Summary: The Dollar ended lower in high volatile trade following a swirl of intervention talk to bring down the rampaging U.S. currency which has jumped 7% in the last 15 days. Reuters reported that Japanese Finance Minister Taro Aso made a rare comment on the US Dollar’s singled handed rises against other currencies, most likely due to investor anxiety over the coronavirus outbreak. In a separate Reuters report, Goldman Sachs analyst Zach Pandl said “Further Dollar appreciation would be harmful to both US and global growth. If the Dollar were to continue rising, we would see a reasonably strong case for coordinated and targeted intervention.” Yesterday the Greenback slipped after the U.S. Federal Reserve introduced unprecedented QE. The Dollar Index (USD/DXY) which hit 102.95 on Friday, January 2017 highs, slipped further to 101.94, down 0.54%. The Euro jumped to an overnight high at 1.0888 before retreating to finish at 1.0755, little changed from yesterday’s 1.0750. The Australian Dollar extended its recovery to finish at 0.5930, up 1%. Sterling soared 1.1740 from 1.1520 on the broadly weaker Greenback. USD/JPY rallied to 111.60 (111.20) as equity markets soared as US lawmakers said they were close to a deal on a USD 2 trillion stimulus bill to provide aid to distressed companies and workers. Against the Canadian Loonie, the US Dollar eased to 1.4460 (1.4530). The latest Commitment of Traders/CFTC report (week ended 17 March) saw speculators cut short currency, long USD positions across the board. The result was a net short USD position for the first time since June 2018. The biggest change was in the Euro where a huge reduction of Euro shorts saw a swing to a net speculative long Euro position. We look at the breakdown in the Trading Perspective and individual currencies. Wall Street stocks jumped. The Dow soared 11.4% to 20,725 (18,149). The S&P rallied 9.8% to 2,430 (2,228). Bond yields were higher with the benchmark US 10-year yield up 8 basis points to 0.84%.

With the focus on stimulus measures and the coronavirus, economic data were relegated to the sidelines. Global Flash Manufacturing PMI’s emerged better than forecast for most countries while Services underwhelmed.

On the Lookout: All eyes are focussed on Washington and the US lawmakers agreeing a fiscal package aimed a battling the economic impact from Covid-19.According to ANZ Bank analysts, the global enormous stimulus unleashed to battle the economic slump won’t stop it but “t does provide a safety net going forward.” Meantime the coronavirus toll in the US continues to grow rapidly. This will weigh on the Dollar as the impact will certainly batter the economy.

Economic data releases today see UK Headline and Core CPI, PPI Input and Output, and HPI. US reports on its Headline and Core Durable Goods Orders for March. A big negative is forecast for the US Headline DGO. Traders will be keeping an eye on this. A larger negative could see further USD selling.

Tomorrow the US Weekly Unemployment Claims is the biggest report which will be closely watched. Jobless claims are forecast to surge to 1.5 million from the previous week’s 281,000.

Trading Perspective: The global short-term US Dollar company funding requirement has eased. Measures for Euro-dollar FX swaps for 3-month maturities stabilised around 8 basis points after blowing out to more than 100 bps last week, according to Reuters.

Overnight the Emerging Market currencies, battered by the surging Greenback in the past week, all managed to record strong gains versus the US Dollar.

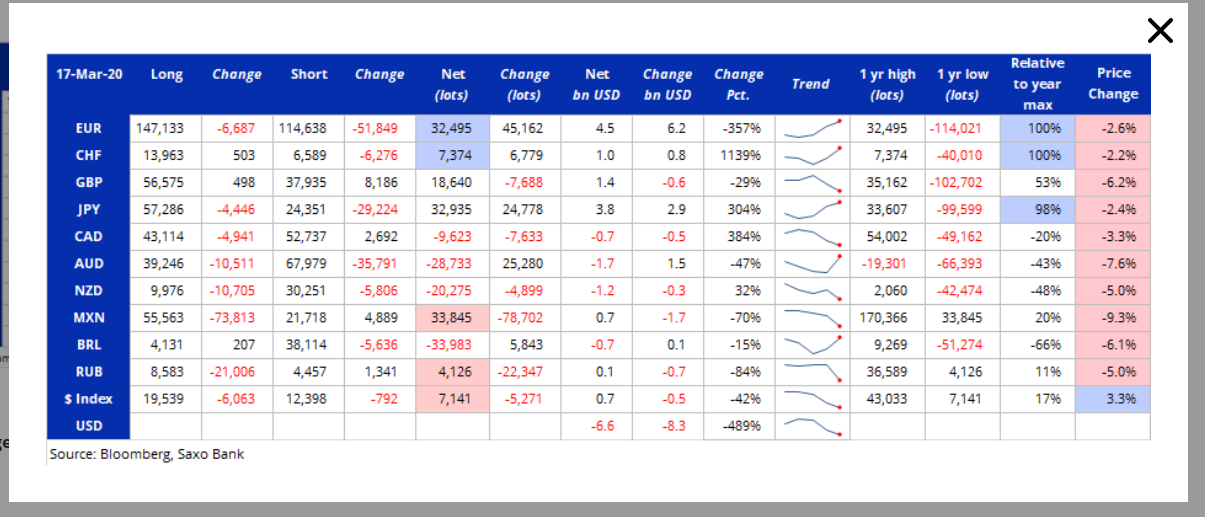

Meantime the latest Commitment of Traders/CFTC report from Saxo Bank saw Net speculative positioning for the week ended March 17 turn short Dollars as a result of aggressive position reductions. The net short US Dollar position was the first time since June 2018.

The Euro saw the biggest reduction which turned the position from a net short Euro to a long one. Despite the slide in the Aussie last week, shorts were aggressively trimmed. We look at the various currencies, Euro, Aussie and the Canadian Dollar.