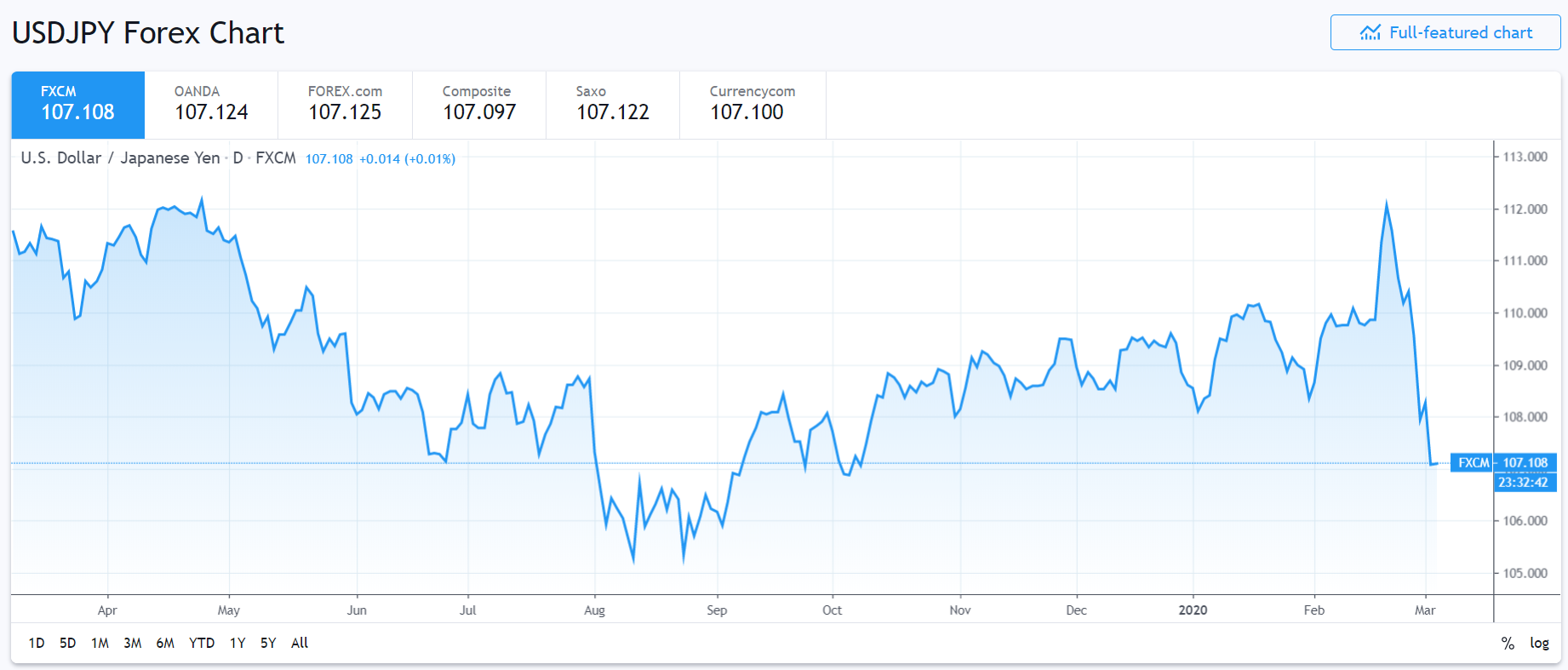

USDJPY plummeted below 107.00 for the first time since early October 2019 to a depth of 106.935 before recovering to settle at 107.22 at the New York close. In early Sydney, USDJPY is trading around 107.10. Following the Fed’s rate cut move, the benchmark US 10-year Treasury yield dropped a whopping 15 basis points to 1.00%. By contrast, Japan’s 10-year JGB yield was one basis point higher at -0.12%. The USD JPY pair is particularly sensitive to moves in the US 10-year yield.

So far, the Fed’s emergency rate cut move has not convinced investors to buy risk assets. This will keep USDJPY heavy.

Keep an eye out for verbal intervention from BOJ officials led by President Haruhiko Kuroda. The BOJ does not like the combination of an appreciating currency and a falling equity market.

USDJPY has immediate support at 106.85 followed by 106.60. Immediate resistance lies at 107.40 followed by 107.90. Look for a choppy trading range of 106.85-107.55. Look to sell rallies, not dips. Choose your levels well.