- Trade Deal “over” comment sparks wobble in Asian markets

- Apple shares touch record high after WWDC

- Rising virus cases see casino stocks tumble as reopening hopes fade

- Dollar breakout rolls over

- Econ Calendar: June PMIs.

Opening Calls

S&P 500: 3,123 (+6 pts)

The FTSE 100 is rising ahead of the Prime Ministers’ statement on the further reopening of the UK economy at 12.30 pm local.

The DAX is pointing higher but progress is being hobbled by the fallout in Wirecard shares, which are falling again at the open.

The S&P 500 is flat over the last five days in a push-pull between the ‘reopening trades’ which are all falling and FAANG where its constituents are hitting record highs.

Navarro: “It’s over”

Asian shares tumbled overnight but then swiftly reversed -all because of comments by White House Economic Adviser Peter Navarro. Navarro, in answering a question on Fox News about the China trade deal answered “It’s over. Yes.” He later had to clarify the deal is still in place to NBC News.

Navarro’s fluffed interview answer served as a useful beta test for how relevant the US-China trade deal still is for markets, even among all the concerns over the coronavirus.” The markets have continued to sing an optimistic tune despite souring relations between the US and China. This wobble overnight demonstrates that optimism rests on the idea that souring relations won’t threaten the phase one deal.

Apple WWDC

Shares of Apple have responded favourably to new software updates at the company’s annual Worldwide Developer Conference, held remotely this year. The biggest news had been well telegraphed, that Apple will no longer use Intel chips in its Mac computers. The new iOS14 will include a new home screen with widgets and a ‘translator’ app that allows live language translation. The record-high share price shows investors looking past a big forecasted drop in sales this quarter to a new post-pandemic world even more dependent on mobile internet and associated devices.

Dollar ‘Fakeout’

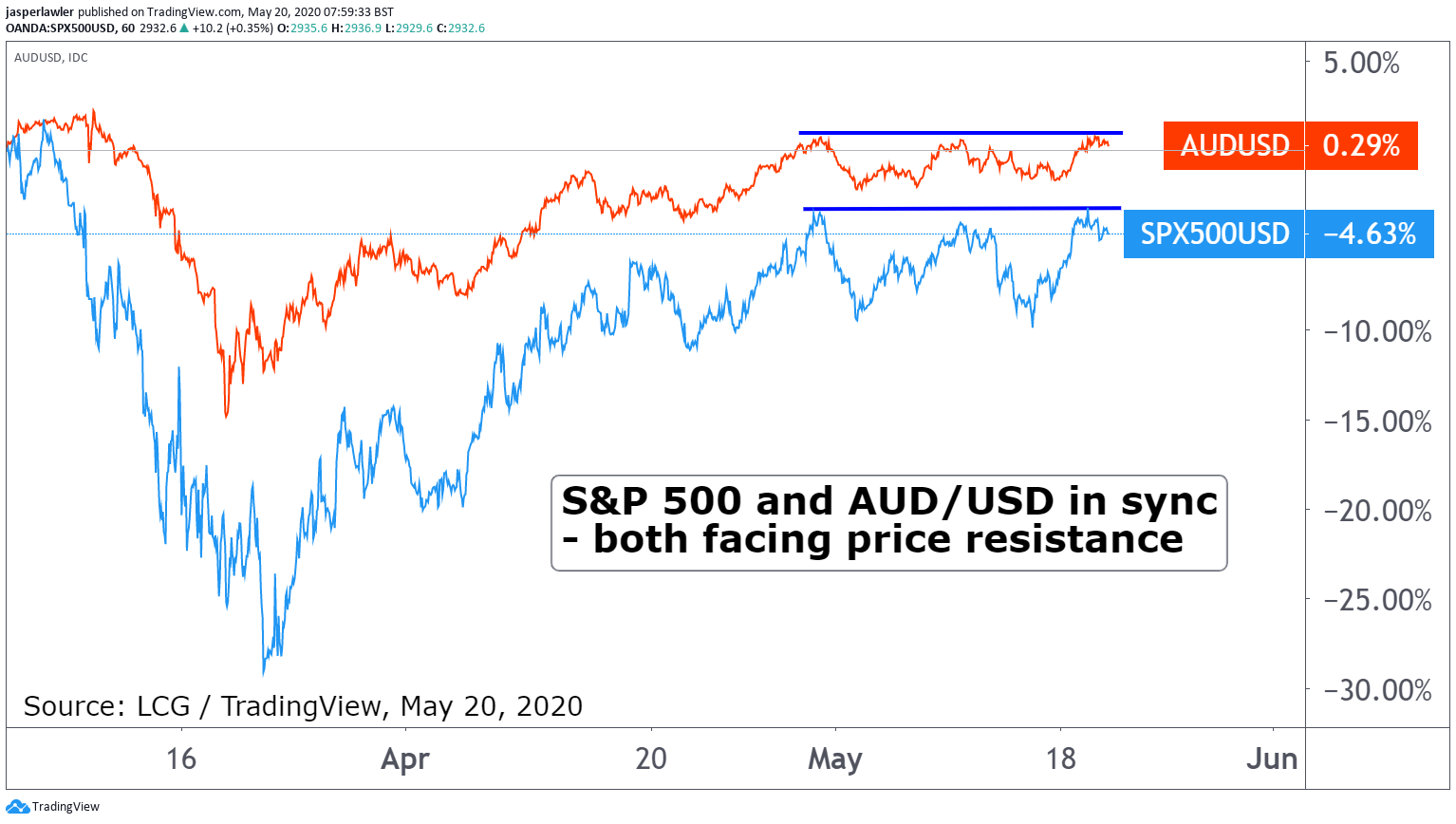

The US dollar index (DXY) has reversed sharply from good early gains on Monday to finishing lower on the day. Both the AUD/USD and NZD/USD currency pairs made ‘bullish outside day’ patterns as the dollar rolled over. We think it will only be if the governments of the countries/US states where coronavirus cases are rising, openly talk about plans to lockdown again, that as a haven, the dollar has a chance.

Chart: Casinos vs. Streaming (5-days)

In the last 5 days, the S&P 500 has been flat while the shares of companies expected to benefit from the reopening have underperformed with big tech that benefits under social distancing outperforming.

Kind Regards.