Summary: The benchmark US 10-Year Treasury yield hit an all-time low of 1.32% (1.37% yesterday) after the Washington Post published that the CDC (US Centre for Disease Control) warned of coronavirus inevitability in the United States. The US Conference Board said its Consumer Confidence Index fell to 130.7 this month, missing forecasts at 132.0. Elsewhere the COVID-19 disease extended its reach through Europe, with Germany reporting its first case and more reported in France and mainland Spain. The Dollar Index (USD/DXY) retreated 0.42% to 98.943 (99.386) after reaching a 3-year high near 100 last week. Heightened risk aversion saw haven flows extend into the Japanese Yen, last up 0.65% at 110.12 per Dollar. The Euro advanced 0.32% to 1.0885 while Sterling gained 0.6% to 1.3005 against the broadly-based weaker Greenback. The Australian Dollar finished little-changed at 0.6602 (0.6605), the antipodean unable to take advantage of weaker Greenback as it faced challenges of its own in the current environment. The latest Commitment of Traders report saw the overstretched long US Dollar positions extend into a 5th week. We examine the breakdown in our trading perspective below.

Other economic data released yesterday saw Japan’s SPPI (Services Product Price Index), a leading indicator of consumer inflation, climbed to 2.3% this month from January’s 2.1% and beating forecasts of 2.1%. US Richmond Manufacturing Index underwhelmed, falling to -2 against forecasts of 10 and a previous 20.

Trading Perspective: The soft US data released yesterday (CB Consumer Confidence and Richmond Manufacturing) coupled with the CDC warning of inevitable COVID-19 spread in the US pushed the US 10-year treasury yield to an all-time low at 1.32 %, down five basis points from yesterday. Global rival rates also retreated but not to the extent of the key US yield. At the risk of sounding like a broken record, without yield support the Dollar cannot move up. Logically, it will come down. The Dollar was also weaker as expectations for further Fed easing continue to build.

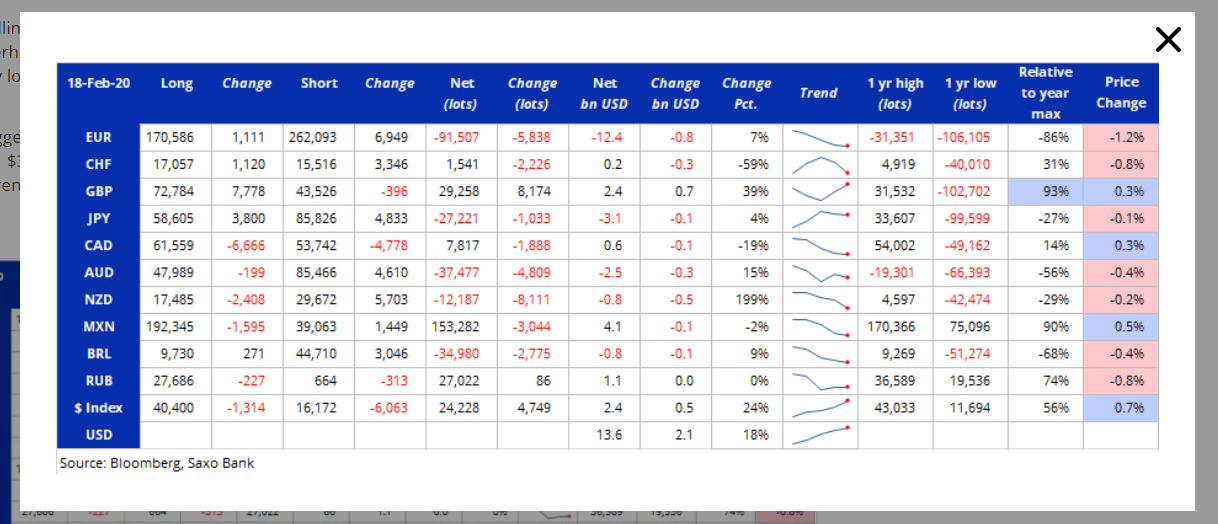

The Commitment of Traders report for the week ended 18 February saw speculators increase their long US Dollar bets (short currencies). The lone exception was the British Pound. According to SAXO Bank, the biggest short was held in the Euro ($12.4 billion equivalent), followed by the Yen ($3.1 billion) and the Australian Dollar ($2.5 billion).

USD/JPY – The Dollar extended its losses against the Yen, trading to an overnight low at 109.890 from yesterday’s Asian opening at 110.70. USD/JPY finished at 110.10 in New York. The latest Commitment of Traders report saw an increase in net speculative JPY shorts to -JPY 29,221 contracts (week ended 18 Feb) from -JPY 21,084 the previous week. Immediate resistance today lies at 110.40 followed by 110.80. Immediate support can be found at 109.80 followed by 109.50. A clean break of 109.80 could see a potential move to 108.50. Look to sell rallies with a likely trading range today of 109.60-111.60.

EUR/USD – The Euro advanced against the broadly-based weaker US Dollar to close at 1.0885 from 1.0845 yesterday. Overnight high traded was 1.0890. Immediate resistance lies at 1.1000 and 1.1030. Immediate support can be found at 1.0860 followed by 1.0830. The latest COT report (week ended 18 Feb) saw an increase in speculative Euro shorts to -EUR 91,507 contracts from -EUR 85,669. That’s a hefty increase in shorts. Look to buy Euro on dips with a likely range today of 1.8055-1.0915.

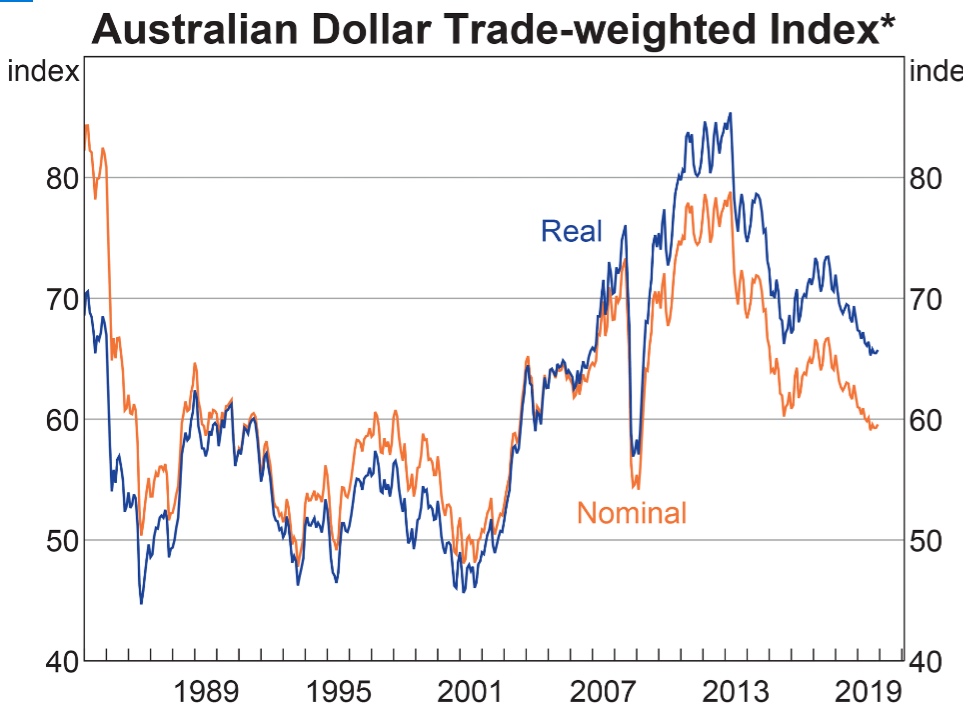

AUD/USD – The Australian Dollar closed little-changed at 0.6604 against the overall weaker US Dollar. The Battler continues to meander near decade lows in the current environment. Against this background, the RBA’s Australian Dollar Trade Weighted Index remains near 2007 lows. The latest COT report saw speculative Aussie short bets increase to -AUD 37,477 contracts from -AUD 32,668. The Aussie will eventually lift because of a weaker US Dollar and a short speculative market. Immediate support lies at 0.6585 followed by 0.6555. Immediate resistance can be found at 0.6625 and 0.6655. Look to buy dips in a likely 0.6590-0.6650 range today.

GBP/USD – Sterling advanced to 1.3005 from 1.2920 yesterday. The British Pound recovered above 1.30 despite tensions between the UK and the EU about its future trade relationship. UK 10-year bond yields were 2 basis points lower to 0.52%. The gap between US and UK 10-year rates has narrowed and this is supportive of the Pound. However, the COT report saw speculative long GBP bets increase in the week ended 18 Feb to +GBP 29,258 from +GBP 21,084 the previous week. Immediate resistance for the Pound lies at 1.3020 followed by 1.3050. Immediate support can be found at 1.2975 and 1.2945. Prefer to sell rallies with a likely range today of 1.2940-1.3010.

GBP/JPY – This cross could be a mover in the next few days for two reasons. First is that the Yen will continue to gain overall should the COVID-19 extend its reach. Second, positioning in the individual currencies are opposing, ie short JPY and long GBP. Ideally, we look to sell GBP/JPY on any rallies. GBP/JPY closed at 143.12 from 143.03 yesterday. Immediate resistance can be found at 143.35 and 143.65. Immediate support lies at 142.90 (overnight low 142.921) and 142.50. A sustained break at 142.90 should see 142.50 initially, followed by 142.20. Look to sell rallies in a likely range today of 142.50-143.50.

NZD/USD – The Kiwi, like its bigger antipodean cousin the Aussie, has failed to take advantage of the US Dollar’s fall. And like the Aussie, speculators are short of the New Zealand Dollar. Speculative NZD shorts climbed to -NZD 12,187 bets (week ended 18 Feb) from -NZD 4,076. NZD/USD closed at 0.6330 (0.6335 yesterday). The Kiwi has immediate support at 0.6310 (overnight low 0.6311) followed by 0.6280. Immediate resistance can be found at 0.6360 and 0.6390. Look to buy dips in a likely range today of 0.6310-0.6370.

Happy trading all.