Summary: Risk-On turned to risk-off in both stock and FX markets on growing fears of ever-rising Covid-19 infections globally. New cases in the US rose further with large parts of the US reporting tens of thousands of new coronavirus infections according to Reuters news. The US Dollar rallied against all its rivals bar the British Pound, buoyed by a UK Independent report that Britain is set to announce a GBP 2 billion funding for thousands of jobs. Brazil’s Real turned lower from earlier gains on caution about the alarming speed of the coronavirus after the country’s president, Jair Bolsonaro, tested positive for the virus. Mexico’s Peso fell 2% against the Dollar as the country’s new death toll from the Covid-19 pandemic yesterday rose to the third highest, behind the US and Brazil. The Australian Dollar slumped to an overnight low at 0.6922 after failing to test 0.70 cents. AUD/USD closed at 0.6945. Victorian Premier Daniel Andrews announced at a press conference last night that Melbourne will re-enter stage three lockdown for 6 weeks effective midnight tonight as coronavirus cases continue to spike in the country’s second largest state. Victoria recorded 191 new cases of Covid-19 yesterday, the highest single-day increase since the start of the pandemic. Sterling rallied to close 0.35% higher against the Greenback at 1.2540 after hitting an overnight high of 1.25922 following the Independent news report. The Euro retreated 0.34% to 1.1275 from yesterday’s opening of 1.1310 on the broad-based US Dollar’s strength. The latest Commitment of Traders/CFTC report for the week ended June 30 “saw buyers return to the Greenback for the first time in six weeks” according to Saxo Bank. Much of the USD buying was due to a 16% reduction of net Euro longs. The USD/CAD pair climbed 0.40% to 1.3603 from 1.3545. Against the Yen, the Dollar was modestly higher at 107.55 (107.38). Wall Street stocks fell. The DOW was down 1.41% to 25,900 (26,285). The S&P 500 lost 1% to 3,147 (3,178). The yield on the key US 10-year treasury dropped 4 basis points to 0.64%.

Data released yesterday saw Japan’s Household Spending slump -16.2%, lower than forecasts at -11.8%. Germany’s Industrial Production in June climbed 7.8% from May’s -17.5% but missed expectations at 11.0%. Canada’s IVEY PMI rose to 58.2, bettering forecasts at 50.2 and a previous 39.1. US JOLTS Job Openings climbed to 5.4 million, beating expectations for a rise of 4.80 million.

On the Lookout: The alarming rise of Covid-19 cases in different hotspots around the world takes the spotlight in the markets today. The US recorded new highs in Covid-19 cases and new deaths. Total infections have climbed above 3 million (3.087 million). Infections hit a record in the state of Texas. Bloomberg reported that Iran suffered its deadliest day while Hongkong reported the largest number of local transmission cases in almost three months. Markets will continue to monitor these developments as well as the next support measures from various governments and central banks. The search for a vaccine has also continued to ramp higher. Last night, Novavax Inc., one of the front-runners in the race to develop a vaccine, was awarded USD 1.6 billion in government funding to support large-scale manufacturing according to the Bloomberg news.

Today’s data calendar is light. Asia kicks off with Japan’s Bank Lending (annual), Current Account and Economic Watchers Sentiment reports. European reports follow with Switzerland’s Unemployment rate, and the European Union’s Economic Forecasts. ECB Vice-President de Guindos is speaking at a function.

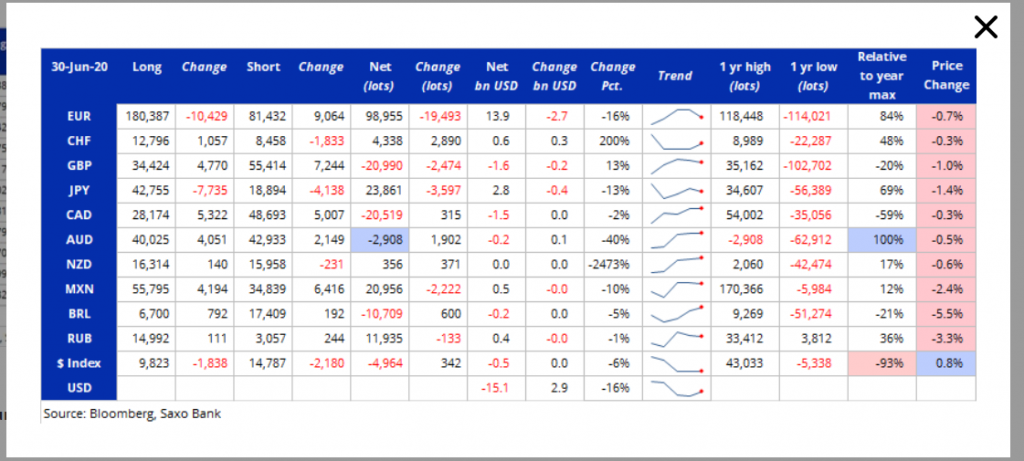

Trading Perspective: Given the market’s risk-off sentiment, the Dollar should keep its overall bid against its rivals. We look at the current market’s speculative positioning in today’s report. According to Saxo Bank, the latest Commitment of Traders/CFTC report for the week ended June 30, US Dollar buying rose for the first time in six weeks. The Greenback strengthened against all ten IMM currencies during that week.

Net speculators cut their net total bearish Dollar bets by 16% to USD15.1 billion, the first week of USD buying in six. Most of that reduction resulted from a reduction in net Euro longs by 16% (EUR 2.4 billion) after hitting a 2-year high. The other notable change was in the Australian Dollar which saw further short covering with net speculative Aussie shorts to the smallest total in over two years.