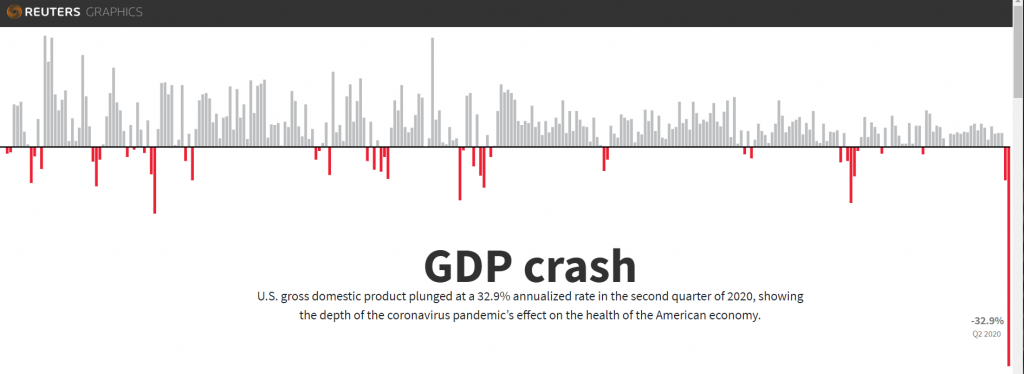

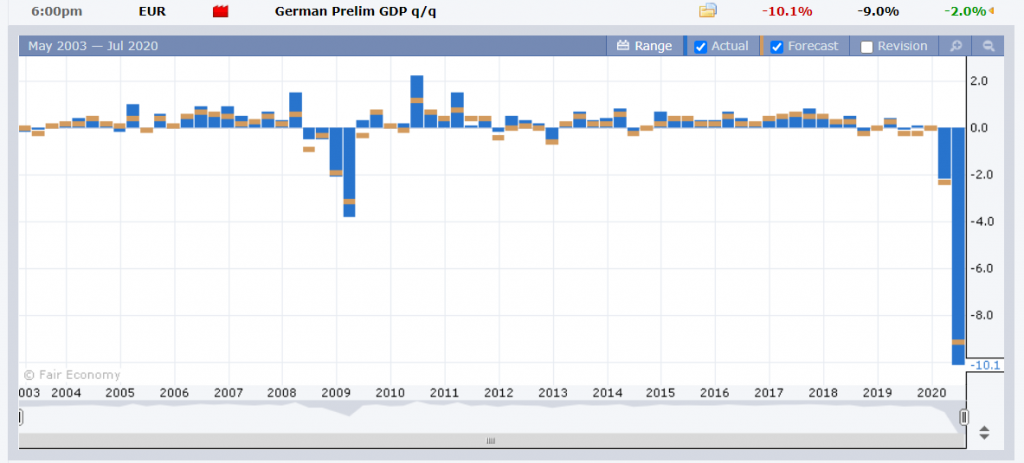

Summary: The Dollar extended its slide after US Q2 GDP plunged a record 32.9% annualized rate, slightly better than expected (-34.5%). It was still the deepest drop since the government began records in 1947. A tweet by President Trump raised the possibility of a delay in the US presidential election and heightened the growing political uncertainty in America. The failure of US lawmakers to agree a new coronavirus bill added further weight on the Greenback. The Euro extended its advance to 1.1848 from 1.1795, fresh 25 months highs despite a worse-than-expected contraction in Germany’s Gross Domestic Product, at -10.1% (-9.0% forecast). Sterling broke up through 1.30 (1.2995 yesterday) to peak at 1.3103, not seen since early March. This time the Greenback’s advance was not broad based. Against the Canadian Loonie, the US Dollar rose 0.57% to 1.3420 (1.3337) due to a slump in Crude Oil prices. The Australian Dollar shrugged off weaker-than-expected Building Approvals data, rebounding off its low at 0.7121 to finish at 0.7195 (0.7188 opening yesterday). Emerging Market currencies were mixed against the Greenback. USD/ZAR (Dollar-South African Rand) was up 1.11% to 16.74 (16.53) while the Dollar slipped against the Thai Baht (USD/THB) to 31.35 (31.48). Wall Street stocks were mixed. The DOW slipped 0.25% to 26,510 (26, 577) while the S&P 500 was up 0.3% to 3,275 (3,265). The benchmark US 10-year treasury yield eased to 0.55% (0.57%). Germany’s ten-year bond rate was 4 basis points lower to -0.54%.

Other data released yesterday saw Australia’s Building Approvals fall to -4.9% in July, weaker than expectations of -2.0%. The Eurozone’s Unemployment rate was at 7.8%, worse than forecasts at 7.7%. The number of Americans claiming Unemployment benefits rose to 1.434 million in the latest week from a previous 1.416 million, but better than forecasts at 1.440 million.

On the Lookout: Despite a better-than-forecast slump in US Q2 GDP, it was still the deepest contraction since 1947 and underscored the economic impact of the coronavirus. President Trump’s tweet which raised the possibility of delaying the November election was the straw that boke the camel’s back for the US Dollar. Political uncertainty has always been a kryptonite for currencies and the failure of the US to control the growing outbreak of Covid-19 presents a bleak outlook.

Germany’s worse than expected GDP was ignored by FX who continue to drive the Euro higher. That faces a test today with the release of Euro area and Eurozone GDP reports. Virus cases from a second wave continue to rise in Spain, France and Italy which cannot be ignored and bears watching.

Today sees Japanese data kick off Asia with its Preliminary Industrial Production, Unemployment rate, Consumer Confidence and Housing Starts. Chinese July Manufacturing and non-manufacturing PMI’s will be closely watched. Australia releases its Q2 PPI and Private Sector Credit data. Europe sees the release of Spanish, Italian, French, and Eurozone GDP numbers. Canada also releases its GDP report. The US rounds up a busy data day with its Personal Spending and Chicago PMI reports.

Trading Perspective: It seems like all doom and gloom for the US Dollar following the release of yesterday’s GDP data and the political uncertainty caused by Trump’s election delay tweet. There is also uncertainty surrounding the US fiscal package due to the inability of the Republicans and Democrats to agree over the coronavirus bill. However, the situation in Europe and other parts of the world are not getting better. The spotlight falls on today’s release of Chinese, Euro area and Eurozone economic data. Coronavirus cases continue to rise in Spain, Italy, France and even Germany. In Asia, Australia is dealing with its own spike in Covid-19 infections, with new cases in Sydney creeping higher. In Southeast Asia, Indonesia and the Philippines are struggling to contain new outbreaks. India, Pakistan, and Bangladesh continue to spiral upwards.

This may see a corrective decline in the Euro, already extremely overbought, as well as other currencies with flows back into the Greenback.