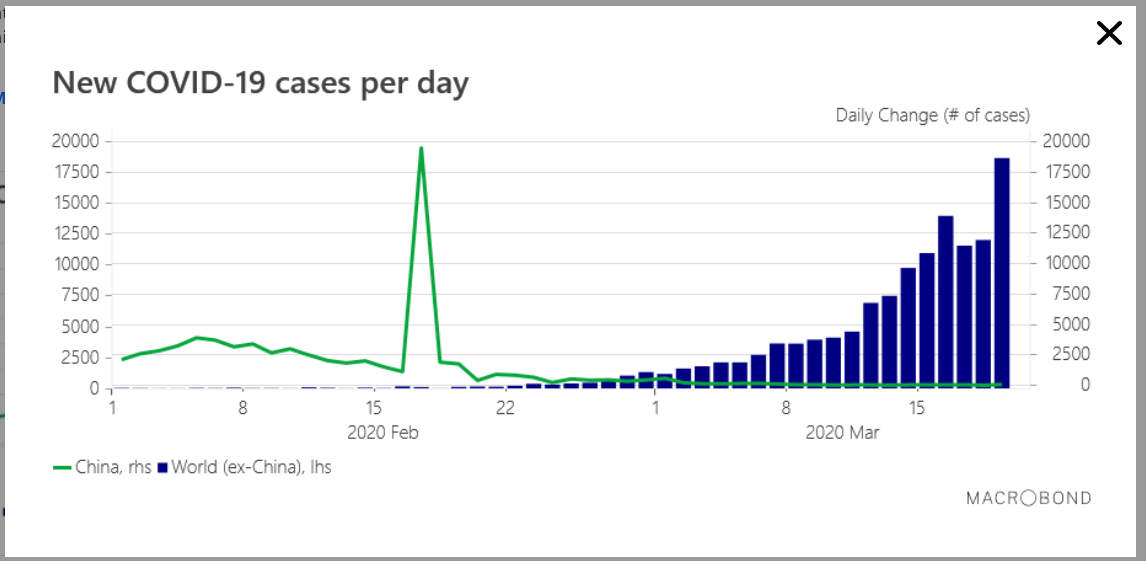

Summary: The Dollar Index (USD/DXY), a measure of the US currency’s value against 6 foreign currencies fell 0.8% to 1.0175 (1.0275) on Friday as Europe and the US scrambled to contain the coronavirus spread. The New York Times reported that cases in New York state alone grew to more than 15,000 (roughly 5% of the global total of 314,700). In Spain, thousands of health workers tested positive. Friday also saw the announcement by six major central banks of coordinated action to enhance liquidity from company funding requirements in the Greenback. The group agreed to increase the frequency of their currency swap operations to occur daily, which is unprecedented.

After plunging to multi-year lows, the Australian Dollar, British Pound and Canadian Loonie rebounded amid elevated volatility. The Aussie soared to 0.5986 overnight (from 0.5775), easing to settle at 0.5805 in late New York after US stocks settled near weekly lows. Sterling climbed to as high as 1.1934, dipping to 1.1610 at the NY close. The USD/CAD pair slumped 1.12% to 1.4335 from its Friday open at 1.4510 and last week’s high of 1.4668. In Italy, according to the NY Times, “containment measures lagged behind the trajectory of the virus.” The Euro, sold hard to an overnight and April 2017 low at 1.06376, rallied to close at 1.0695 on the weaker US Dollar.

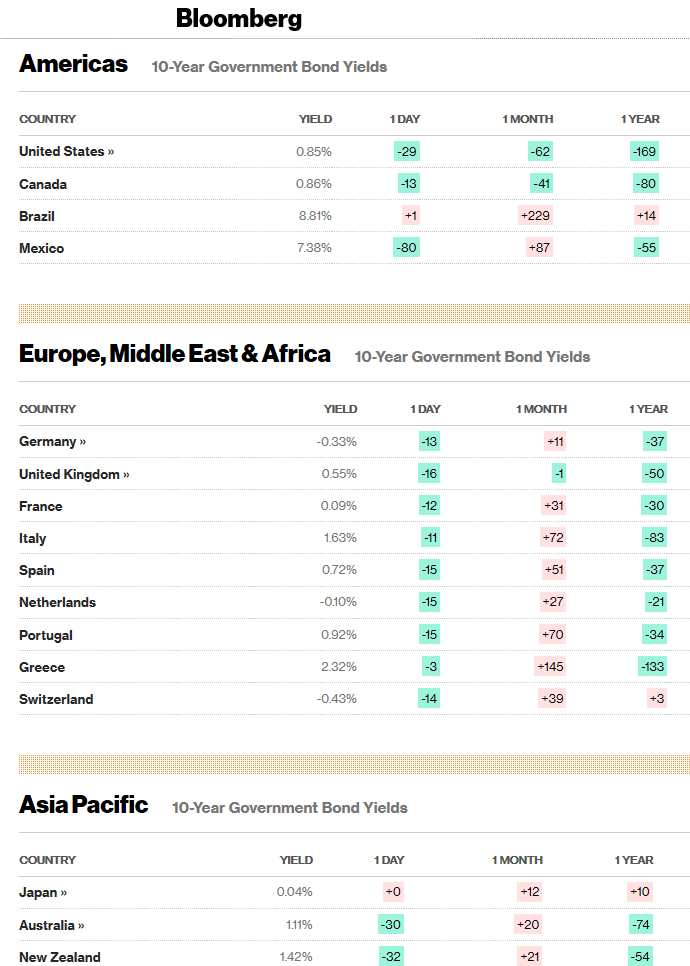

US Bond yields fell. The benchmark US 10-year rate fell 29 basis points to 0.85%.

Wall Street stocks fell to their lowest close this week. In late New York trade the DOW was 4.6% lower to 18,997 while the S&P 500 lost 4.3% to 2,274.

On the Lookout: We can expect further elevated FX volatility today. This time though, its not a one-way bet for a stronger Greenback despite funding demand. The economic data calendar for today is a light one. The week ahead though, beginning tomorrow sees global manufacturing and services PMI reports. Covid-19 developments and global containment efforts remain centre stage.

Yesterday, Australian Prime Minister Scott Morrison announced venues “where people congregate” will be shut to enforce social distancing amid the virus breakout. Morrison added that schools will be open (except in the state of Victoria) but it would be to the discretion of parents as to whether to send their children. The RBNZ announced early this morning that it would conduct large-scale asset purchases of New Zealand bonds (QE) following similar moves by global central banks last week.

Meantime New York state coronavirus cases rose more than France or South Korea. Total US cases neared 24,000, the death toll surged to 306 over the weekend. The US now has the third highest numbers after Italy and China.

Trading Perspective: FX opens in Asia with a clear risk off stance in highly volatile trade. US stock futures hit limit down as investors await a stimulus agreement in Washington. USD/JPY dropped to 110.46 before rebounding to 111.00 in a few minutes. The New Zealand Dollar slumped 100 points to 0.5604 from its NY close at 0.5704. The Euro eased to 1.0665 from 1.0695. Risk aversion saw the Aussie slip to 0.5725 from 0.5800. USD/CAD climbed to 1.4455 from 1.4335. The extremely choppy trade means no strong views, be flexible and pick your levels. We examine those in a per currency report.