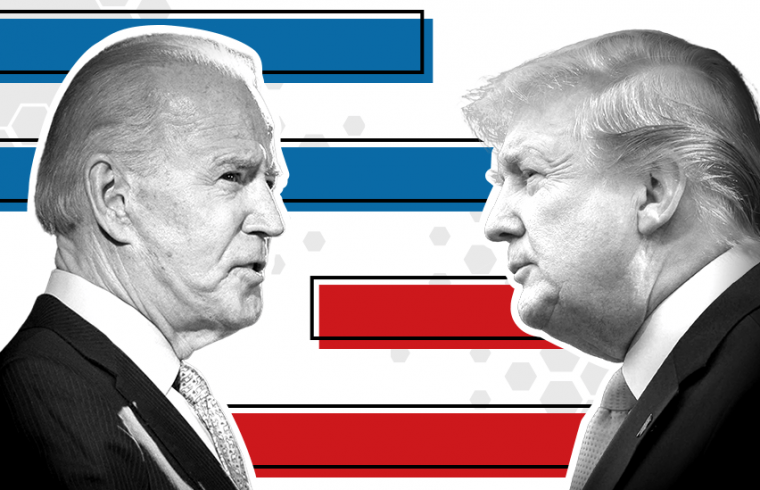

There are a slew of geopolitical factors impacting global markets as we approach the last full week prior to US elections. Investors are focused on the battle between President Trump and former Vice President Biden, while also keeping an eye out for Covid-19 vaccine developments, Brexit negotiations and most importantly, the negotiations for a new massive US economic stimulus package.

Earlier today the markets were generally in a “risk on” scenario, with equities being the notable exception waiting for an agreement to take shape between Republicans and Democrats in the US. Investors look keen to continue their current risk appetites so long as a stimulus deal remains alive. Nonetheless, time is certainly running out with only so many days left until the US election.

Giles Coghlan, Chief Currency Analyst, HYCM expects long trading opportunities to persist in XAU (Gold) with the current US Dollar weakness and a rush to safe-haven territory in the run up to Election Day on November 3rd.

Key events from the past week

- AUD: RBA minutes show cutting bias, October 20. The RBA minutes this week show that members discussed lowering interest rates towards zero. The expectations are now for an RBA rate cut at the upcoming November 03 rate meeting.

- GBP: Sterling rises on Brexit deal hopes, October 21. The GBPUSD rose on news that EU negotiators are expected to go to London as soon as today (Thursday 22 October) to resume trade discussions with the UK. Will this optimism remain?

- COVID-19: AstraZeneca trials to resume, October 21. AstraZeneca trials in the US are set to resume as early as this week according to sources cited by Ransquawk. Expect further positive vaccine news to be a positive boost to risk sentiment.

Key events for the coming week

- CAD: Interest rate decision, October 28. The Bank of Canada is expected to keep rates unchanged with OIS markets giving an 85% chance of no change. Be prepared in case there is a surprise cut which will result in instant CAD sell-ing.

- EUR: Interest rate decision, October 29. The ECB has expressed concern recently over both the strength of the Euro and the weak inflationary pressures facing the eurozone. Will this cause them to potentially cut rates this week or will they keep interest rates unchanged?

- USD: Election risks, October 19-23. As long as Biden maintains a firm lead over President Trump in the polls that should be positive for risk and continued negative pressure for the USD.

Don’t miss the latest news and discussion on our Telegram channel. Subscribe today!