Good morning. Here are our market highlights:

– China Stocks Snap 8-day winning Streak

– Shanghai Composite drops over %

– European shares open lower, Wall St futures down

– Dollar rebounds & Gold back under $1800

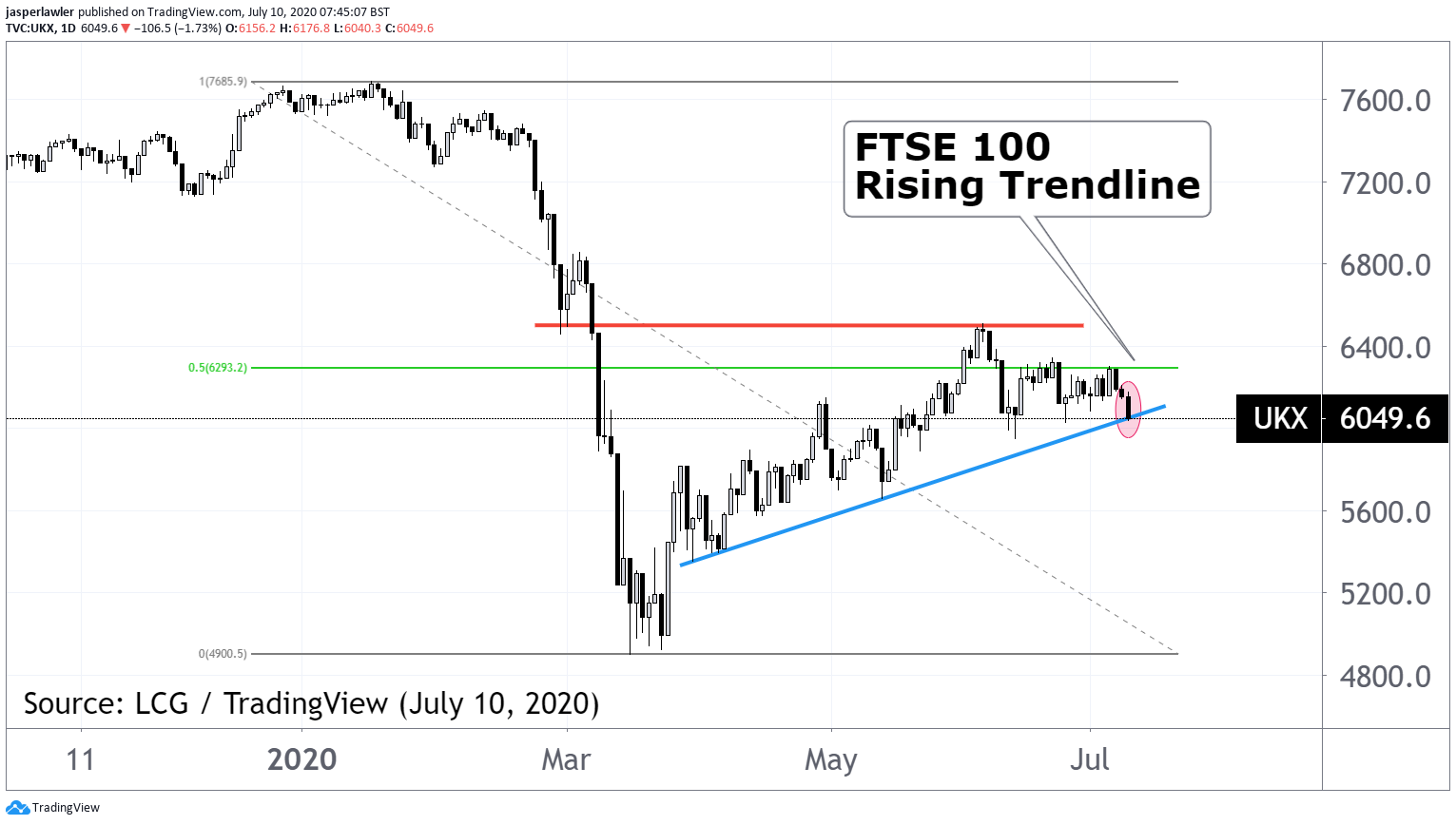

– CHART: FTSE 100.

Inspiration

“You learn in this business. If you want a friend, get a dog.” – Carl Icahn.

China Stocks rollover

Chinese shares rolled over on Friday with some sharp losses. The Shanghai Composite lost over 2% while shares in Hong Kong were on course for similar declines. The down-day is more a symptom of over-extended momentum than anything, but a delayed reaction to caution in state media played its part. Some consolidation seems necessary in what became an overheated market, but we tend to think it will be short-term as Chinese retail investors buy the dip.

European open

Shares in Europe are nursing opening losses. Declines in China might be adding to the downside, especially among China-sensitive assets like miners. Investors have demonstrated less faith in Europe’s recovery than elsewhere in the world with a shallower rally since March. Now the onset of the quarterly and semi-annual reporting season will show whether they were correct to do so.

Earnings next week

Top US banks officially kick off earnings season next week. Apprehension before earnings season probably better explains the inability of stock markets to take out June peaks than rising COVID cases. Investors feverishly took on positions they thought would do best post-pandemic during the rally in May and now its wait-and-see time.

Dollar Rebound

A recovery in the US dollar came after the Dollar index struck 4-week lows, and EUR/USD reached a monthly peak. It’s both a technical pullback and a symptom of broader market caution where some investors are holding more cash.

Gold under 1800

Weakness in the dollar had explained a lot of the short-term strength in gold, so the rebound in the dollar is having the opposite effect. We think gold bugs should actually be pleased to see the drop in gold when havens are rising. To us, it shows the strength in gold is part of a bigger theme than haven appeal.

Chart: FTSE 100 (6-months)

The FTSE 100 is testing a rising trend line, which can be a high R:R entry point, but a break lower would be a strong signal the uptrend has ended.

Kind Regards.