The Euro pair EURUSD had a relatively quiet session in New York on Friday, trading sideways between 1.11954 and 1.12394. The market’s negative risk sentiment kept the Euro’s topside limited. The rising number of Covid-19 cases in the US and new hotspots around the world like Brazil, Mexico and India kept EUR/USD pressurized. Strong buying interest under the 1.1200 level kept the shared currency EURUSD from moving lower.

Next time round, it might be a different story. Bear in mind the speculative market positioning on the Euro remains short with total bets at multi-year highs. The European Union plans to bar travellers from the US, Russia and dozens of other countries considered risky due to their lack of control over the spread of the coronavirus outbreak. While Brexit concerns weighed more on the British Pound, any negative news will also weigh on the Euro. June 30 is the deadline for the UK to ask the EU for an extension of the Brexit transition period.

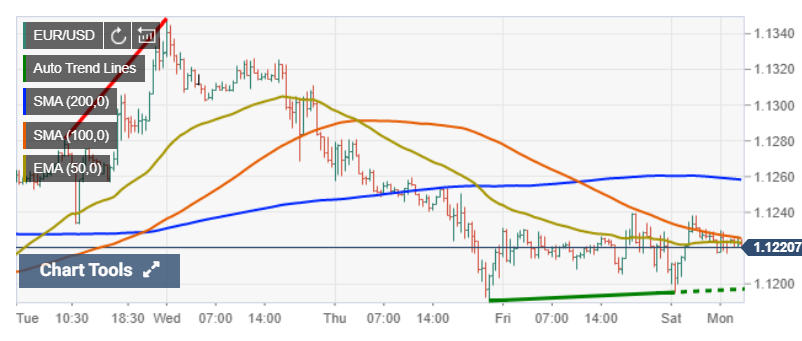

Month, quarter and half year end rebalancing of portfolios from hedge and pension funds, insurance companies and the like could see choppy trading in the shared currency. EURUSD has immediate support at 1.1200 followed by 1.1170 and then 1.1120. Immediate resistance can be found at 1.1240 followed by 1.1280. Look to sell rallies of EURUSD with a likely trading range today of 1.1170-1.1270. Prefer to sell rallies.