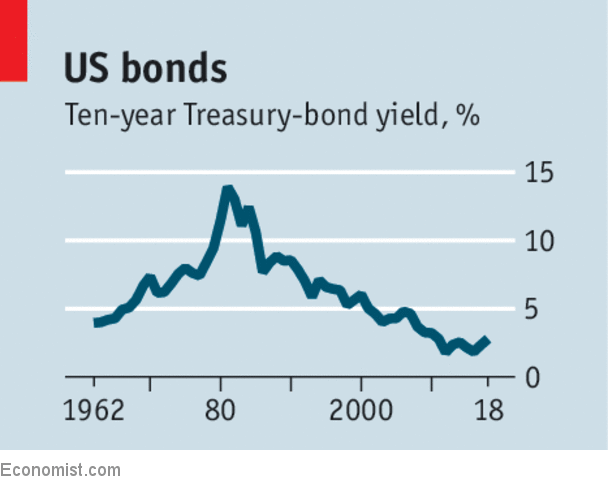

Summary: The Dollar dropped against all its rivals while the benchmark US 10-year bond yield slumped 10 basis points to 0.73% following a dovish Federal Reserve. The Fed kept interest rates unchanged (0-0.25%) as expected but policy makers signalled that rates would remain at current levels until 2022. The US central bank also said it would continue to buy Treasuries at its current pace over the coming months. Federal Reserve Chair Jerome Powell warned that the US faces a long road to recovery, pledging to continue to support the economy for “as long as it takes”. The likelihood of no US rate hikes for the next 12-18 months hurt the Greenback, boosting currencies. Wall Street stocks initially rallied but turned lower at the close following Powell’s speech. The Aussie, Kiwi, Canadian Loonie, Euro and Sterling all climbed to multi-months peaks against the US Dollar but trimmed their gains at the New York close. Against the haven Yen, the Dollar slumped 0.67% to finish at 107.15 (107.75 yesterday). The Australian Dollar jumped to 0.70643, overnight and 11-month highs before slipping to 0.6995 (0.6965 yesterday). The Euro closed at 1.1375 after trading to 1.14223, near 3-month highs. Sterling climbed to 1.28133, highs not seen since March, before falling to 1.2747 in late New York. The USD/CAD pair plunged to 1.33149, multi month lows, rallying to 1.3408, little changed from 1.3415 yesterday. Wall Street stocks finished lower. The DOW slipped 1.15% to 26,974 (27,278) while the S&P 500 settled at 3,187 (3,207), down 0.65%.

Data released yesterday saw Japan’s Core Machinery Orders slump in May to -12.0%, missing expectations of -7.5%. China’s CPI fell to 2.4% on an annual basis, lower than forecasts at 2.7% while PPI dropped to -3.7% against expectations of -3.2%. US Headline and Core CPI both slipped to -0.1% (versus forecasts at 0.0%).

On the Lookout: The spotlight now falls in the upcoming economic reports from the rest of the world. Expected improvements in upcoming US data will limit Greenback losses. The jury will be out on data coming from Europe, the UK, Japan, China, and Asia. Today sees Japan’s BSI Manufacturing Index and Australians M1 Inflation Expectations. Europe follows with French Final Private Payrolls (Q1), Italy’s May Industrial Production. The US rounds up today’s reports with its Headline and Core PPI, and Weekly Unemployment Claims.

Trading Perspective: The bounce back in the US Dollar and drop in equities post-FOMC highlight their overextended positions. Markets have been driving stocks and currencies higher for the past few weeks and are ripe for a correction. Comments from Fed Chair Jerome Powell suggested that while the US faces a long road to recovery, the worst is over.