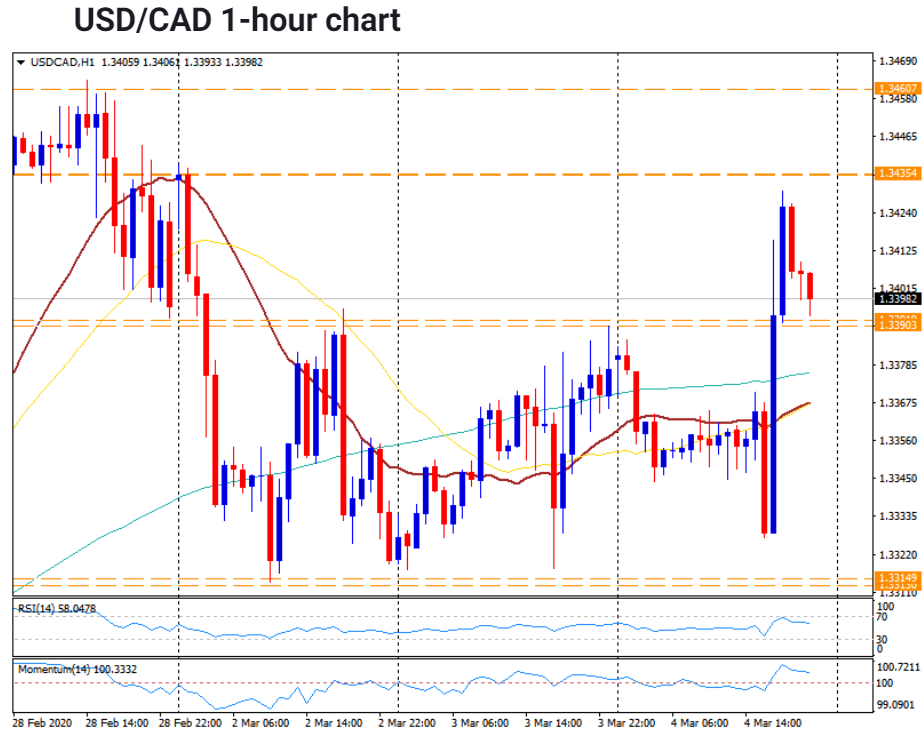

USDCAD jumped to an overnight high at 1.34313 (1.3375) following the Bank of Canada’s decision to slash its prime Overnight Cash rate by 0.5% to 1.25% (1.75%). The Dollar slipped to close at 1.3400, for a gain of 0.2%. Canada’s 10-year bond yield was steady at 0.95% (0.96% yesterday). The BOC’s move was widely expected.

Expect the USDCAD to consolidate its gains. Immediate resistance lies at 1.3390 followed by 1.3350 and 1.3315. Immediate resistance can be found at 1.3435 followed by 1.3465, last week’s highs.

Look to trade a likely range today of 1.3380-1.3440. Prefer to sell USDCAD rallies. The US Dollar still has room to move lower in the medium term, and the Loonie should benefit.