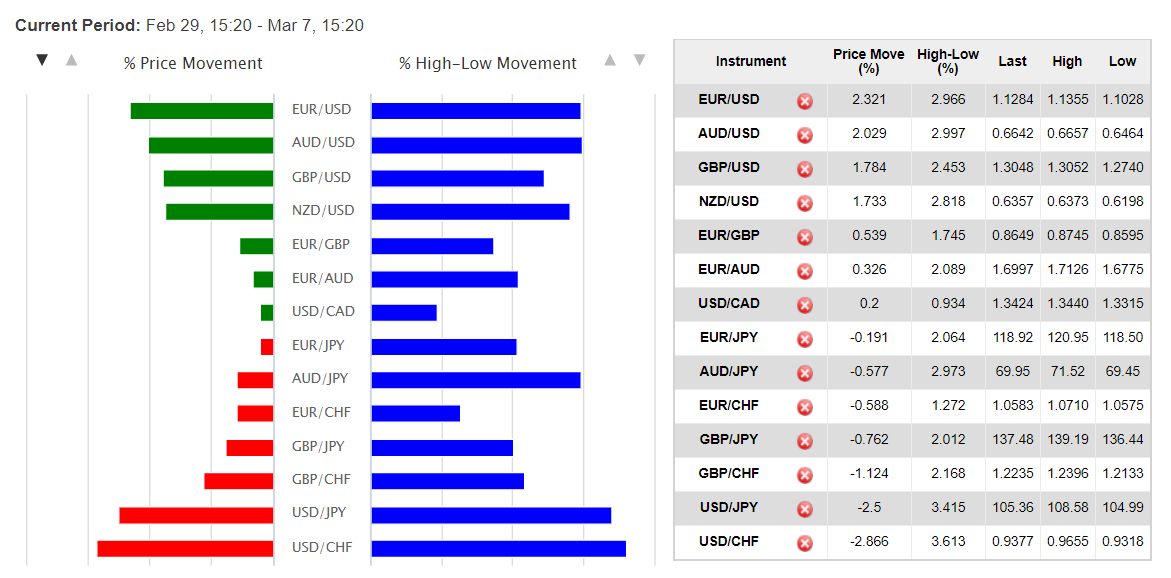

Summary: What a difference a day makes. The US Dollar and Wall Street rebounded off their worst day since the 2008 crisis. Hopes of government stimulus after US President Trump suggested that a payroll tax cut and several other stimulus measures may be in the works to temper the economic damage from the coronavirus outbreak. Outside of the US, other major world economies took steps to cushion the effects from the spread of Covid-19. The USD/JPY pair, main risk barometer in FX, jumped to an overnight high at 105.919 from 102.45 yesterday, settling at 105.45 in late New York, a gain of 2.22%. The Dollar gained 1.05% against the Swiss Franc to 0.9395 (0.9255) after data suggested that the Swiss National Bank had intervened to weaken its currency. Sterling slumped 1.3% to 1.2903 from 1.3105 on doubts over Brexit ahead of today’s UK budget release. The Euro retreated to 1.1300 from 1.1450 weighed by the stronger US Dollar and Italy’s confirmation that it had 10,149 cases of Covid-19 amidst a nationwide lockdown. Broad US Dollar strength pushed the Australian Dollar to a low of 0.64626 (0.6600 yesterday) before pulling back to 0.6490. Against a basket of currencies, the Dollar rose 1.63% to 96.45 (94.99). Wall Street stocks rebounded off their worst beating since the 2008 crisis, treasuries slumped, and yields soared. The benchmark US 10-year bond yield ended 25 basis points higher at 0.80%. Germany’s 10-year Bund yield climbed 6 basis points to -0.80%. Japanese 10-year JGB rates were at -0.11% from -0.18% yesterday. The DOW was 4.78% higher at 24,910 (24,065) at the New York close. The S&P 500 gained 4.9% to 2,875 (2,770). Brent Crude Oil prices rallied 9.8% on news that Russia was open to talks with OPEC.

On the Lookout: Markets now look to today’s events and primary economic data for fresh catalysts.

Reserve Bank of Australia Deputy Governor Guy Debelle speaks at the Australian Financial Review Business Summit in Sydney (9 am Sydney time). Audience questions are expected.

Later today in Washington DC, US Treasury Secretary Steven Mnuchin is due to testify before the Subcommittee on State, Foreign Operations and Related Programs on the Proposed Fiscal Year 2021 Budget. His speech will be closely monitored as Mnuchin will communicate President Trump’s economic policies.

The UK’s Annual Budget is scheduled for its Release (10:30 pm Sydney) where expectations are still high that Chancellor Rishi Sunak will announce a GBP 5 billion boost for British exports. Fresh doubts over Brexit amid differences between the EU and UK remain and weighed on the British Pound overnight. Meantime total coronavirus cases in the UK rose to 373 with 6 deaths.

Australia releases its Westpac Consumer Sentiment Index which is the lone Asian economic report.

The UK reports on its February Manufacturing Production, Construction Output, Goods Trade Balance, and Industrial Production data. Finally the US reports on its Headline and Core CPI data.

Trading Perspective: After Monday’s huge Dollar fall a bounce was inevitable. Even prior to hopes for stimulus measures, central bank officials from Japan and Switzerland had warned of excessive movements in their currencies. CNBC reported that data from the Swiss National Bank had intervened to weaken its currency. FX markets have experienced what traders refer as “stealth” intervention, where a central bank intervenes on the quiet, without much fanfare, to either strengthen or weaken its currency. The BOJ and SNB have been doing this for years. Japanese officials spoke out against a strengthening Yen and weakening Nikkei since Monday.

FX volatility has doubled since late February but still lags behind the extent of the equity markets. Expect heightened volatility to continue in FX.

The US Dollar could bounce further although it is too early to call a bottom to the Greenback.