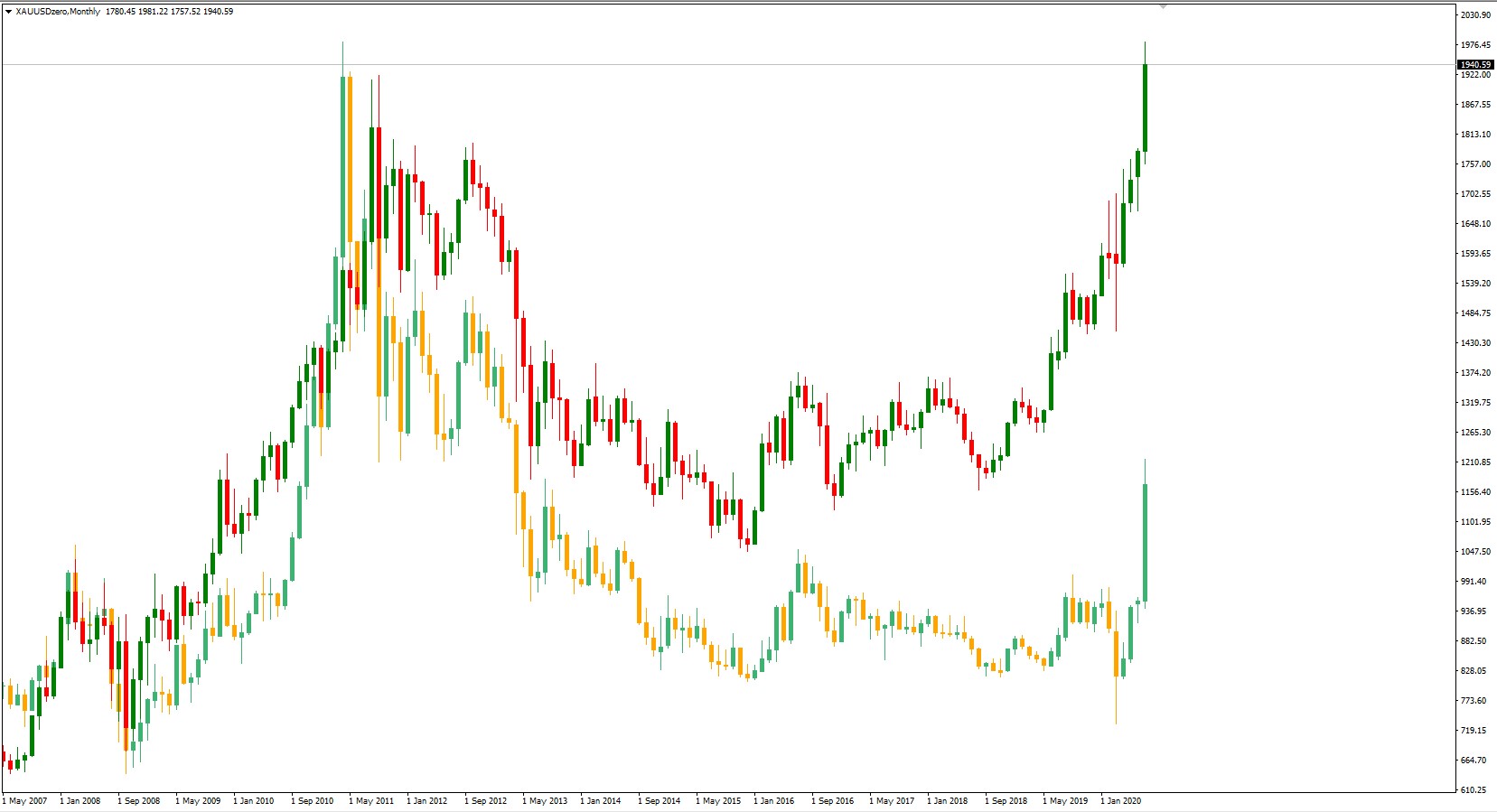

Current Highs

Gold has steamrolled straight through the 2011 highs, with silver following suit though not nearly as spectacularly as gold. The rise of gold in 2020 has truly been a sight to behold, the pandemic, the political minefield and of course, the stimulus have all contributed to varying effects that have created the perfect storm. Though the rise in gold has been derived from the unprecedented pandemic driven turmoil and investors seeking safe havens, there are factors that cause concern, especially for firms who may deal in the physical aspects of gold trading.

The role of inflation

Gold prices have always fluctuated based on supply and demand principles with strong correlations to the health of the economy. During economic growth, the demand for gold as an investment option is usually reduced. However, the manufacturing requirements of gold tend to remain consistent. In an economy that is struggling, or suffering from undue challenges, where uncertainty is rife, the demand for gold has historically risen to protect capital.

The best gauges of economic health have usually been derived from inflation and interest rates, which have high levels of correlation with a variety of asset classes. Most notably, cash, when inflation rises, the cash devalues. Under normal economic conditions, you may see investors pick up bonds or even exchange one currency for another to try and offset the value devaluation. But we are not in normal economic conditions and when the real yields decline, as we see now, then the next best option to protect capital is gold.

The Goldrush before a run?

Now the real concern is the supply of gold, it has been speculated upon before, but with the current state of world events, it’s even more relevant. Gold is seeing a bit of a pinch on the supply side, with so many investors uncertain about the economy its no wonder that they have moved into gold. What wasn’t foreseen as readily was the level of individuals choosing to take delivery as opposed to rolling contracts over. This could very well have the same effect as a run on a bank, and gold exchanges operate in a similar compacity; after all, they don’t necessarily have all the actual gold in the bank.

Regardless of the above concerns, investors will likely continue to pile into gold, provided: Rates remain at historic lows, monetary and fiscal policy remains accommodative, the USD stays on the weaker end of the spectrum, stimulus remains infinite, the debt keeps growing, and yields don’t return to civilised levels. Which is likely to linger until some clarity around the pandemic and recovery becomes concrete.

Gold and Silver vs USD, Monthly, May 2007 – July 2020.