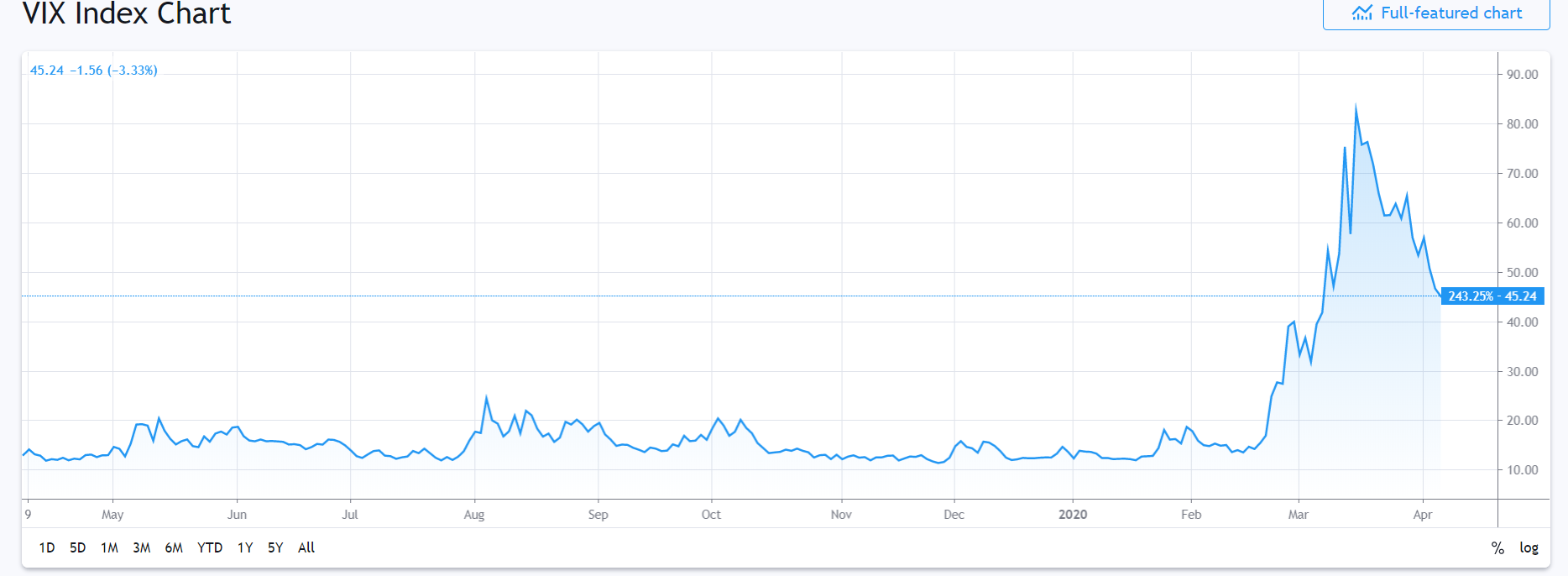

Summary: The Dollar extended its rise against the Japanese Yen while it stalled against other rivals while risk appetite rose lifting the Australian, New Zealand and Canadian Dollars higher. Markets digested the latest reports that saw Covid-19 death rate slow in Europe and the US while deaths in Japan and Asia quickened. USD/JPY rose 0.67% to 109.20 (108.47) as reports surfaced that Japan is preparing to declare an emergency today. The Euro was moderately lower at 1.0797 (1.0812) ahead today’s Eurogroup meeting to discuss options to support their economy during the coronavirus epidemic. Sterling eased modestly to 1.2242 (1.2270) after UK Prime Minister Boris Johnson was moved to an intensive care unit as his Covid-19 symptoms worsened. The Australian Dollar climbed 0.73% to 0.6090 (0.6002) while the CBOE VIX Fear Index slumped to its lowest level in 2 weeks to 45.24, still at elevated levels. Wall Street stocks bounced on the increase in risk appetite. The DOW climbed 6.5% to 22,525 (21,058) while the S&P 500 rose to 2,650 from 2,491. Treasury yields were higher with the key US 10-year rate at 0.67% from 0.59% yesterday. Germany’s 10-year Bund yield was up two basis points to -0.43%.

Germany’s March Factory Orders dropped to -1.4% from a downwardly revised +4.8%, beating expectations of -2.7%. The Eurozone Sentix Investor Confidence Index underwhelmed at -42.9 against median forecasts at -30.5. UK March Construction PMI slipped to 39.3 from 52.6, lower than expectations of 44.0.

On the Lookout: While markets finished with a positive risk mood on a slowing coronavirus death rate in Italy, Spain and New York, the numbers are still far from encouraging. It does appear as lockdown measures are working. Meantime, in Asia, Japan and Singapore are bringing in tighter measures as the daily number of confirmed cases start to rise again. Confirmed cases in Indonesia, Southeast Asia’s largest country with a population of around 273 million, continued to rise.

On the economic front, today’s main event sees the RBA rate policy meeting (2.30 pm Sydney). The RBA is widely expected to keep its Official Cash Rate at 0.25%. The Eurogroup, composed of Euro area member states meet to discuss measures to aid its member economies to soften the impact of the coronavirus. Australia also reports its Trade Balance, ANZ Job Advertisements, and AIG Services Index. Japan reports its Average Cash Earnings, Household Spending and Leading Economic Indicators. European data kick off with Swiss Unemployment Rate, German Industrial Production, and Italian Retail Sales. The UK reports on its Halifax House Price Index. Canada’s Ivey PMI and the US JOLTS Job Openings round up the days data.

Trading Perspective: The Dollar’s advance stalled against many of its Rivals as volatility eased and risk appetite climbed. Coronavirus data will continue to be the main catalyst for FX.

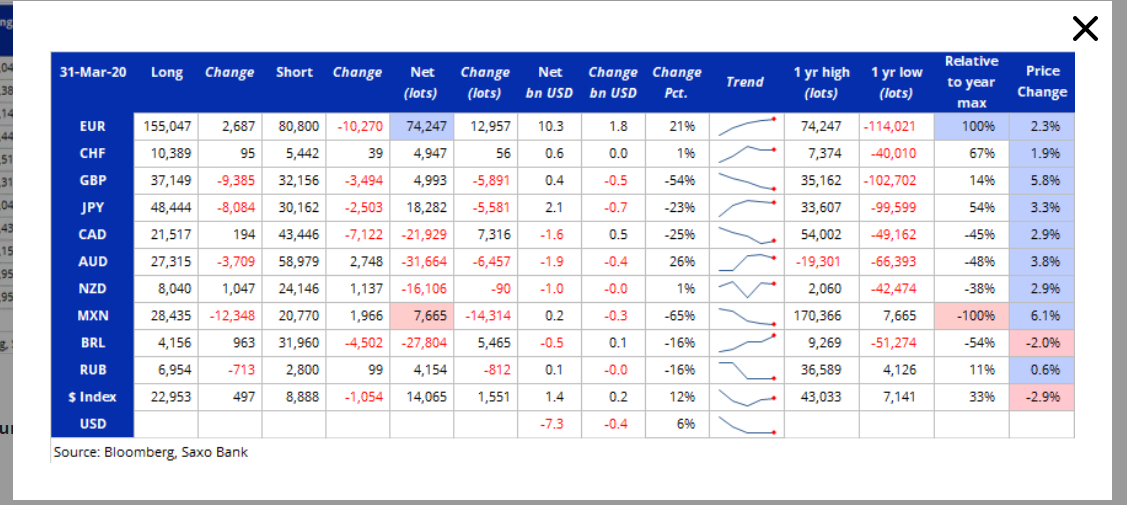

Market positioning will also remain a factor. The latest Commitment of Traders/CFTC report for the week ended March 30 saw an increase in net total US Dollar shorts. While the Dollar’s weakness was more broad-based, the bulk of USD shorts came via a continued build up of Euro longs. Total speculative Euro long bets were the largest since mid-2018. We look at the specific currencies and their numbers.