Oil exploration is a dying industry, truthfully, it is the entire oil industry that is heading into a different era. Oil exploration is a difficult, risky, and expensive exercise, it can take years to successfully begin extracting oil, and with the push towards environmentally friendly alternatives the industry is facing some critical challenges. Costs are rising while the value of oil has remained subdued, the effects of coronavirus have been obvious, but the concern now is that it will likely be long lasting. Now the oil industry is facing more pressure from creditors, the public, regulators, and in some instances the oil itself.

Oil production is expensive

Oil exploration is not a simple process it requires a serious amount of capital, its also an exercise that does not always net a positive result. The purchase of a successful oil field is not exactly clear cut, the oil explorers do not actually know if there is oil under the land until after it is purchased, at best it is an educated guess. After purchase they begin looking, they might get lucky and ‘strike oil’ but this isn’t the end of it, then the testing begins to access the quality and the quantity of oil estimated to be beneath the feet. As you can imagine, its laborious, time consuming, expensive, and full of risk, it is a lot of work to find out if a) there is any oil and b) if its of good quality. Which is why even after years of work and millions of dollars, the investment decision to drill comes last.

Long lasting damage

The implications on oil prices from the pandemic has not been easy for oil producers, it naturally didn’t help when some of those involved in production *Cough Russia, Saudi Arabia Cough* thought it would be a good idea to have a price war. Regardless the long-term effects were unenforceable and still are in their entirety, the world has changed, and the timelines of planned changes has been moved up, especially on the environmental side, and its creating pressures on more than one front.

The ESG side

The big timeline change is the environmental, social and governance pressure that has been mounting on fossil fuel providers, the climate and environmental impacts of oil production have been public knowledge for years and its has been politicised over decades. The impacts of the pandemic have only highlighted the issues even further, giving more evidence on the environmentalist side as to how damaging fossil fuels can be and that the world does seem to need anywhere near as much oil as it once needed.

The social, political and the environmental aspects have led into the governance and regulatory controls that are putting even graver pressure on the oil industry. Creditors are tapering the options to provide lines of credit to oil companies, while simultaneously providing incentives for others focusing on renewable energy and cleaner energy programs.

Shale

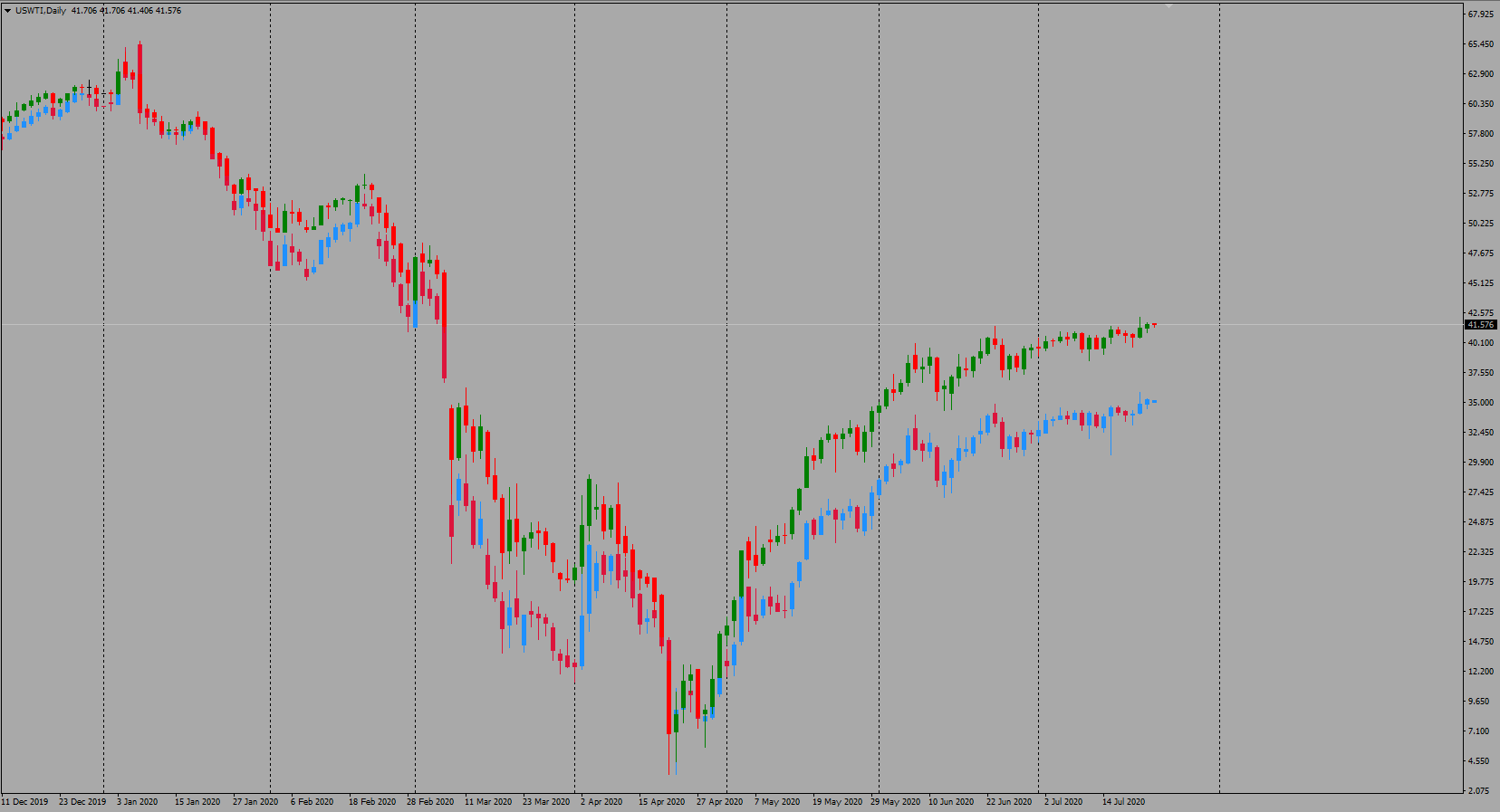

Then we have to think about shale and of course West Texas Intermediate crude oil, fracking is by far the most expensive of oil production methods available today. The slump in demand and the subdued oil prices have really not aided their situation. Even now with oil at $41 the vulnerabilities that shale manufacturers already had have just been amplified tenfold. At this point, north American oil and gas producers are likely to have the worst year of bankruptcies they have ever seen. During the 2015 oil price collapse, more than 200 oil companies in North America filed for Bankruptcy, with a combined owing in the $150B mark, back then oil never went to negative values.

Can oil companies and prices survive?

Ultimately the oil companies with the biggest balance sheets, who can adapt to the changing world. Smaller firms with smaller reserves are unlikely to be able to invest into green energy replacements as easily, yes some might get lucky but not all.

Do not get me wrong though, the total end of oil demand is also an unlikely scenario there are some things that will still and always require oil to some degree. While oil-based power needs are in decline, I’m not certain that we could say that It is feasible to totally eradicate oils total demand, distillates and a variety of oil derived products will still need to be produced for likely an extensive time. And theoretically a side affect of this behaviour would be higher oil prices…eventually.

So in my own view, I would still not be betting on oil exploration being non-existent in the next few decades, though I would not be surprised if the amount of exploration and production was halved from what it is today.