Summary: The US Dollar fell across the board even as global risk assets recovered on hopes of a coordinated central bank response to the coronavirus crisis. Heightened FX volatility saw choppy trade in what traders know as the “twilight zone” (the transition from the New York close and Asian open). The action was fast and furious. The Euro outperformed, climbing to 1.1185, as speculative shorts scrambled to cover. The ECB said in a prepared statement: “we stand ready to take appropriate and targeted measures, as necessary and commensurate with the underlying risks.”

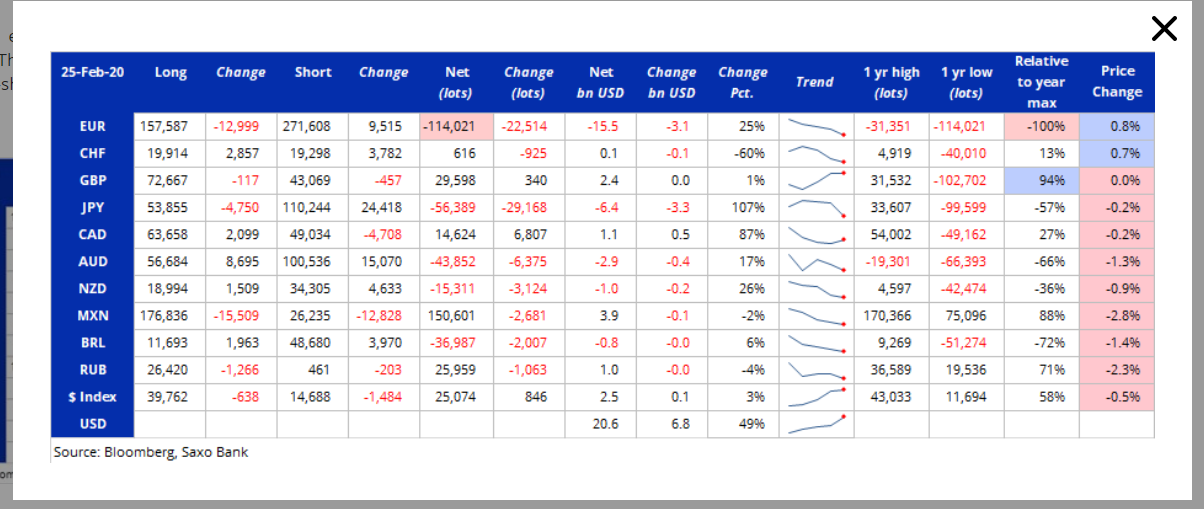

The latest Commitment of Traders/CFTC report (week ended 25 Feb) saw total net speculative Euro short bets at a 38-month high. EUR/USD eased to 1.1132 as equities bounced. Euro area Manufacturing PMI’s were mostly upbeat and triggered the Euro’s up move. On the other side of the Atlantic, US manufacturing sector activity slowed as COVID-19 hit supply chains. US ISM Manufacturing Index fell to 50.1 from 50.9 missing forecasts at 50.5. The Dollar Index (USD/DXY) which measures the Greenback’s strength against a basket of foreign currencies, slipped further to 97.60 (98.127), down 0.4%. The Australian Dollar lifted 0.44 % to 0.6535 from 0.6485 on the broad-based US Dollar fall. All eyes on the RBA rates policy meeting today, (2.30 pm Sydney time). The RBA is widely tipped to trim its Overnight Cash Rate to 0.5% from the current 0.75%. Sterling, once again, underperformed, dipping 0.3% to 1.2775, 4.1/2-month lows as traders remained cautious ahead of Brexit talks between the UK and the EU. Market positioning on the British currency remained long GBP bets which is also weighed on the currency. The DOW was up 3.6 %, while the S&P 500 gained 3.12 % at this time of writing. Wall Street stocks rocketed just at the close.

On the Lookout: It’s all about the Aussie today. The RBA is widely expected to cut its Overnight Cash Rate (prime lending rate) to 0.5% from 0.75% at the conclusion of its policy meeting today (2.30 pm Sydney time). That said, surprise cannot be ruled out, as is the case in FX. The Australian Dollar stayed positive, hovering near around 0.6535 on the elevated risk assets.

Speculation runs high that the upcoming G7 summit in the US will see finance ministers and central banks provide stimulus.

Australia kicks off today’s economic data with its Building Approvals and Current Account. Japanese Consumer Confidence follows. Euro area reports see Swiss GDP (Q4), Spanish Unemployment Change, Italian Monthly Jobless rate, Eurozone Headline and Core Flash CPI, PPI, and Unemployment rate. The UK reports on its Construction PMI. The US Wards Total Vehicle Sales number rounds up the day’s data.

Trading Perspective: Expect FX to consolidate first up within the ranges that have been established in the last 24 hours. Market positioning saw an increase in total net speculative US Dollar long bets. This will see further Dollar selling as the Fed takes the lead in providing the necessary stimulus response to the coronavirus crisis. The latest Commitment of Traders report from Saxo Bank saw net total speculative US Dollar long bets jump 49% in the latest week ended 25 February to the most since 11 December 2019. The bulk of these longs were against the Euro and Yen.