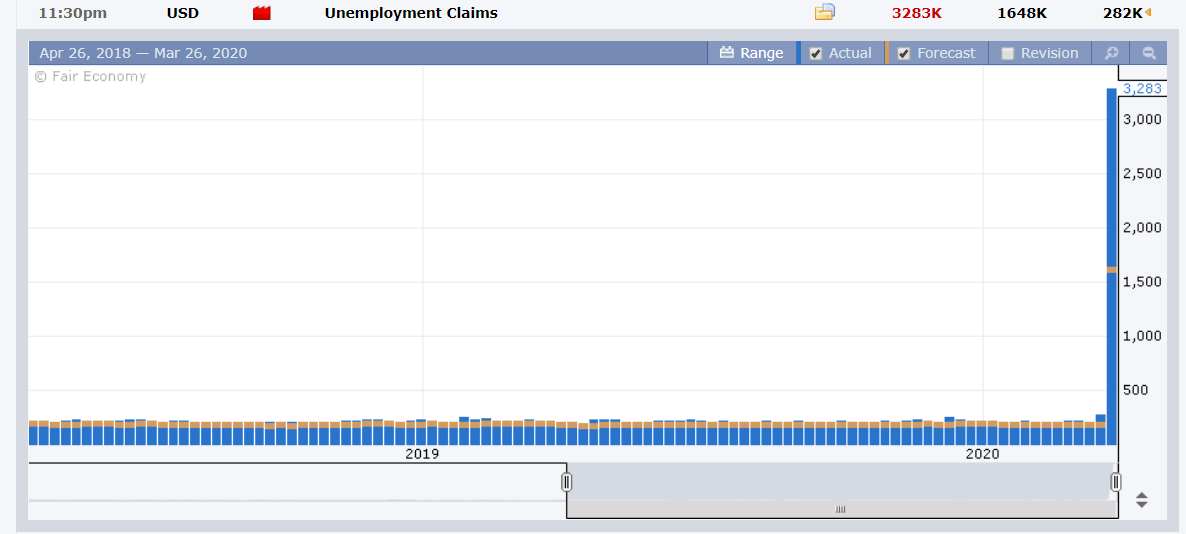

Summary: It was just another day in the markets as with multiple events and data occurring over the course of a trading session. Weekly US Unemployment Claims, already expected to rise, blew out to 3.283 million, a record high, overwhelming median forecasts of 1.50 million. The Dollar tumbled against all of it’s rivals, majors and EM currencies alike. Sterling skyrocketed 3% to 1.2185 in late New York after the Bank of England left its current policy unchanged but kept the doors open for additional stimulus. The Australian Dollar, down to 2002 lows just a week ago, soared 2.6% to 0.6065 on the broadly weaker Greenback. The Euro advanced beyond 1.1000 to 1.1049 before easing to settle at 1.1030, up 1.4%. Against the Yen, the Dollar slid to 109.205 overnight and near 2-week lows, closing at 109.50 (111.20 yesterday). USD/CAD slumped to 1.4010 from 1.4205 yesterday, settling at 1.4120. The Dollar Index (USD/DXY) slumped 1.73% to 99.296 (100.96). US stocks rose after the Senate unanimously approved the USD 2.2 trillion economic aid bill. The US House is expected to pass the stimulus bill when they meet tonight.

The blowout in US Jobless Claims stirred hopes of more stimulus measures.

The Dow finished 6.3% higher at 22,500 (21,240). The S&P 500 rallied 5.9% to 2,635 at the close (2,480 yesterday). Global bond yields fell. The key US 10-year treasury rate closed at 0.84% from 0.86%. Germany’s 10-year Bund yield dropped 10 basis points to -0.37%. Japanese 10-year JGB’s yielded -0.02% from +0.03% yesterday. The BOE kept its Official Bank Rate unchanged at 0.10%.

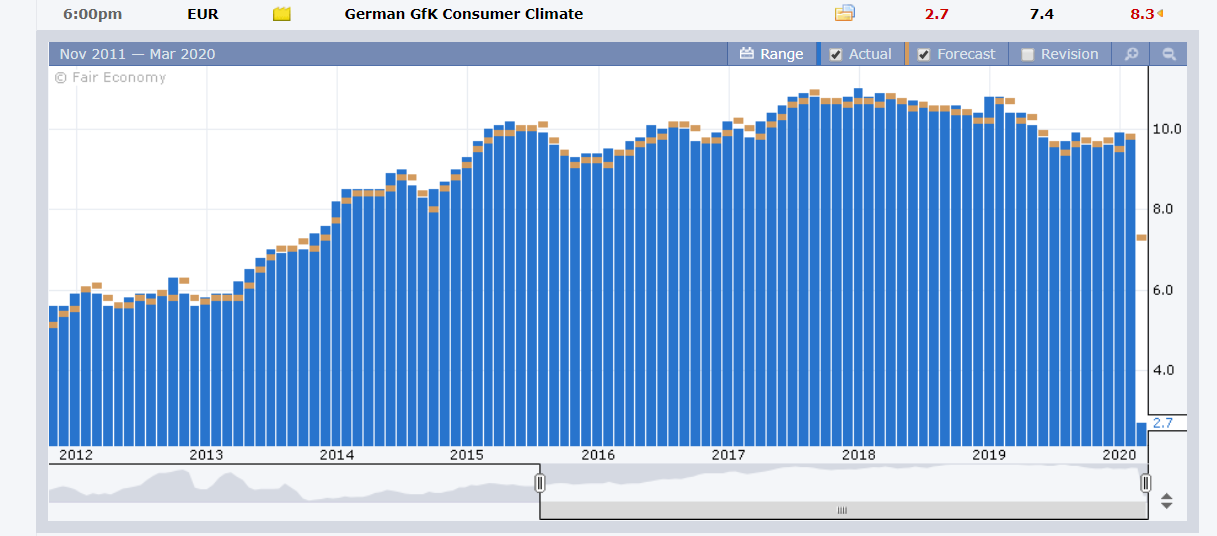

Other data released yesterday saw UK Retail Sales slump to -0.7% in March, underwhelming forecasts at 0.2%. Germany’s GFK Consumer Sentiment Climate Index slumped to 2.7 from a downward revised 9.3 and median forecast of 7.4. US Final GDP matched forecasts at 2.1%. The US Goods Trade Deficit improved to -USD 59.9 billion in March from -USD 65.9 billion in February, beating forecasts of -USD 64.5 billion. It was the lowest deficit since October 2016.

On the Lookout: While claims for unemployment benefits in the US blew out to an unprecedented 3.283 million, a record high, many economists had predicted the rise to as high as 5 million. This has cushioned the Dollar’s fall. The US Goods Trade Deficit improved to the lowest deficit since 2016, also below the USD 60 billion mark. In Europe, Germany’s GFK Consumer Climate Sentiment Index slumped to 2.7 from a downward revised 8.3 and below forecasts at 7.4.

Confirmed Covid-19 cases in the US surpassed that of China and Italy, with a recorded 82,353 (China 81,782). Spain’s coronavirus death toll topped China’s, rising to 4,000.

Today sees mostly second tier economic data. Japan reports its Tokyo Core CPI. The G20 continue their satellite meeting on measures to deal with the Covid-19 outbreak. US reports today are: Core PCE Index, Personal Income, Personal Spending and the revised University of Michigan Consumer Sentiment and Inflation Expectations Indexes.

Trading Perspective: The Dollar traded lower against all the major and Emerging Market currencies after US Unemployment Claims blew out to unprecedented levels, at 3.283 million. The median forecast was 1.5 million claims. Economists had expected the claims to jump as high as 5 million so to a certain extend the Dollar’s drop was cushioned.

Across the Atlantic Germany’s GFK Consumer Climate Sentiment dropped to its lowest level since 2009. Spain’s Covid-19 death toll rose to worlds second highest, next to that of Italy. We can expect the economic toll in both countries, and thus the Eurozone to be severe.

The benchmark US bond yield was 2 basis points lower to 0.84%. Those of its global rivals fell more than that of the US. Germany’s 10-year bond yield dropped 10 basis points to -0.37%.

The Dollar’s sharp downtrend may slow with consolidation the order of the day.