subject to higher margins due to the stringent regulations governing forex brokers. However, professional clients receive higher leverage, although they may have to forego some of the benefits offered to retail clients such as investor compensation under UK’s FSCS or the Investor Compensation Fund (ICF) in the EU.

For International clients, the broker has relaxed the floating margin requirements substantially, to the extent of 0.1 percent for major FX pairs. But the margins are tied to the notional trading value, and an increase in the trading volumes would impact the margins adversely.

The following table highlights the various asset classes and the corresponding margins for clients based in the UK, EU, and the other International locations

| Asset class | Min-Max leverage: UK/EU | Min-Max leverage: Intl |

| Forex | 20:1- 30:1 | 25:1- 1000:1 |

| Commodities | 10:1- 20:1 | 25:1- 500:1 |

| Indices | 5:1- 10:1 | 25:1- 800:1 |

| Shares | Fixed at 5:1 | Fixed at 10:1 |

| Cryptocurrencies | Not available for clients | 1:1- 200:1 |

Since the forex broker’s primary platform is the MetaTrader 4, it supports three order types- Market, instant, and pending. All the order types also come with the stop loss/take profit function and are triggered once the initial order goes through. When it comes to the speed of order execution, the MT4 platforms support one-click/ instant orders with trades going through within a fraction of a second.

If you register with FXTM, not only would you be trading with one of the best forex brokers offering one of the lowest spread in the industry, but you will also relish some of the exceptional trading conditions in terms of leverage, order types, and speedy trade execution.

EDUCATION

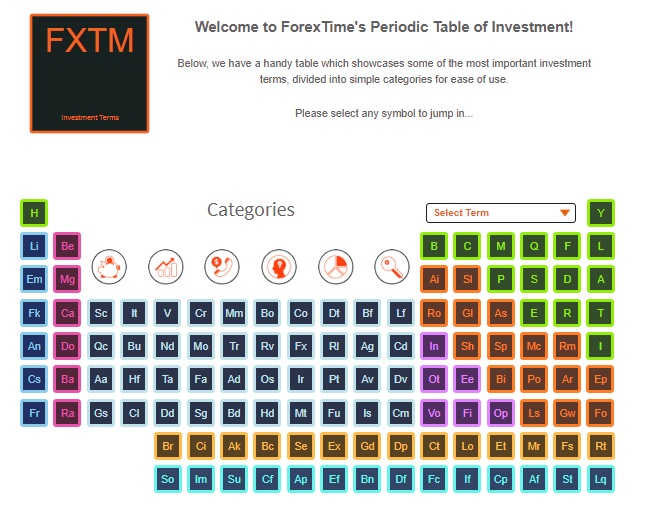

ForexTime has quite a few readily available resources on its website when it comes to educating freshers and experienced traders. Some of them include a guide on forex trading, a glossary of forex definitions, educational videos, articles, and a neatly cataloged periodic table of all the leading investment and trading terms. You can also download ebooks on Cryptocurrencies, Elliott Wave, Candlestick strategies, and habits of successful traders- all written by the head of education at FXTM, Andreas Thalassinos. Besides, you can also participate in the numerous webinars on technical analysis, risk management, market themes, and other useful topics organized by the top forex broker from time to time. You can also access the video recording of the past webinars if you find anything interesting out there.

CLIENT SUPPORT

When it comes to client support, FXTM has several support options, including Live Chat, Phone, Email, WhatsApp, Viber, Telegram, Facebook, and Call-back. Besides, you can find answers to some of the frequently asked questions in the FAQ menu. The Live Chat is open 24/5 and is accessible in 17 languages. As part of our review of the top forex broker, we’ve had quite a few exchanges with the live support team, and our experience has always been pleasant. While the initial response time of the live chat was < 10 seconds, the crew operating the support desk were customer-friendly, and swift in responding to our questions and clarifications about the CFD broker’s products, and services.

Illustrated below is the contact info of the customer support via phone/email

| Customer support hotline-UK | +44 20 3734 1025 |

| Malaysia | +60-3-9212 5856 |

| India | 000800-100-4352 |

| Indonesia | 007 803 321 8183 |

| Nigeria | +234 803 153 4373 |

| South Korea | 003-0813-2643 |

| Thailand | +66 60 003 5095 |

| [email protected] | |

| [email protected] |

SUMMARY

Based on our extensive review of FXTM, we are happy to conclude with a positive outlook of one of the best forex brokers in the industry. Not only does FXTM offer premium trading conditions on a moderate range of financial instruments, but the CFD broker is also one of the safest when it comes to client privacy and security of funds. Added to that are the globally renowned MetaTrader platforms, the CFD broker’s exclusive FXTM Trader, ample educational resources, and excellent 24/5 multi-lingual customer support to back it up.

On the flip side, the info on the website is a little disorderly, and you may not find what you’re looking for in one place. Also, the CFD broker has six account types with the product offering linked to it, which can be confusing since you have to go through all the account categories in detail to decide which one is suitable for you. While the CFD broker does not have anything much to offer in terms of trading tools, the “FXTM Invest,” the social trading platform from FXTM is also accessible only by International clients.

To conclude, all forex brokers have something positive to offer, while they also have a few drawbacks. If you are a high-volume trader and concerned about the spread, liquidity, and execution speed, FXTM has you covered. On the other hand, if you are a fresher and do not want to invest heavily or pay large sums as spread/commission, the CFD broker has the account type specially tailored for your needs.