The New Zealand Dollar or Kiwi as it is fondly known among FX traders had its wings clipped by the RBNZ yesterday following the conclusion of its monetary policy meeting. The New Zealand central bank kept its interest rate and policy unchanged as was widely expected. However, the RBNZ surprised many when it left the possibility of negative interest rates alive and indicated its preference for a weak currency. Comments from the RBNZ that “members noted that the exchange rate has appreciated since the May Statement, dampening the outlook for inflation and reducing returns for New Zealand exports.”

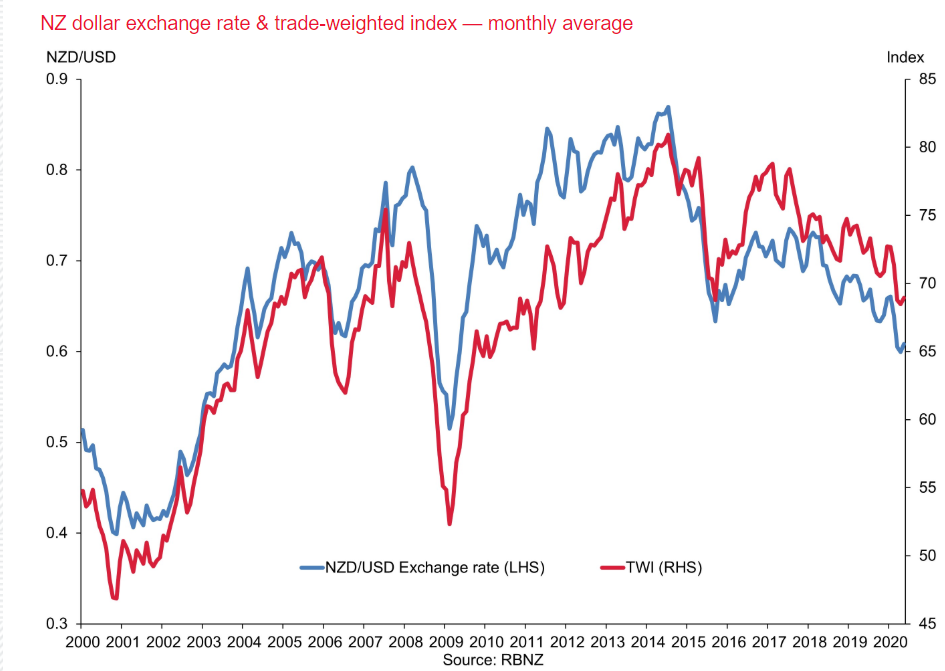

The RBNZ is referring to the New Zealand Trade Weighted Index (NZDTWI) which measures the value of the New Zealand Dollar against New Zealand’s major trading partners (China, Australia, USA, South Korea, UK, Europe, Singapore and others). The RBNZ has been known to talk the currency down in the past when it has risen, this time suggesting the option of a negative policy rate. Which should be taken seriously by FX.

NZD/USD has immediate support at 0.6400 followed by 0.6370 and 0.6330. Immediate resistance can be found at 0.6440 and 0.6470. Look for the Kiwi to consolidate today with a likely range of 0.6370-0.6470. Look to sell rallies.