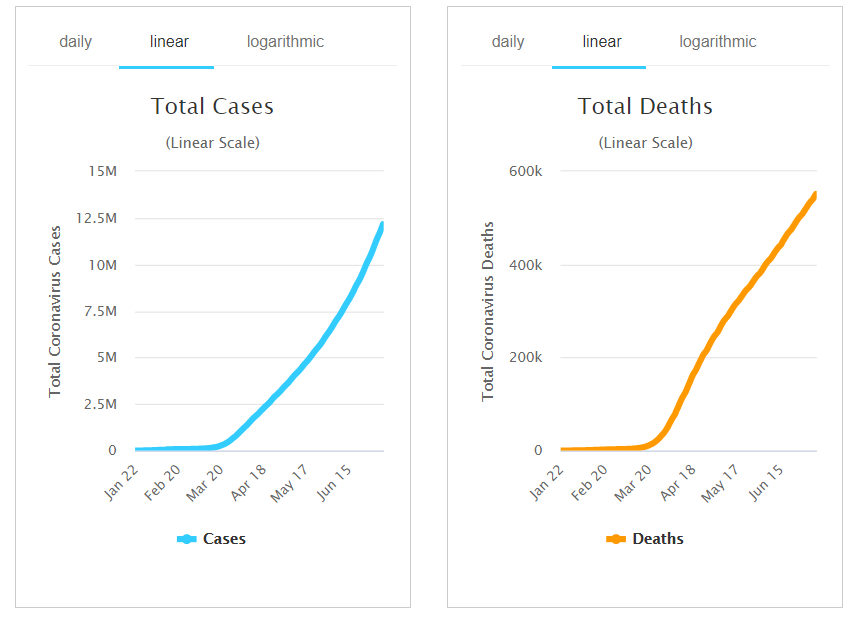

Summary: Risk wars extended with a surge in new global Covid-19 infections foiling a record rise in the tech-heavy US NASDAQ. In the US, the daily number of new coronavirus cases topped 60,000, a fresh one-day record. The resurgence of Covid-19 infections continued in other parts of the world. In cities such as Tokyo and Melbourne, restrictive measures returned as a rise in daily virus were also recorded. Also aiding the Greenback’s rise was a US Supreme Court ruling that President Trump cannot block the release of his financial records to prosecutors. The Dollar Index (USD/DXY), a favoured gauge of the US currency’s value against a basket of 6 major currencies, rebounded 0.33% off 4-week lows to 96.792 (96.476). The Euro retreated from a one-month high to 1.1282 (1.1334 yesterday) as the stronger Greenback and overbought conditions weighed on the shared currency. Sterling edged lower to finish at 1.2605 after peaking at 1.2670 overnight. Risk currencies slid. The Australian Dollar slipped 0.39% to 0.6962 after failing to clear 0.70 cents. Against the Canadian Loonie, the Greenback soared to 1.3585 from 1.3512 as Oil prices slumped. The Dollar dropped to 4-month lows against the Offshore Chinese Yuan (USD/CNH) to 6.9960 (7.0010 yesterday) as China’s benchmark Shanghai Stock Exchange saw a 9% rally so far this week on optimism over new policies would liberalise the country’s financial markets. Wall Street stocks closed mixed. The NASDAQ closed higher at 10,745 (10,685) while the DOW ended down 1.57% to 25,705 (26,115). The S&P 500 lost 0.74% to 3,152 (3,175). Global bond yields dropped. The benchmark US 10-year treasury yield fell 5 basis points to 0.61%. Germany’s 10-year Bund yield was at -0.46% (-0.44% yesterday).

Data released yesterday saw Japanese Core Machinery Orders rose 1.7%, beating forecasts for a drop at -5.2% and a previous -12.0%. Germany’s May Trade Surplus climb to +EUR 7.6 billion from the previous month’s +EUR 3.2 billion. Canada’s Housing Starts climbed to 212,000 units beating expectations of a 185,000 rise. US Claims for Unemployment Benefits dip to 1.314 billion, bettering forecasts of 1.375 billion.

On the Lookout: The election uncertainty is now becoming a factor for the markets which should provide support from safe-haven flows into the Dollar. Trade tensions appear to be on the ascent again. Markets will be monitoring any new developments on this front.

Today’s data calendar is relatively light. Japan kicks off with its annual PPI report for June. Earlier in the day New Zealand’s Electronic Card Retail Sales rose 16.3%, which did not budge the Kiwi. China reports its June New Loans data. Europe enters the market with France’s Industrial Production followed by Italian Industrial Production data for May. Canada releases its June Payrolls report, Unemployment Rate, and Average Hourly Wages. The US rounds up the day’s data with its Headline and Core Producer Price Index (PPI) for June.

Trading Perspective: Markets will continue to monitor the rising spread of the coronavirus around the world. Which could see more restrictions returned for economies and weigh on risk sentiment. The daily total of new deaths has also risen, led by the US with 710 and Brazil with 1,129 as at yesterday. If these of numbers (new daily cases and new daily deaths) grow, it will see risk-off big-time. Traders will also look out for the next stage of fiscal measures to battle the virus outbreak. The US is expected to announce its fiscal stimulus between July 20-31 according to Treasury Secretary Steven Mnuchin.