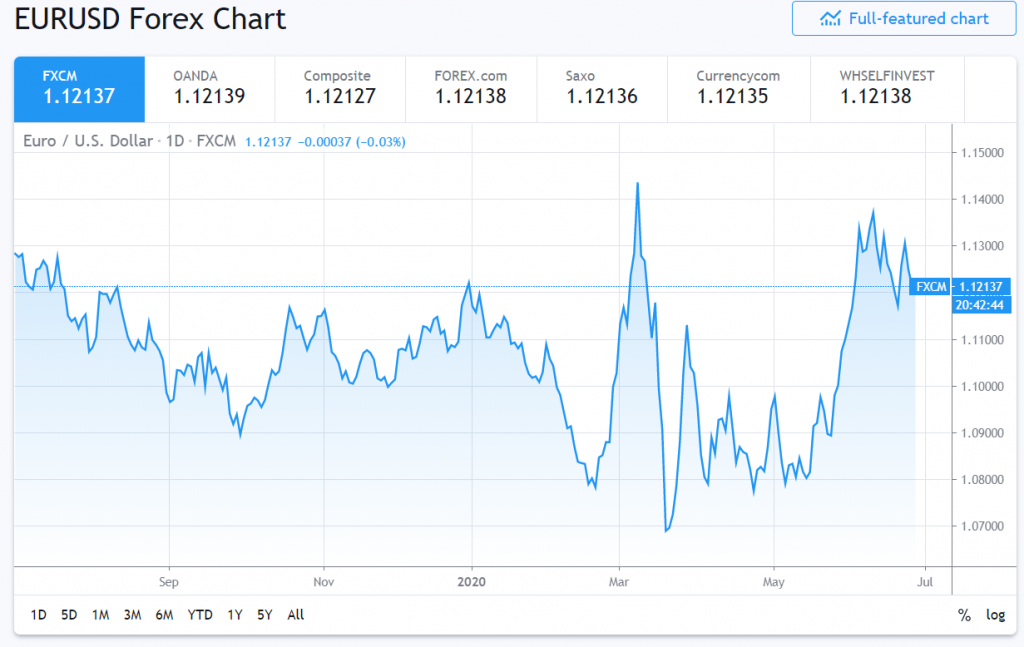

The Euro managed to climb off its overnight lows at 1.11904 to finish above the 1.1200 level to 1.1217. The shared currency’s trade was subdued after its initial slid from yesterday’s 1.1250 opening. EUR/USD traded to an overnight high at 1.12597. The net speculative long Euro market positioning is keeping the Euro from advancing. The ongoing trade tensions between the US and the European Union will also cap any meaningful gains in the shared currency. With limited topside, the downside potential is gaining. Only a broad-based weaker US Dollar will support the Euro.

EUR/USD has immediate resistance at 1.1230 followed by 1.1260 and 1.12290. Immediate support lies at 1.1190 followed by 1.1160 and 1.1130. Look for the Euro to consolidate within a likely range of 1.1170-1.1220. Prefer to sell Euro rallies, the currency has lower to go.