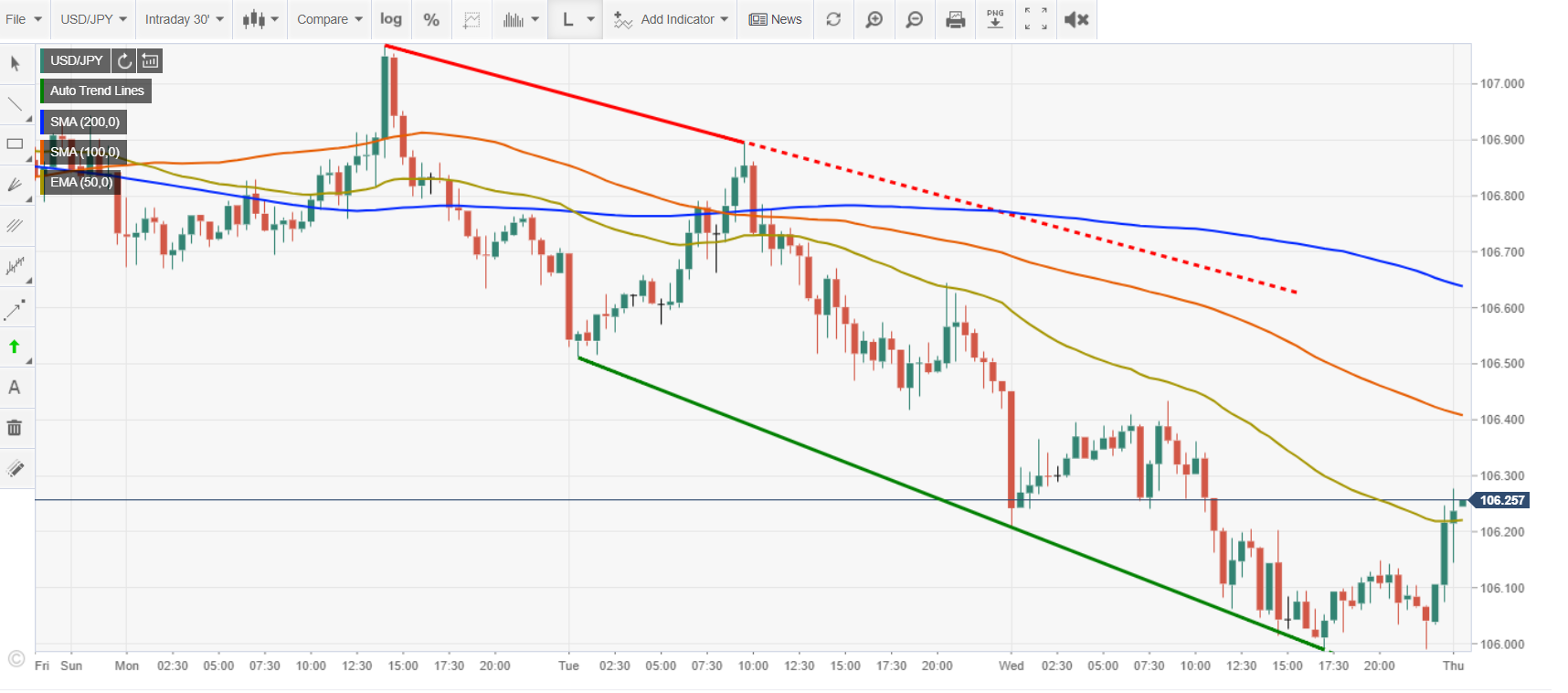

The Dollar retreated to fresh 7-week lows at 105.988 against the haven sought Yen in low volume trade as Japan celebrated their Golden Week holidays. Bleak economic data and an escalation in US-China relations has lifted demand for the Japanese currency. The Yen was the only currency to climb against the rallying Greenback yesterday. USD/JPY grinded lower and closed in New York at 106.10 (106.35 yesterday). As a result, the Yen has also climbed against its other rivals, including the Asian currencies. Many of these Asian currencies represent the countries that trade with Japan. Japanese officials will not be pleased to see a strong domestic currency against weak Asian EMS and a weak Nikkei (stock market).

With Tokyo back today, expect importer USD buying support to emerge at the immediate support level at 105.75. The next support level lies at 105.50 and 105.00. Immediate resistance can be found at 106.40 followed by 106.70. Look to trade a likely range today between 105.85 and 106.85. Prefer to buy dips in USD/JPY today.