Summary: The battle for risk continued with markets finishing on a cautious note as the number of new coronavirus cases around the world grew. In the United States, new Covid-19 infections hit 37,000 which is their biggest increase ever. Reports that US regulators were prepared to relax financial rules that would free up capital from the biggest banks saw financial stocks rally before falling back after stress test results in volatile trade. FX meantime was more subdued. The Dollar Index (USD/DXY) a favourite gauge of the Greenback’s value against a basket of 6 major currencies was up 0.24% to 97.394 (97.232). Which was mostly due to a 0.28% fall in the Euro to 1.1217 (1.1252 yesterday). The Australian Dollar outperformed, climbing 0.45% to 0.6890 from 0.6850 shrugging off the news that Australia posted its largest one-day increase in Covid-19 cases in 2 months. Australia’s increase of 37 new cases paled in comparison though to that of the US which was 32,300+ at the latest count. Sterling ended little changed at 1.24127 (1.2420 yesterday). The USD/JPY pair was modestly higher to 107.15 (107.07). New Zealand’s Dollar, the Kiwi rebounded off its lows at 0.6400 to 0.6432. USD/CAD was flat at 1.3645 (1.3640) despite a bounce in Crude Oil prices. Brent Crude climbed to USD 41.50 (USD 40.50 yesterday). The Greenback finished mixed against the Emerging Market currencies. The DOW was at 25,700 (25,600 yesterday) while the S&P 500 was at 3,085 (3,065 yesterday). Key US 10-year bond yield was at 0.69% (0.68% yesterday). Germany’s 10-year Bund yielded -0.47% from yesterday’s -0.45%. Data released yesterday saw New Zealand’s June Trade Surplus ease to +NZD 1.253 billion from May’s +NZD 1.339 billion which was revised up. Germany’s GFK Consumer Climate Index in June saw a -9.6 print, bettering forecasts of -11.7. US Durable Goods Orders beat expectations of 10.3%, coming out at 15.8%. Core DGO rose to 4.0%, bettering forecasts of 2.4%. The US Q1 Final GDP matched forecasts at -5.0%. Weekly Unemployment Claims were at 1.48 billion, missing forecasts at 1.32 billion.

On the Lookout: Expect a cautious and slow start to Asia today with China celebrating its Dragon Boat Festival holiday. FX will consolidate at current levels with the US Dollar retaining its overall bid.

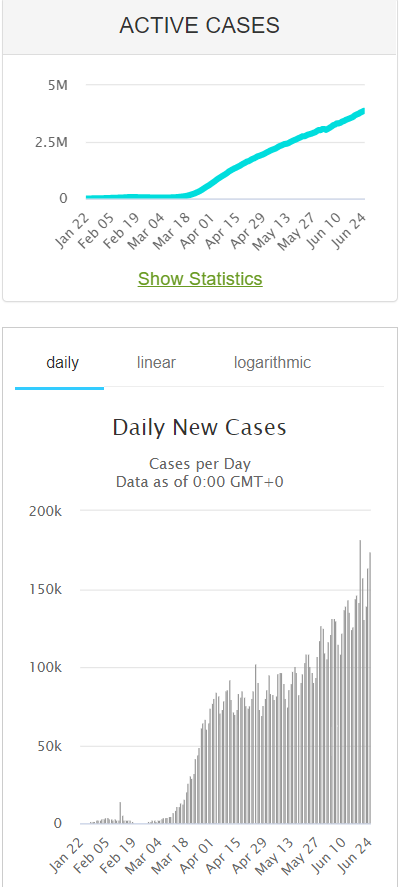

The spotlight will continue to fall on the resurgence of Covid-19 as fears mount on the second wave of infections in the US and the rest of the world. Europe also saw a rise in new cases. India, Brazil and Mexico’s coronavirus cases continue to climb among the emerging economies. Bank of Japan Governor Haruhiko Kuroda just came across the wires, commenting that Covid-19 has a severe impact on countries all over the world and Japan is no exception.

Today’s main event is a speech from European Central Bank head Christine Lagarde in the EBLC Northern Light online Summit 2020 on the World Economy. Expect fireworks from the former IMF President. The economic data calendar is light. Japan kicks off with its Tokyo Core CPI report. Europe sees Spain’s May Retail Sales report. The Bank of England releases its Quarterly Bulletin. US data scheduled for release follow with US Core PCE Price Index, Personal Spending, Personal Income and the University of Michigan’s Consumer Sentiment report.

Trading Perspective: Expect FX to consolidate within the recent ranges in Asia today. The US Dollar will keep its bid while risk appetite remains shaky. With the spotlight back on the resurgence of Covid-19, traders will monitor developments. Other risk factors, which should also be USD supportive are the trade tensions between the US and European Union.