Summary: FX saw a muted, nervous start in early Asia with risk-off sentiment prevailing as trade tensions build between the US and China. Golden Week holidays kick off today with Japanese and Chinese markets closed for most of the week. Over the weekend, US President Trump and Treasury Secretary Mike Pompeo escalated trade tensions with China suggesting that the Communist Party’s leadership downplayed the severity of the coronavirus, increasing imports and decreasing exports of medical supplies. Trump threatened to impose new tariffs on China over the coronavirus crisis.

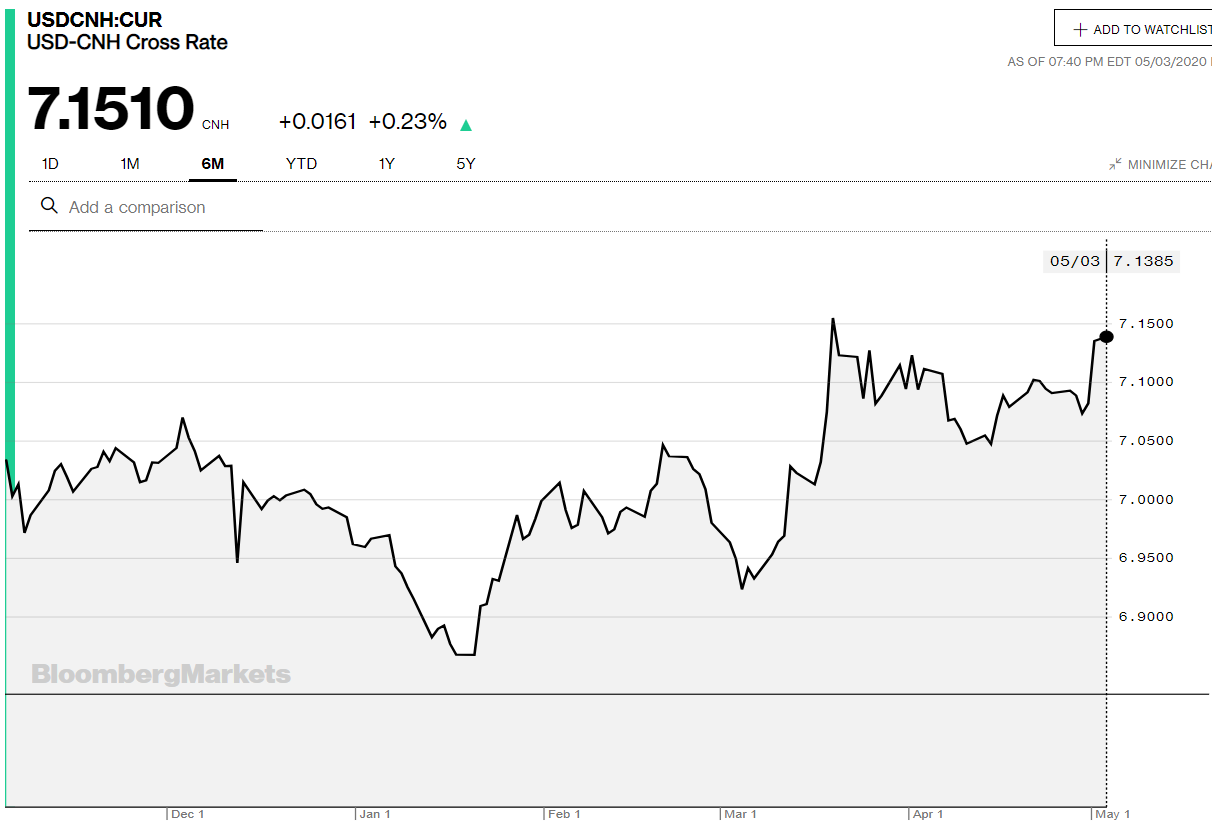

In thin, illiquid trading the Aussie and Kiwi stayed on the back foot, sustaining losses from Friday. AUD/USD, down 1.4% on Friday, dropped from its 0.6420 NY close (0.6515 Friday) to 0.6401. The New Zealand Dollar slumped to 0.6040 from 0.6060 NY close and 0.6103 Friday. The Euro dipped to 1.0963 from 1.0980 New York close (1.0952 Friday start). Against the safe-haven Yen, the Dollar dropped 0.55% to 106.92 (107.20 Friday). Sterling was changing hands against the Greenback at 1.2490 (1.2588 Friday). USD/CAD rallied 0.9% to 1.4100 (1.3940 Friday morning). Canada appointed Tiff Macklem, an experienced central banker as the 10th and new Governor of the Bank of Canada. Emerging Market currencies and risk assets slumped. The USD/CNH pair (onshore US Dollar/Chinese Yuan) climbed to one-month highs at 7.1350 from 7.0825 Friday. In early Asia, USD/CNH traded up to 7.1510. Against the South African Rand, the Greenback was trading 1.3 % higher at 18.84 from 18.52. Wall Street stocks retreated. The DOW finished 2.11% lower to 23,710 (224,245 while the S&P 500 was 2.13% down in late New York to 2,826 from 2,828.

On the COVID-19 front, Gilead Sciences donated its entire supply of Remdesivir, the drug that has shown success in helping patients recover faster, to the US government.

Data released Friday saw US ISM Manufacturing PMI’s fall in April to 41.5 from 49.1 in March but better than forecast of a fall to 36.7.

On the Lookout: Amidst thin trading conditions due to the start of Golden Week celebrations in China and Japan, we have another busy data week ahead.

Today kicks off with Australia’s Building Approvals and ANZ Job Advertisements. Euro area reports follow with Switzerland’s Final Manufacturing PMI’s. Shortly after, Italian, German, French and Eurozone PMI’s follow. Eurozone Sentix Investor Confidence Index and the European Union’s Economic Forecasts follow. Finally, the US releases its April Factory Orders report.

Tomorrow (Tuesday) the RBA meets on interest rates followed by it policy Statement.

On Wednesday, New Zealand Payrolls, Euro area Services PMI’s and the US ADP Non-Farms Payrolls data are released. Thursday (May 7) sees Australian and Chinese Trade Balances, US Weekly Jobless Claims as well as the Bank of England’s interest rate meeting and policy statement, and US Weekly Unemployment Claims. Finally, on Friday Canadian and US Non-Farms Employment Changes and Unemployment rates for April are released.

Trading Perspective: As Washington ramps up its accusations on the failure of China’s leadership to report the coronavirus outbreak in late January to the rest of the world, expect the risk-off theme to prevail in Asia. Liquidity will be at a premium with Japan and China on holiday today.

Initially, as the risk-off mood extends we can expect the Yen to outperform while Commodity and Emerging Market currencies will continue to decline against the US Dollar.

The Aussie, Kiwi, Loonie and Emerging Market currencies are headed south.

However, should the situation worsen, and the US imposes capital controls on China, the Greenback could suffer as outflows resulting from a shift from USD reserve holdings into EUR, GBP, JPY and other reserve proxies.