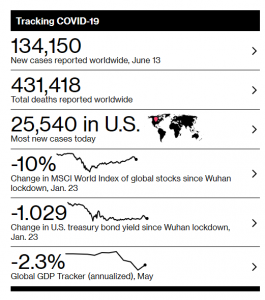

Summary: Fears of a second wave of the coronavirus swept markets after weekend reports of a fresh outbreak in Beijing, China amidst the reopening of many global economies. Beijing shut down its biggest fruit and vegetable market and nearby housing districts after dozens associated with the centre tested positive. In the US, record numbers Covid-19 cases and hospitalizations swept through several states led by Texas, Florida, North Carolina, Arizona, California, Oklahoma and North and South Carolina. On Sunday, Tokyo reported its highest number of coronavirus cases since May. Risk appetite remained wobbly on Friday even as Wall Street stocks rebounded from lows at the NY close. The Dollar maintained its rally its rivals that began on Thursday, despite easing off its highs. In early Asia, the Euro was trading at 1.1245 from 1.1295 Friday morning, above its overnight lows at 1.12136. Dismal UK economic data saw Sterling plunge to 1.2511 (1.2595 Friday). The risk sensitive Australian Dollar gapped lower in early Asia to 0.6825 from Friday’s New York close of 0.6840 and its 0.6850 opening. The USD/CNH (offshore US Dollar/Chinese Yuan) jumped to 7.0870 from 7.0750 NY close. Against the Japanese Yen, the Greenback was higher, changing hands at 107.47 (106.85 Friday). Japan’s Revised Industrial Production fell more than expected and the 10-year US bond yield was up 3 basis points to 0.70%. Equity prices rebounded off their lows on Friday. In New York, the Dow finished up 1.35% to 25,547 (25,237). The S&P 500 rose 0.73% to 3,040 (3,020).

Data released Friday saw Japan’s Revised Industrial Production fall to -9.8% from -9.1%, missing forecasts at -9.1%. The UK’s May GDP slumped to -20.4% from April’s -5.8%, underwhelming expectations of -18.6%. Britain’s Manufacturing Production dropped to -24.3%, missing forecasts at -15.0%. Construction Output plunged to -40.1% from the previous month’s -5.9% and expectations of -24.0%. Canada’s Capacity Utilisation Rate slumped to 79.8% from 81.4%, missing expectations of 80.1%. US Preliminary University of Michigan Consumer Sentiment climbed to 78.9, beating median forecasts at 75.0.

On the Lookout: Asia opens a new week amid fears of a second wave of coronavirus cases ahead of a big week. Today sees the release of China’s trifecta of Fixed Asset Investment, Industrial Production and Retail Sales data. China also reports on its Unemployment rate. Expectations from analysts are for an overall improvement in the economic data even as Beijing’s partial shutdown renewed fears of the pandemic. New Zealand’s Food Price Index, just out, saw Food Prices slump to -0.8% from the previous month’s 1.0%. The Kiwi was little changed at 0.6425.

Other data released today see Japan’s Tertiary Industry Activity report, the Eurozone’s Trade Balance and Swiss PPI. Canada releases its Manufacturing Sales. The US rounds up today’s data with its Empire State Manufacturing Index and TIC Long-Term Purchases.

The week ahead sees the Bank of Japan’s policy meeting, monetary policy statement and BOJ Press conference. Thursday sees the Swiss National Bank’s Policy rate meeting and SNB Press Conference. The Bank of England’s monetary policy meeting and outcome is mid-week (early Thursday morning in Sydney). Federal Reserve President Jerome Powell appears twice this week with speeches on the US economy and Covid-19. Norway’s central bank also has its policy meeting this week. Emerging Market central banks also meet on policy this week with Indonesia, Taiwan, Poland, Russia, Chile scheduled.

Trading Perspective: Risk will remain jittery and we would need to see much better than anticipated data to offset current market fears of a second wave of coronavirus cases. This should keep a bid to the US Dollar and the currencies will struggle. Traders will keep their eyes on any developments on the pandemic. Amidst all of this, there seems to be no end to protests, although there has been a slowdown in the pace of events. The risk currencies may have more downside room in this environment.