NASDAQ and Tech

The Nasdaq has been the king of the bulls throughout the pandemic, price gains across the board have pushed it well beyond the $11,000 mark, which is extraordinary. The indexes advance is starting to ring a few bells, though positive earnings results from some of the esteemed FAANG’s and more, could not stop Thursday’s drop of 2.8%. Even before the drop, there has been talk on the street of a tech bubble, with some reminiscing the last one from the dot com era. Though the times were different, some of the same signals are presenting themselves with familiarity, and we can’t discount a speculators market that has seen its rise throughout the pandemic.

The Drivers

While the rise of the Nasdaq 100 and the S&P 500 has been phenomenal, there are elements that suggest a reason for it more so in the Nasdaq. The Nasdaq is a tech-heavy composite, and throughout the pandemic, when the constraints of social distancing have restricted human interactions, the tech industry has filled the void. In most instances, the household names, Amazon, Netflix, Google, Tesla, and Microsoft have all contributed to doing wonders on the adaptation to consumer required services. And even more stellar, they have then managed to exceeded earnings forecasts by large margins throughout what has already become been a year for the history books in July.

What is making the alarm bells ring then?

Comparing the S&P500 and the NASDAQ to one another during the dot com era and now, will show a price ratio that has well and truly exceeded the last major tech bubble. We also must account for a global pandemic and a great degree of stimulus that has certainly found its way into the stock markets. The current global situation is very different from what the NASDAQ, among other indexes are presenting as a prosperous economy, a dislocation from reality that has not been seen before. This dislocation suggests a fragility to financial markets, and no one could argue that the financial system has been operating under increasingly stressful conditions. Abnormal deviations across the financial system are prevalent, the Gold to Silver Ratio, Bond yields and inversions, and the unstoppable stock market.

2000 vs Today

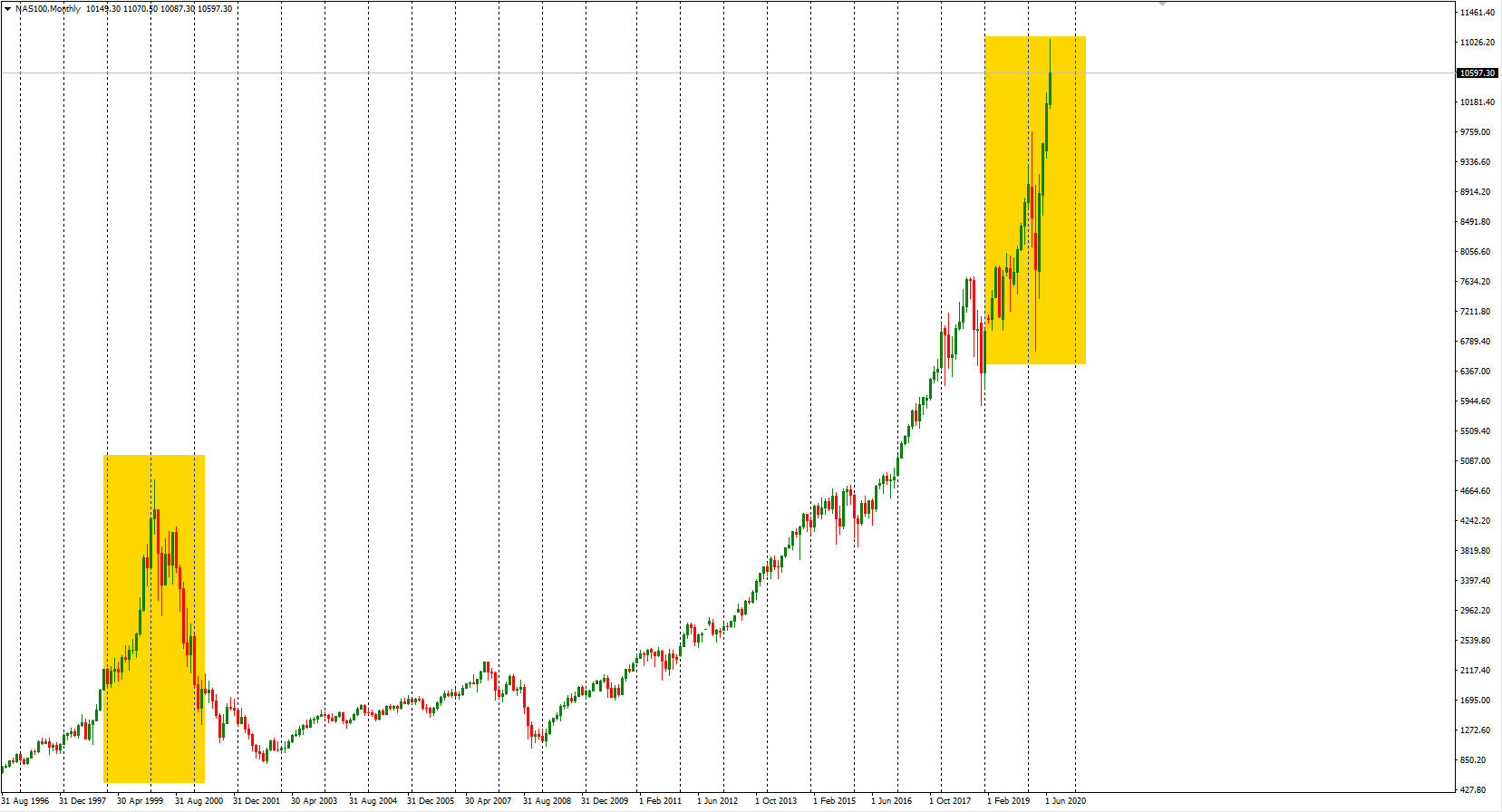

NASDAQ 100 Dotcom vs Pandemic

The key problem that I see in the dotcom vs pandemic tech scenario comparison’s is that many are missing the backdrop of monetary policy differences. During the dotcom era, we saw monetary policy tightening, and global cash rates were increasing. That is a polar opposite to what we see today, easing monetary policy, with huge sums of stimulus. My thoughts are that the monetary policy action is creating an entirely different beast, with outcomes not yet foreseen, and it is going to be a wild ride for the greater financial system.