As countries are slowly shutting its door to the world putting a halt to global activities, the financial markets recovered a semblance of normality last week mostly lifted by the massive stimulus packages by the government and quantitative program by central banks.

- Gold was rising again

- The oil market was a tad bit more stable

- The stock market rebounded on stimulus packages

- King dollar was under pressure.

Coronavirus

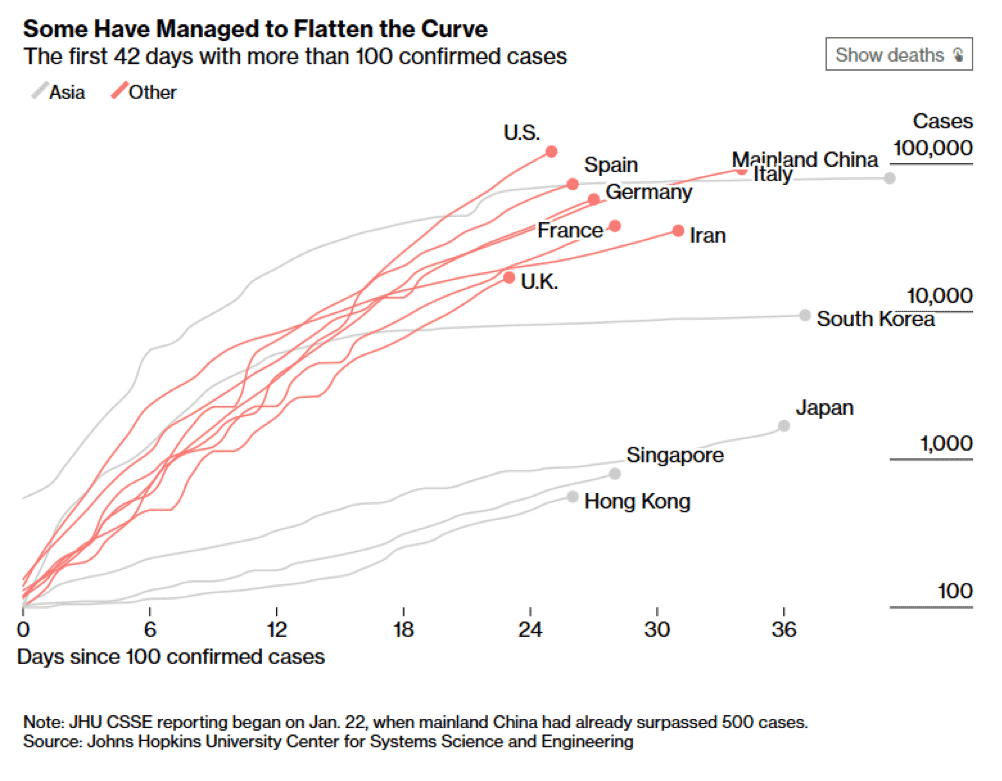

While the worst may be over for some Asian countries, Europe and the US is now the epicentre of the virus. The United States has the most recorded cases of more than 140K cases with New York city being hit the hardest. The prediction for the US is not looking good as Dr Anthony Fauci, the face of the Trump administration’s coronavirus task force predicted 100K-200K deaths.

Stock Market – Where is the Bottom?

Despite the degree of calm seen last week, it is unlikely that the worst days are over. The outlook for the near term is uncertain and the intervention measures are providing support to the current exogenous shock of COVID-19. More fiscal measures are expected if the situation persists.

There was a significant increase in the number of coronavirus cases and deaths over the weekend. Investors should, therefore, brace for a volatile open on Monday. The Volatility Index has dropped from the highs seen mid-March but remains in elevated levels at 65.54.

Stock futures fell on reports that coronavirus cases in the US can reach around 200K. Major US equity benchmarks futures is down by around 2%. Investors will continue to monitor signs that the virus has peaked to forecast when activities will resume and the volume of stimulus to shore the global economy.

Senate Blocks Phase 3

The oil market continues to bear the brunt of a pandemic-induced economic downturn and an oil price war. The oil and gas industry has been undergoing significant challenges due to the structural shift with the industry.

|

An oil storage problem, higher storage costs, faltering demand and a significant rise in production are creating a perfect storm for the oil market.

|

Economic Data – A Busy Friday for the US

Investors will likely monitor the series of PMI data releases across the week. However, China PMI figures will stand out as now that the spread has slowed down in the country, the business activity will progressively return. Even though it may be too early to expect upward revisions in the PMI figures, investors will be looking for clues on the rebound.

|

A positive sign that the Chinese economy is poised for recovery could help risk appetite.

|

Friday will be a busy day for the US on the data front as investors will have more insights on the consumer confidence and labour market. The US jobs market has been the strongest sector of its economy. Jobless claims report last week have shown that the labour market will be significantly hit.

|

A significantly worse-than-expected report will fuel anxieties in the markets and weighed on risk appetite.

|

Key events of the week

Monday

KOF leading indicator (Switzerland)

Business Climate (Eurozone)

Pending Home Sales, and Dallas Fed Manufacturing Business Index (United States)

Building Permits (New Zealand)

GfK Consumer Confidence (UK)

Jobs/Applicants Ratio, Unemployment Rate, Retail Trade, Industrial Production and Large Retailers’ Sales (Japan)

Tuesday

HIA New Home Sales (Australia)

Non-Manufacturing PMI and NBS Manufacturing PMI (China)

Gross Domestic Product (GBP)

Real Retail Sales (Switzerland)

Unemployment Rate and Change (Germany)

Consumer Price Index (Eurozone)

Gross Domestic Product (Canada)

S&P/Case Shiller Home Prices Indices, Chicago Purchasing Managers’ Index, Consumer Confidence (US)

AiG Performance of Mfg Index, and Commonwealth Bank Manufacturing PMI (Australia)

ANZ – Roy Morgan Consumer Confidence (New Zealand)

Tankan Large Manufacturing Outlook, Manufacturing Index and large All Industry Capex (Japan)

Wednesday

Building Permits (Australia)

Caixin Manufacturing PMI (China)

Retail Sales and Markit Manufacturing PMI (Germany)

Markit Manufacturing PMI (UK)

Unemployment Rate (Eurozone)

ADP Employment Change, Markit Manufacturing PMI, ISM Manufacturing Employment Index & Manufacturing PMI, Manufacturing Prices Paid, Manufacturing New Orders Index (US)

Markit Manufacturing PMI (Canada)

EIA Crude Oil Stocks Change (US)

Thursday

Consumer Price Index (Switzerland)

Trade Balance, Initial Jobless Claims and Factory Orders (US)

International Merchandise Trade (Canada)

AiG Performance of Construction Index (Australia)

Friday

Retail Sales (Australia)

Caixin Services PMI (China)

Market PMI Composite (Germany)

Markit PMI Composite and Retail Sales (Eurozone)

Markit Services PMI (UK)

Nonfarm payrolls, Average Hourly Earnings, Labour Force Participation Rate, Unemployment Rate, Markit Services & Composite PMI, ISM Non-Manufacturing New Orders, PMI, Employment Index and Prices Paid (US)

|

Indicative Index Dividends – Tuesday 31 March 2020

|

|

Index

|

Dividend

|

Index

|

Dividend

|

|

ASX200

|

0.07

|

WS30

|

0

|

|

US500

|

0.262

|

US2000

|

0.123

|

|

NDX100

|

1.034

|

CAC40

|

0

|

|

STOXX50

|

0

|

ESP35

|

0

|

|

ITA40

|

0

|

FTSE100

|

0

|

|

DAX30

|

0

|

HK50

|

0

|

|

JP225

|

0

|

INDIA50

|

0

|