It was hard to know where to start with this week’s Trader Guide, but I felt a look at the flows to cash and the USD were the best place to start. I touch on the fact that markets don’t make a lot of sense right now – take last night, for example, the S&P500 gained 0.5%, yet the Russell 2000 closed +6.8%. We saw oil +24%, yet inflation expectations fell and HY credit closed +56bp. It seems fitting then that as soon as I publish a video on the USD going on a one-way ticket higher, with EM getting hit, and posing a new risk to consider with credit, we see a broad USD sell-off in Asia. Now, that could be because the California Governor has issued an order for the public to stay at home, as has the LA Mayor, but the USD was sold off into those headlines, so it may just be Asia selling an extended long position into the weekend.

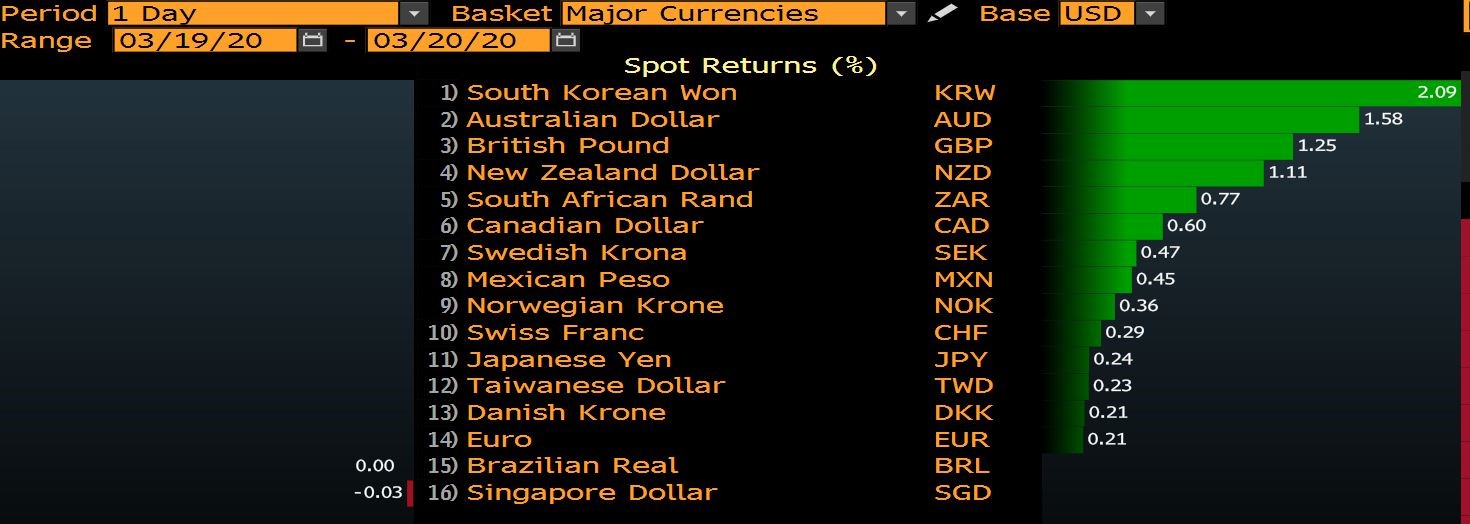

FX moves on the day vs the USD

We saw weekly jobless claims increase by 70k to 281k overnight, and I talk about the importance of this data point as a lead indicator for the US unemployment rate, and for sentiment more broadly in the video. The fact, then, that Goldman Sachs believes we could see weekly jobless claims increase to 2.25million shows how painful this will likely be. It feels like the pace of asset purchases from the Fed will only increase.

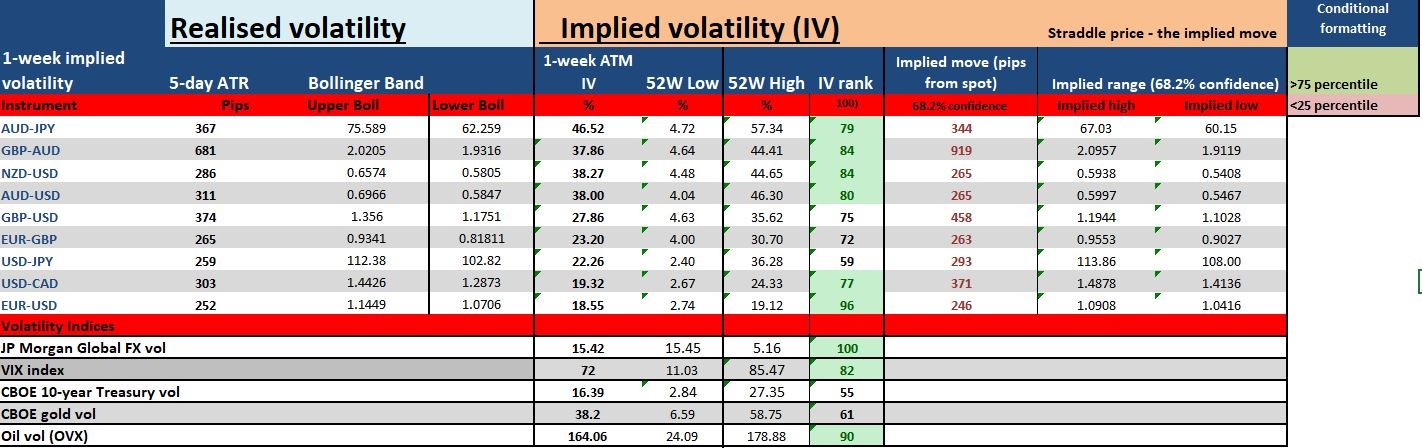

As I touch on, volatility is still way too high to be calling bottoms in risk. There is still too much capital heading into money market funds and out of HY credit and equities, although we’re coming up to month-end and the prospect of rebalancing into equities from fund managers is elevated. Let’s see, but Asian equities are higher today, the USD is weaker and S&P500 futures are lower despite oil pushing a further 2.2% in Asia.

It’s been a long, painful and emotional week for all, where the thought of markets being closed for two days is incredibly refreshing – but who knows what news we’ll hear through that time – it will be big though and suggests the prospect of gapping on the Monday open is sky-high. Many will not want to hold positions into that risk, so we may see a market, whether short or long, closing, to run a flat book into the weekend. Time to recharge because we go into battle again on Monday.

Good luck to all and wish you all the best of health.