When we marry leverage and incredible movement in financial markets we adapt and alter our approach, or we run the risk of either being stopped out or for a loss that could be disproportionate to the account size.

When traders anticipate greater movement in an instrument the primary consideration is that it should dictate the level of risk they are willing to take in every trade – we define this through the placement of our stop-loss. Obviously gapping is a concern here, which is why we consider the risks of holding our positions through periods (such as weekends) when markets are closed and we can’t react real-time – however, the stop loss is there to guide our desired risk on each position.

Subsequently, the distance to the stop loss should define the position size, and this needs to be proportionate to the account size. If you have a $1000 account it is not recommended to put down $900 as margin on a EURUSD exposure when you have leverage of 500:1 – it could work out well, or it could blow up this small account in a short period, especially in a fast-moving market.

Position sizing, especially in a highly volatile (vol) market is what separates pro from green traders. It is the utmost consideration and the backbone of any disciplined trading plan, for those wanting to survive in high vol periods, let alone growing the capital in the trading account.

When our primary job as a trader is to manage risk, we need to understand how movement and implied movement in price impacts our trading, let alone our strategy, so here is a quick guide on how you can better harness volatility.

- There are many ways we can quantify volatility, but at its heart we assess implied or realised volatility.

Implied volatility – Pepperstone offers the VIX index which measures S&P500 30-day implied volatility (see how to trade the VIX xxxx). While this is specifically focused on anticipated movement in the S&P500, we can use this as a guide for strategy – Generally speaking, if Pepperstone’s VIX index is above 30%, we would expect big daily percentage changes in the index, with sizeable swings in price. This will likely resonate in FX and commodity markets too.

- Realised volatility is simply the extent and the magnitude by which a financial market moves from a predefined mean. It is a statistical fact and can be very helpful for traders. Two of the best-known indicators we can use are Bollinger Bands and the ATR (Average True Range).

- Bollinger bands represent the extent to which price moves from the 20-day moving average – the wider the bands, the greater the movement or distributions in price from this short-term mean, and the more we need to consider reducing our position size.

- Statistically, we know that 68.2% of moves in price (from a mean) are contained within the upper and lower Bollinger bands (i.e. two standard deviations) – So, traders will often use the lower Bollinger band to ascertain the extent of short-term downside risk. Where in a strong trending market, we will see price hug the band

-

- In a fast-moving market, it is best to use either the 3- or the 5-day ATR to assess the degree and average movement in the daily (true) ranges. Context is key, and while we not only look at the level of the ATR in relation to a prior period (say the past 12 months), we also look at the absolute level and use this to define our risk

- On any timeframe, the ATR offers a guide as to how far away the stop loss should be placed. When we know the distance to the stop (our risk), we can better achieve correct position sizing. In the above example, the 5-day ATR for USDJPY sits at 210 pips, so we would ideally leave our stop at least 210-pips away from the entry. This is a sizeable amount of risk to take, even for a trader trading the daily timeframe.

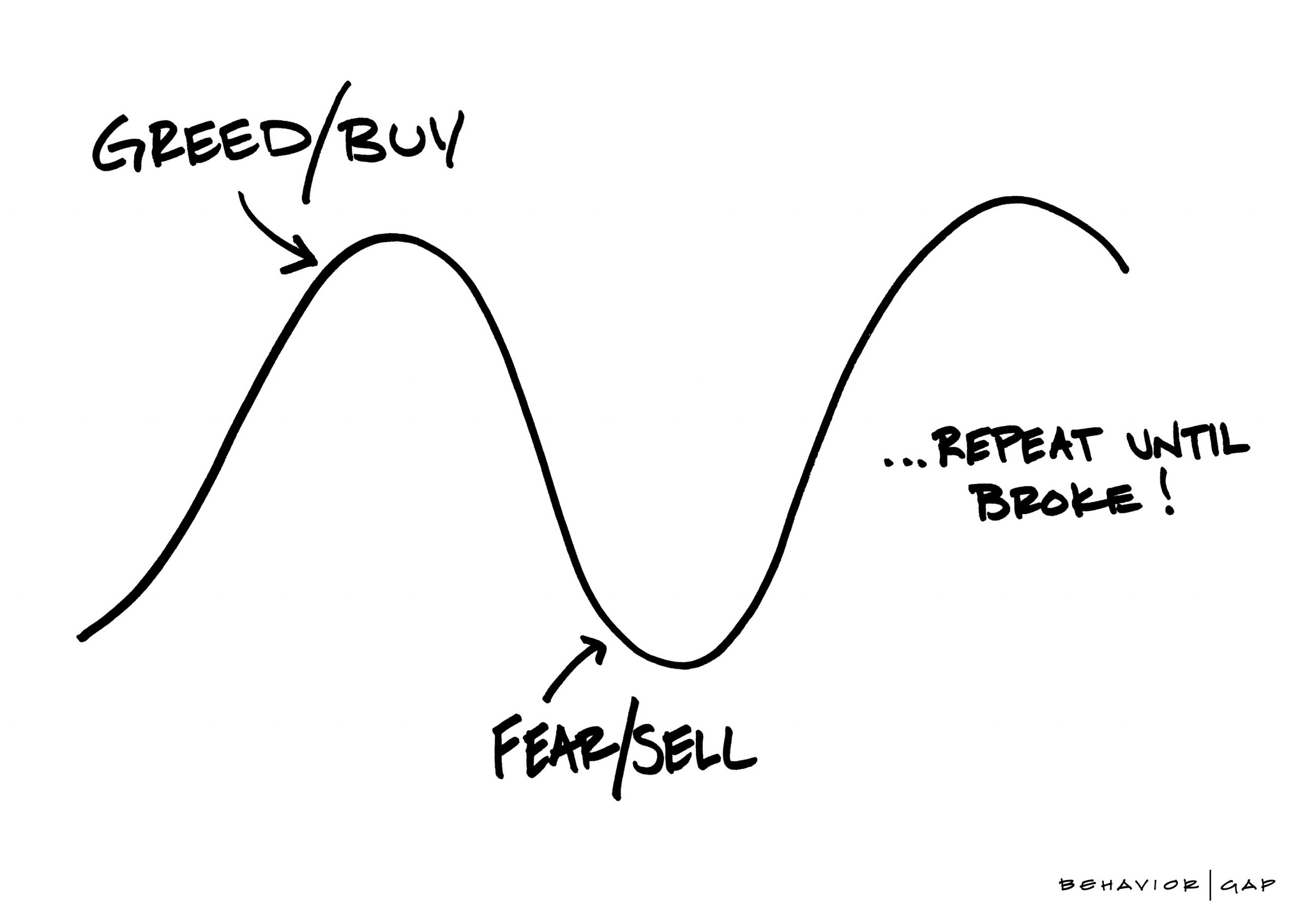

- Taking on more risk and not reducing position size can be a trading disaster waiting to happen

- Many will go even further, maybe, leaving a stop 1.5x ATR as to give the trade sufficient ‘breathing room’ – this is a huge amount of risk to take on a trade, especially for a small account

- Individual financial instruments have their own characteristics, and each come with their own typical degree of movement. For example, traders are aware that the average daily moves in the NASDAQ 100 tend to be greater than the S&P500. Or, the average moves in the Nikkei 225 are often larger than the ASX 200. We see this at a currency level, with AUDJPY often having far more powerful moves than AUDNZD.

- We, therefore, need to be aware not just of leverage in the product, but the fact is there are differing degrees of leverage in each instrument. Most traders are taught to put 1% or 2% of their account equity on each trade – I feel this is too rigid, and we should adjust, not just for volatility, but by the instrument itself.

- Volatility is agnostic on direction – A high ATR or Bollinger Band does not try and predict direction; it just portrays the extent of the move in price. We use vol to help stay in the game and manage position size, not to assess entry points.

- Fast-moving markets mean you need to change your trading behaviours and time in front of the screens. In a market, with extreme volatility, we see wild swings and often on little news – if you’re not in front of the screens you can’t react with the same agility and you put yourself at a disadvantage – traders react to price moves.

- Liquidity is a core consideration – in a fast-moving, intense market, market makers and liquidity providers may not offer the same level of deep pools of liquidity and this can only exasperate moves – especially around key announcements or a major market-moving headline

- In high vol periods, we often see the market craving for information to provide answers to whatever the economic, geopolitical or liquidity crisis is. This a dynamic where headlines drive significant price shifts and can be problematic for retail traders who are up against news recognizing algos. Twitter can be a great source of information.

This list should offer some guidance on how you can better trade high vol markets. I have not focused on FX implied volatility, which is something I look closely at in my Friday ‘Trader’s week ahead guide’ and I’ll write a more complete guide here soon. And while there are other realised vol measures, it is important that traders are smart and look at their edge to help stay in the game through high vol period and that means adapting – the best way they will do this is not just to get the direction of the trade correct, that always helps, but inevitably you will not get every trade in the money. So, the ability to respect leverage and extreme volatility, obtain a more precise measure on risk, achieve correct position size and manage the losers correctly is how we stay in the game in times of extreme vol