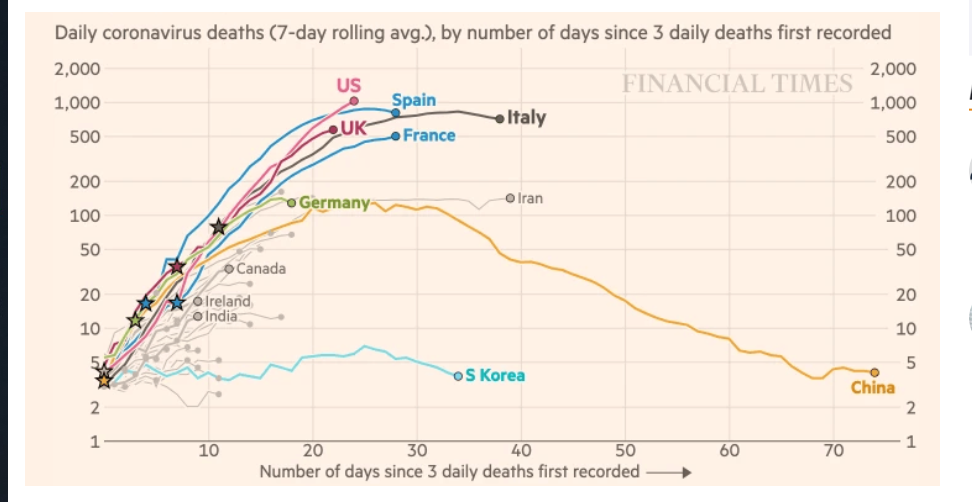

Summary: It was a case of risk-on, risk-off as markets tried to get a feel of the overall Covid 19 impact even as the pandemic’s curves gave signs of flattening. The US Dollar fell against its rivals, including the risk and Emerging Market currencies, paring losses at the New York close. Wall Street stocks slid, erasing sharp gains to close in the negative. The build in risk appetite fizzled with no immediate end in sight for the current crisis based on mixed headlines. The Australian Dollar soared to 0.62080 overnight and one-week highs (0.6091) after the RBA kept its key interest rate unchanged at all-time lows of 0.25%. AUD/USD eased to 0.6172 in late New York. The Euro rallied 0.86% to 1.0894 (1.0795) on the broad-based US Dollar weakness. Sterling advanced to 1.2335 from 1.2245, shrugging-off reports that UK Prime Minister Boris Johnson was transferred to the intensive care unit due to persistent coronavirus symptoms. UK Covid-19 cases slowed for the second day while fatalities remain low. Against the Canadian Dollar, the Greenback slid to 1.39454, near 2-week lows, before rallying at the NY close to settle at 1.4013. Brent Crude Oil prices slid 2% (USD 32.40) as supplies swelled and expectations for an agreement on output cuts between major producers dwindled. The USD/JPY pair eased to 108.81 from 109.18.

In late New York trade, the DOW erased earlier gains, finishing down 0.21% to 22,555. The S&P 500 lost 0.38% to 2645. Global bond yields climbed. The benchmark US 10-year bond yield ended 4 basis points higher at 0.71%. Germany’s 10-year Bund gained 12 basis points to -0.32%. Australian 10-year bond yields were at 0.90% from 0.76% yesterday.

Data released yesterday saw Japan’s Household Spending dip to -0.3%, bettering forecasts at -3.3%. Australia’s Trade Balance rose to +AUD 4.36 billion, beating median estimates of +AUD 3.75 billion.

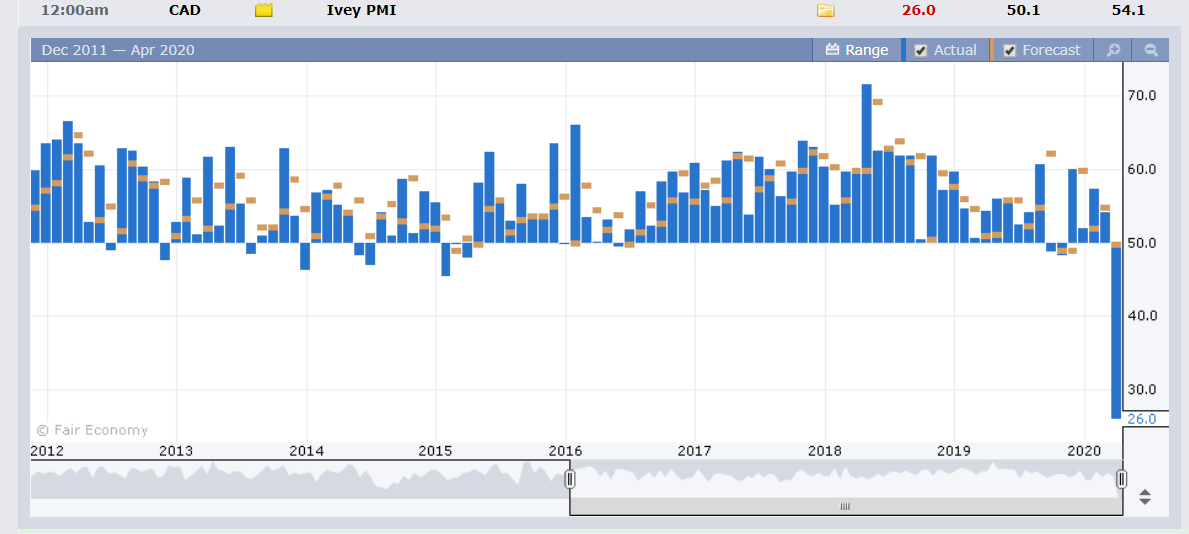

German Industrial Production climbed to 0.3% in March from an upwardly revised 3.2% the previous month, beating expectations of -0.7%. Canada’s IVEY March PMI slumped to 26.0 from 54.1, underwhelming forecasts of 50.1. US JOLTs Job Openings climbed to 6.88 million, better than forecasts of 6.55 million from an upwardly revised 7.01 million.

On the Lookout: Uncertainty continued to dominate trade into a shortened trading week ahead of the long Easter break which begins on Good Friday. Volatility stayed high. Despite growing signs of a slowing on the Covid-19 contagion, the market’s risk-on mode evaporated at the New York close. Global leaders continue to look at additional stimulus support measures.

With liquidity thinning into the weekend, we can expect higher volatility in FX.

Today’s economic calendar is light. The main event comes in at the end of the North American trading day which is the release of the Fed’s FOMC Minutes.

Japan kicks off with its Core Machinery Orders, Current Account and Economic Watchers Sentiment. Australia reports its Home Loans data for February. Canadian data follow with Housing Starts (March) and Building Approvals (February).

Trading Perspective: The Dollar Index (USD/DXY) retreated after hitting 100.931 yesterday, just below the resistance level of 101.00. This coincides with a EUR/USD base at 1.07727 Tuesday night. The Euro takes virtually 60% of the weight in the Dollar Index.

As we approach the Easter weekend, market positioning will be a key factor with expected high volatile trade. We highlighted the net speculative USD shorts increased as a result of a strong build in Euro long bets which totalled the biggest since June 2018.

While Covid-19 pandemic may be easing off in parts of the world, other parts (Japan, Asia) are still unknown and the crisis is still far from over. This will continue to be USD supportive.