Summary: Breaking news from Channel News Asia this morning that China imposed a strict lockdown in Hebei province to contain a fresh Covid-19 cluster yesterday will see a choppy start to trading in Asia today. Over the weekend, record new coronavirus cases in the US roiled risk appetite as concerns grew on a possible V-shaped economic rebound. The global death toll from the pandemic climbed over the half-a-million mark to a total of 503,149. The US Dollar extended its climb on safe-haven demand, finishing with modest gains. Wall Street stocks slumped. Sterling was the biggest loser in FX, plummeting 0.93% to 1.2336 (1.2416) with another round of Brexit talks scheduled today. German Chancellor Angela Merkel warned that the UK must “live with the consequences” of leaving the EU. The Euro traded mostly sideways, closing little changed at 1.1217 (1.1220). The Australian Dollar, risk leading currency, slipped 0.49% to 0.6860 (0.6887) on broad risk aversion. In early Asian trade, the USD/JPY pair slipped to 107.16 from its New York close at 107.23.

Wall Street stocks slumped with major indices losing over 2%. The DOW closed at 25,040 from 25,700 Friday, for a loss of 2.42%. The S&P 500 lost 2.13% to 3,015 (3,085 Friday). Bond yields fell with the benchmark US 10-year yield down to 0.64% from 0.69%. In Europe, Germany’s 10-year Bund yielded –0.47% from -0.45% Friday. Japan’s 10-year JGB yield was flat at 0.00%.

Data released on Friday saw Tokyo Core CPI match forecasts at 0.2%. US Personal Spending rose to 8.2% in June, just short of expectations at 8.7%. Personal Income beat forecasts with a print at -4.2% against -6.0%. The revised University of Michigan Consumer Sentiment Index slipped to 78.1, against expectations of 79.1 and a previous 79.1.

On the Lookout: As we head into the June quarter-end close, expect highly volatile moves in FX. The market’s risk-off theme will dominate with traders monitoring the latest coronavirus updates, particularly in the new hotspots. This morning’s report that China imposed a strict lockdown in Hebei province to contain a fresh Covid-19 cluster yesterday will pressurise risk further.

Economic data releases today are light with the big event the US Payrolls report due on Thursday with the US away on Friday to celebrate its Independence Day (4th of July).

Today’s economic calendar kicks off with Japan’s May Retail Sales. Earlier New Zealand reported that its Total Filled Jobs (May) dropped to 0.8 million from April’s 2.16 million.

European reports start off with Spain’s June Preliminary CPI data, Germany’s June Preliminary CPI, Eurozone Consumer Confidence (June), Eurozone Business Climate and EZ Economic Sentiment Indicator. The UK reports its June Preliminary CPI, May Net Lending to Individuals and May Consumer Credit. Canada reports on its Industrial Price Product Index. Finally, the US reports its Pending Home Sales and Dallas Fed Manufacturing Index.

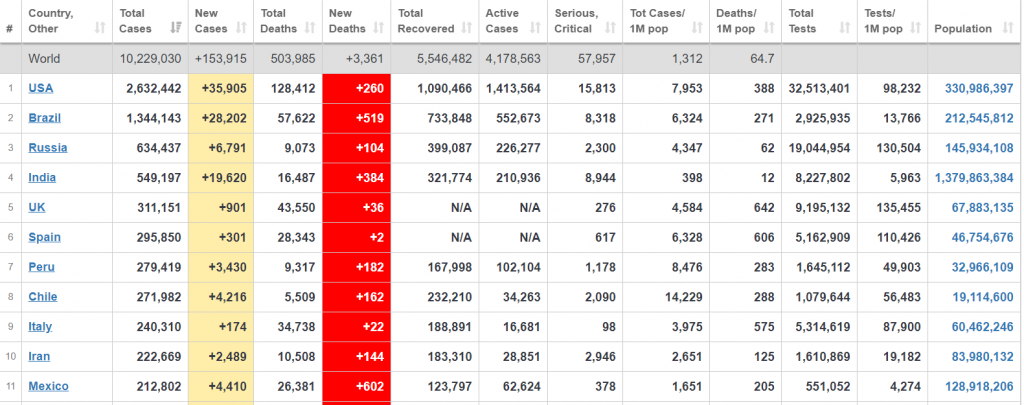

Trading Perspective: The US Dollar will retain its haven bid while coronavirus cases keep rising. New hot spots keeping popping up. Today’s Coronavirus Worldometer, which provides global Covid-19 live statistics and is sourced by official websites from world Ministries of Health and other Government institutions tells the story. Aside from the US, the table shows an alarming rise in new cases and new deaths in Brazil, India and Russia. Mexico’s total new deaths are the highest in the world. That said, the month and quarter end will see conditions thinned with choppy trade.