Plus500 Review:

The Israeli-based multi-asset company with 2000+ products

BRIEF INTRODUCTION

Plus500 is a trademark of Plus500 Limited, an Israel incorporated firm in 2008, which has since expanded to all the major global markets. One of the widely regulated CFD provider in the industry, Plus500, has come a long way in the last 12 years, providing a range of more than 2000 CFD products across multiple asset classes and market segments from its proprietary Plus500 trading platform. The leading provider of Contracts for difference (CFDs) delivers trading facilities in forex, commodities, cryptocurrencies, indices, shares, besides ETF’s and options from two account types- Retail and Professional.

Plus500 has registered offices in four countries- The UK, Cyprus, Australia, and Singapore. However, the CFD provider has clients from more than 50 countries through its authorized and regulated organizations and functions under the following subsidiaries-

- Plus500CY Ltd- is authorized and regulated by the Cyprus Securities and Exchange Commission.

- Plus500UK Ltd- is authorized and regulated by the Financial Conduct Authority (FRN 509909).

- Plus500AU Pty Ltd- holds an AFSL license #417727, issued by the Australian Securities and Investments Commission (ASIC). Besides, the CFD provider is a registered Financial Services Provider – FSP No. 486026 issued by the Financial Markets Authority (FMA), New Zealand and a licensed Financial Services Provider, authorized by the Financial Sector Conduct Authority (FSCA), South Africa FSP #47546.

- Plus500SG Pte Ltd- holds a capital markets services license from the Monetary Authority of Singapore to operate in capital markets products (License No. CMS100648-1).

You do not own or have any rights to the underlying assets. Please refer to the Disclosure documents available on the website.

In July 2013, Plus500 went public and listed on London’s Alternative Investment Market (AIM), a sub-market of the London Stock Exchange (LSE), designed to help smaller companies access capital from the public. About six months later, the company’s market valuation soared to hit the USD 1 billion mark on the Exchange, registering phenomenal growth in the 5+ years since its inception.

In 2018, Plus500 Ltd joined the UK FTSE 250 index of leading mid-cap companies, listing its ordinary shares on LSE’s secondary market under the ticker symbol PLUS. On 31st December 2019, the company’s shares settled at 886 pence apiece on the Exchange, a drop of more than 73 percent for the year.

Plus 500 is one of the safest retail providers in an industry of forex scams. All clients funds are in segregated accounts, the CFD provider provides negative balance protection to all clients, and offers their services in more than 30 languages.

In our review of Plus500, we cover the range of markets, the trading platforms (web, desktop, and mobile), trading conditions, educational resources, client support, and the reasons why you should consider trading with the CFD provider.

RANGE OF MARKETS

The CFD provider provides clients access to more than 2000 financial instruments across five asset classes. In our review of the CFD provider, we have segregated the number of products under each asset class and listed them in the table below. When it comes to shares, clients can trade CFDs in publicly-listed companies in 22 countries, including the US, UK, Europe, and Australasia, in addition to a few selected Cannabis stocks.

Individuals interested in trading ETFs can access a massive number of Exchange-traded funds (ETF’s) that track the performance of equities, commodities, indices, REITs, and other global securities. Besides, the CFD provider also provides clients the choice to trade in one-month options contracts in selected financial instruments within its product offering from FX, indices, shares, and commodities.

Tabled below are the range of products across the various asset classes and market segments

| Asset class as CFDs | Number of products |

| Forex- Major, minor, exotic, and currency indices | 72 |

| Commodities | 22 |

| Cryptocurrencies | 14 |

| Indices | 32 |

| Shares | Over 2000 |

| ETF’s | 93 |

| Options | 24 |

TRADING PLATFORMS

Plus500 offers only its proprietary trading platform, which is available as the Plus500 Webtrader, the Windows 10 App and the mobile trading software. The Webtrader is quickly accessible once you register with the CFD provider while the Windows 10 App is available to download from the Microsoft Store on your computer. Likewise, the forex provider’s mobile app, accessible for Android and iPhone users, can be downloaded from the Android Playstore or the Apple App Store.

As part of our CFD provider review, we tested only the Plus500 Webtrader from a demo account. We were unable to review the mobile application due to certain restrictions.

Following is our evaluation of the Plus500 computer-based trading platforms.

The Plus500 Webtrader-

The Webtrader is accessible directly after you log in to your trading account and comes with a simple, user-friendly interface with two background colors. The default workspace comprises the watchlist and chart-which can be triggered by clicking on the symbol in the MarketWatch panel. You can add symbols to the watchlist by choosing any of the multiple options available adjacent to the section. The menu on the top left of the workspace includes trade, open positions, orders, and closed positions. Besides, you also have the option to switch from the demo to real account, deposit funds, change the background color, or interact with the support team via live chat.

When it comes to trading tools and order execution,

- You can place email and push alerts for each of the symbols in the watchlist or add them to favorites.

- The platform supports individuals placing hedged or contradicting trades.

- View the instrument details like the trading unit, leverage, trader sentiment, spread, margin requirements, overnight funding costs, session timings, and lots of other info.

- Under live stats, the platform displays the percentage change in multiple time frames- Five minutes- one day.

- You can access 13 chart types in eleven-time frames- Tick chart to weekly, with the option to expand the chart to the full-screen mode.

- The platform comes with more than 100 technical indicators, comprising overlays, oscillators, and volume indicators, besides 21 drawing tools.

- The Webtrader does not include live news, although the CFD provider provides access to the economic calendar and corporate events from the platform .and the website.

When it comes to the order types, Plus500 provides the primary market and pending orders with the stop loss/ take profit option. The CFD platform does not offer the instant or one-click orders nor the automated trading facility that is the USP of all the top forex providers. In addition to the basic order types, clients can also access trailing stops and the guaranteed stop order. However, guaranteed stops are not available for all instruments, come with a broader spread, cannot be revoked, and should be within a specific range from the market price.

To summarize, the platform is suitable for chartists and manual traders who are not in a hurry to execute orders, since the platform does not support one-click trading. On the other hand, high-volume traders and those using automation to execute trades may not find the trading terminal useful.

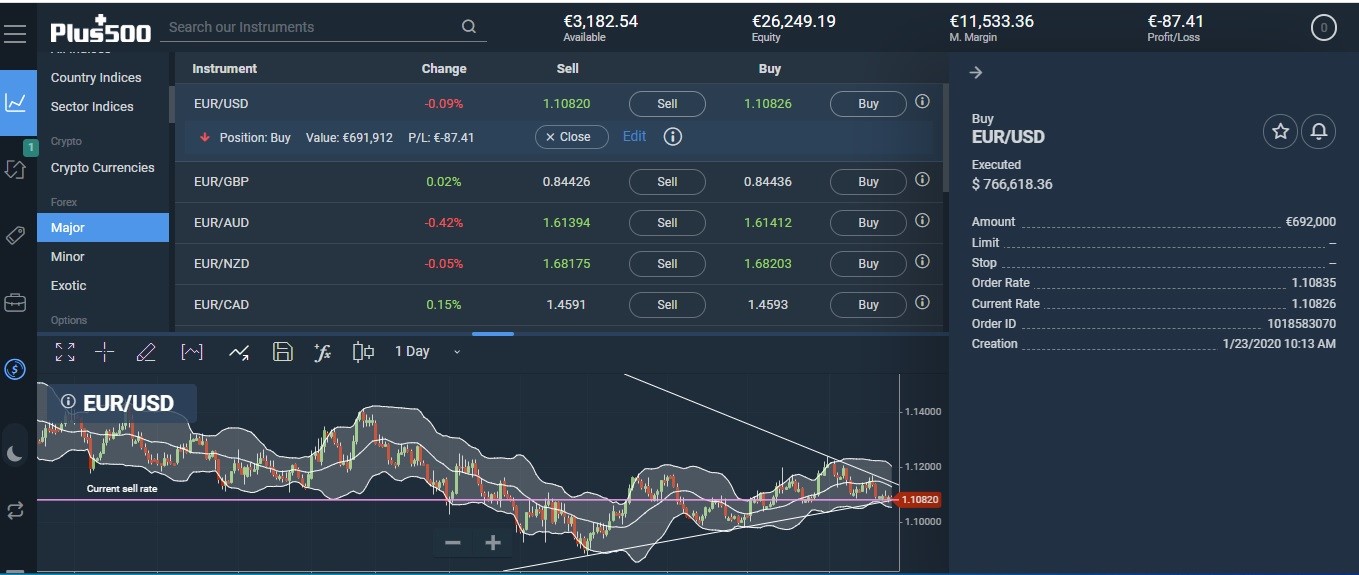

Illustration of the Plus500 Webtrader

TRADING CONDITIONS - Spreads, margins, and orders -

In our Plus500 CFD platform review, we take a look at the trading conditions comprising spread, margins/leverage, and orders. But before we get to the trading conditions, let’s take a quick look at the account types offered by the top forex provider.

Plus500 offers two kinds of accounts- Retail Account and the Professional Account, with an exception in Singapore, where individuals can register only under the Retail Account. The top CFD provider holds all client deposits in segregated accounts with negative balance protection. Clients registering for either of the account types have identical spread, leverage, and similar trading conditions, but while retail clients come under the Investor Protection Fund (ICF) in Europe and the Financial Service Compensation Scheme(FSCS) in the UK, Professional Clients forego the investor protection for higher leverage.

Spread-

If you register with Plus500, your central trading cost is the spread. Unlike a majority of forex brokers who provide the option of both the spread and commission, the top CFD provider only charges the bid-ask difference.

Plus500 provides two kinds of spread- Fixed and Dynamic. While the dynamic spread is continuously adjusted based on market conditions, the fixed spread can be changed to dynamic from time to time. To find out which instruments come under the category of fixed and dynamic spread, go to the instrument categories on the website and click on “View full details.” Alternatively, you can also get in touch with the client helpdesk.

In our review of the lowest spread offered by the CFD provider from a demo account, we found the EUR/USD pair persistently trading with a difference of 0.6 pips, a reasonable spread in comparison with a majority of forex brokers.

Margin/leverage-

Clients registering with the CFD provider under ASIC, FMA, and FSCA regulations can trade with higher leverage or lower margins in comparison with clients controlled by FCA or CySEC due to the flexibility of the supervisory authorities in Australia, New Zealand, and South Africa. The minimum margin offered to clients under the above regulators is 0.33 percent or leverage of 300:1 in forex, indices, and shares.

Retail clients coming under the CySEC and the FCA regulations in Europe and the UK have to pay higher margins due to the regulatory framework that is in force in the region. On the positive side, clients signing-up with the forex provider receive the best in terms of client protection, excellent order execution, access to the services of the financial ombudsman, rights to the investor compensation fund. Besides, retail clients looking for higher leverage can register as Professional Clients, and trade with lower margins- more or less in line with that offered by the CFD provider to clients under the other jurisdictions. However, they should be willing to waive off some of the client protection measures under the Mifid II regulations.

Likewise, in October 2019, the Monetary Authority of Singapore, in its bid to protect retail investors from over-leveraging in the volatile FX markets, cut down the max leverage by forex brokers from its earlier 1:50 to 1:20.

Orders-

Plus500 is a market-making CFD provider, acting as a counterparty to all client trades, and does not guarantee instant price execution. Unlike some of the top forex providers who maintain their servers in Equinix or other data centers to ensure speedy order execution via liquidity providers, Plus500 has no such requirement, since the dealing-desk provider provides two-way quotes.

According to the order execution policy of the CFD provider,

- The parent company, Plus500 Ltd, provides all the quotes/prices displayed on the trading terminal.

- There is an identical hedge trade between Plus500 and Plus500 Ltd for all trades executed by Plus500 on the Plus500 Ltd trading platform.

- All trading activity between the client and Plus500 is automated to ensure prompt, fair, and expeditious execution of client orders.

- All orders are recorded and allocated in sequence, based on the client type, the order type, the type of the financial instrument, and the execution venue to direct the order.

- The ‘profit and loss’ of all executed orders are immediately accessible on the client account, and since the process is fully automated, the forex provider ensures sufficient steps to maintain accuracy, subject to the quality of the raw data.

EDUCATION

Plus500 offers very few resources when it comes to educating beginners to the forex and CFD markets. We could only find five educational videos with a couple of them related to the offerings of Plus500.

CLIENT SUPPORT

Individuals who wish to get in touch with the CFD provider’s 24/7 client support can reach them via live chat, WhatsApp, and Email. But before getting in touch with the customer support, you can quickly browse the FAQ section where you can find answers to several frequently asked questions from nine categories.

As part of our review of the top forex provider, we contacted the live helpdesk with a flurry of questions and were satisfied with the initial response time and the quality of support provided. However, we did not find a telephone number to contact the provider, which is a little strange from one of the best CFD providers regulated by multiple tier-I agencies.

SUMMARY

Following our in-depth forex provider review, we have maintained an optimistic outlook of Plus500 in spite of recognizing both pros and cons. On the positives, the CFD provider has been in the industry for more than a decade, offers more than 2000 products from their proprietary trading platforms, and offers low spreads. Besides, the top forex provider’s regulations cover multiple jurisdictions, and the firm with a market cap of about £1 billion from 108.66 million outstanding shares is successfully trading on the London Stock Exchange for about two years now. The other significant features include excellent customer support, adequate risk management systems, and a straightforward account opening process.

There are a few negatives as well- The trading tools besides the alerts are not so great. The CFD platform provider does not provide automated trading, one-click order placement, nor guarantees instant execution, all very significant when it comes to trading conditions.

If you are an individual looking for a CFD provider offering low spread, moderate leverage, reasonable order execution speed, and guarantees on the security of your funds, then Plus500 should be one of your top choices. If, on the other hand, you are an experienced high frequency or algorithmic trader and prefer to execute your trades via an automated trading platform like the MetaTrader or cTrader, you can choose from the several other CFD providers out there.

CFD Service. Your capital is at risk