Summary: The Dollar Index (USD/DXY), a measure of the value of the US Dollar relative to a basket of 6 currencies, eased 0.34% to 102.467 after the Federal Reserve took unprecedented steps to shore up credit across the US in an attempt to support the economy. The Euro advanced 0.45% to 1.0745 (1.0695) after slipping to 1.0636 overnight. Against the Yen, the Dollar rose 0.58% to 111.20 with demand for the Greenback still strong. The Australian Dollar maintained its gains to finish at 0.5820, up 0.4%. Sterling slumped 0.72% to 1.1520 (1.1600) after British Prime Minister Boris Johnson reluctantly instructed Britons to stay at home and admitted that the UK National Health System will be unable to handle the spread of Covid-19. The USD/CAD pair soared to 1.4560, easing to 1.4535 in late New York trade as Oil prices stayed soft. The Loonie ended as worst-performing major against the Greenback. Equities were not impressed as US lawmakers struggled to reach an agreement on a coronavirus stimulus package after falling short on a deal over the weekend. Wall Street stocks closed mixed. The Dow was flat at 18,648 (18,978). The S&P 500 lost 3.05% to 2,228 (2,274). Bond yields dropped. The benchmark US 10-year yield finished 9 basis points lower to 0.76%. In contrast, Germany’s 10-year Bund yielded -0.38% from -0.33%.

On the Lookout: The Fed’s unlimited QE announcement shows the commitment of to bring order after days of chaos. Markets took notice as the move is unprecedented. However, US lawmakers need to get their act together and provide fiscal support which the Fed cannot do. The Dollar finished mixed, weighed by lower US bond yields, while supported by short term demand.

Today sees the release of global flash manufacturing and services PMI’s for March.

Australia’s Flash Manufacturing-PMI, just released was at 50.1 in March, from February’s upwardly revised 50.2 (49.8). Flash Services fell to 39.8 in March from 49.0 in February. Japan follows with its PMI report. European PMI releases today are from France, Germany and the Eurozone. The UK and US also release their Manufacturing and Services PMI reports. US Richmond Manufacturing PMI and New Home Sales round up today’s data.

Trading Perspective: According to a CNBC report, Net speculative US Dollar bets (among hedge funds and large speculators) turnaround to net short from an overall long position based on the latest Commitment of Traders/CFTC report. This writer will look for the data and provide more information.

While the Dollar Index (USD/DXY) was a touch lower, it ended mixed against various rivals. Expect more of this today. High volatility eased but is still a feature of FX markets looking ahead.

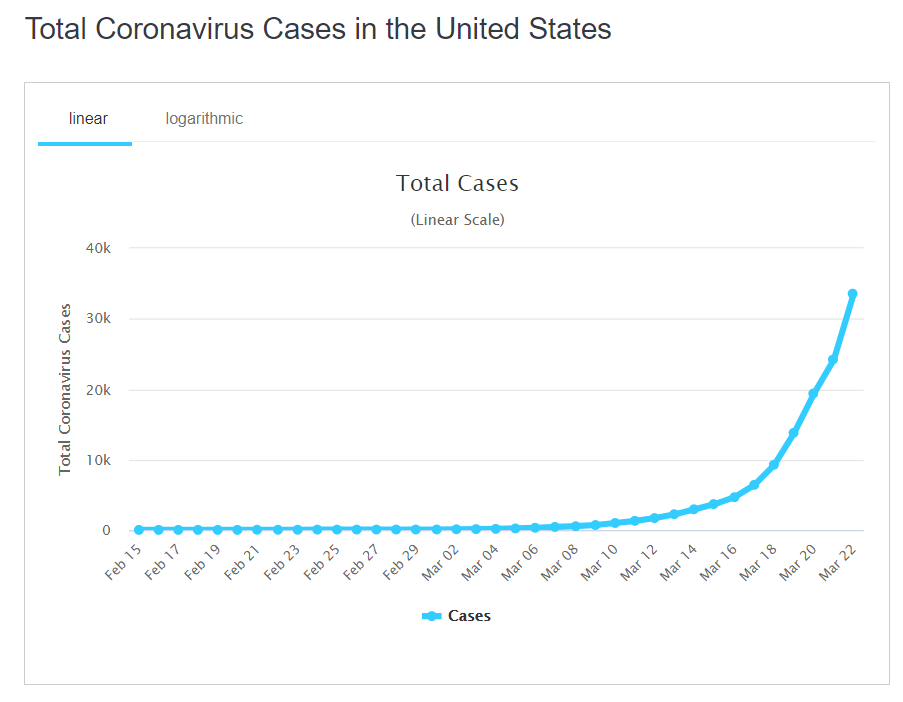

Meantime Covid-19 continues to spread in the United States of America. The latest report saw total US cases rise to 41,700 (worldwide cases 372,500). Italy reported fewer cases and deaths for the second day in a row. The US Dollar will continue to ease on this.

Stay safe, happy trading.