Fed interest rate decision meeting, stimulus talks and earnings reports in focus.

Summary: Key indices and equities across major global markets continue to remain mixed as cues from politico-economic proceedings in major global economies and local earnings report have influenced a chaotic short term market momentum. European market today saw most major indices and equities trade on a positive note, but gains were capped on account of decline in luxury stocks influenced by disappointing earnings reports. Accelerating decline in the US Dollar against major global currencies is causing investors to fear inflation prospects, but the same is yet to actually impact the physical trading market.

Precious Metals: Rare metals continue to trade higher as cues from escalating covid-19 count and tension stemming from China-U.S. relations keep safe-haven demand fundamentally underpinned. Both Gold and silver are trading at fresh yearly highs while Gold has also conquered new all-time highs having conquered nine-year highs in recent past as rally fuelled by USD weakness adds significant support to gold bulls.

Crude Oil: Crude Oil price in the international market is trading with range bound momentum near familiar levels as traders get ready for weekly US crude oil inventory update. This week’s oil count will provide short term directional bias as physical market demand outlook has already taken a hit over Sino-U.S. tensions and last week’s high build in US stockpile.

DXY: The US Dollar index, which measures the strength of US Greenback against six major rival currencies, continues to edge lower but stays firm above the 93 handle for now. However, a promise from US Fed to keep stimulus active across the year and rising covid-19 count in the USA, tensions with China are causing USD to come under significant pressure despite support from its status as safe-haven asset causing it to face worst monthly decline since 2011, having already gone down by 9% since March.

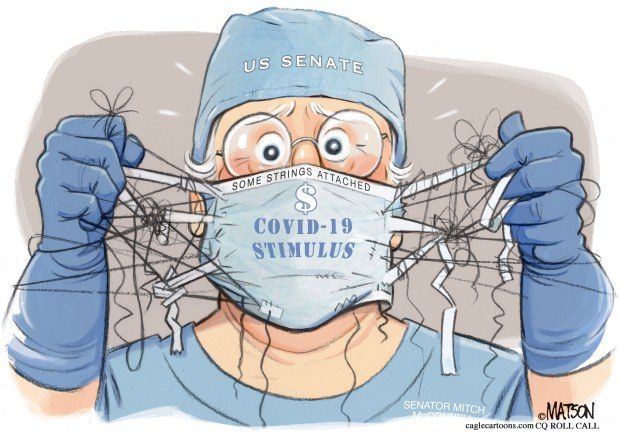

On The Lookout: Focus continues to remain on stimulus talks. While promise for 5th stimulus package keeps risk sentiment well supported, the deadline for unemployment benefits looms close, and strong opposition for Senate Republicans’ stimulus brief from several members of same party and Democrats has caused fears to rise again in US market. With less than three days to go unless signs for progress on stimulus update comes to headlines, the market is likely to take a sharp nosedive in the near future.

US Federal Reserve has announced that it will extend its lending facilities until the end of this year which is a three-month extension compared to the previous deadline of September 30 and this move was highly welcomed by traders across the globe. Focus also moves to monthly 2-day interest rate decision meeting starting today.

Earnings calendar boasts a busy roaster today with reports scheduled to release from Visa A, Pfizer, Amgen, McDonald’s, AIA group & AIA ADR, 3M, Starbucks, S&P Global, AMD, E-Bay, Rockwell Automation, Yandex, Maxim, TransUnion, OakTree, Seagate, Dolby Labs, Harley Davidson, Franklin Resources and Xerox. On the macro calendar schedule, US calendar sees the release of CB Consumer confidence data.

Trading Perspective: US futures trading in the international market were flat on account of tough stimulus talk proceedings. Wall Street is expected to edge lower at open while cues from earnings report provide intra-day market momentum.

Please let us know your thoughts in the comment section below.