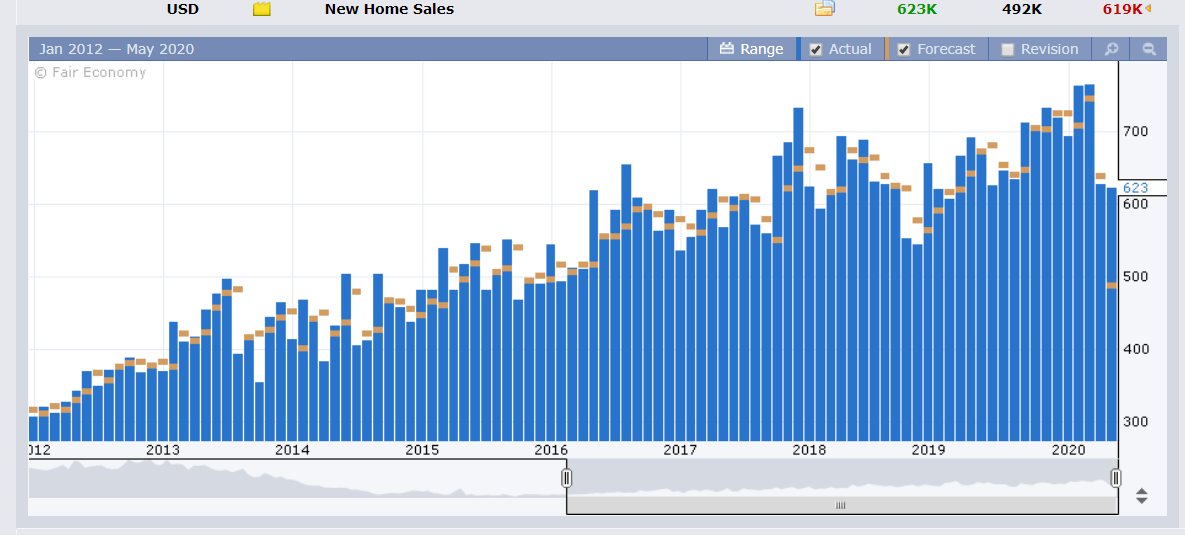

Summary: Risk-on, Dollar off. It’s a pattern that is now becoming familiar. Markets embraced global economic repopenings and a concerted push to find a Covid-19 vaccine while shrugging aside ongoing US-China tensions, for now. The Greenback fell against all of its rivals with Risk and Emerging Market currencies outperforming while equities rallied. US biotech company, Noravax Inc became the latest company to join the race to test a vaccine for the coronavirus, announcing it had started human trials in Australia. The risk leader Aussie Dollar ratcheted higher to 0.66751, near 3-month highs before easing to settle at 0.6660 (0.6547), up 1.53%.Against another growth currency, the Canadian Loonie, the Greenback slumped 1.4% to 1.3780 from 1.3980 in late New York. The Euro rallied 0.74% to 1.0985 from 1.0905 yesterday buoyed by the overall weaker US Dollar. Sterling rebounded strongly to close at 1.2338 from 1.2188 amid rumours of a potential breakthrough in trade negotiations between the UK and EU. The USD/JPY pair was modestly lower to 107.54 from 107.72. News reports that the US is considering a range of sanctions against China amidst Beijing’s pressure on Hong Kong saw Wall Street stocks pare gains at the close. The DOW finished 1.2% higher to 25,067 (24,775). The S&P 500 rose above the 3,000 level to 3,024 for the first time in early March before paring gains to 2,994 in late New York. Global bond yields were higher. The benchmark US 10-year rate rose to 0.70% from 0.66%. Germany’s 10-year Bund yield climbed 7 basis points to -0.43% while Japan’s 10-year JGB yield was unchanged at -0.01%. US economic data mostly bettered expectations. New Zealand’s Trade Surplus rose to +NZD 1,267 million from +NZD 722 million, beating forecasts of +1,250 million. UK CBI Realised Sales Diffusion Index fell to -50 from -55, beating forecasts of -65. US Conference Board Consumer Confidence rebounded slightly to 86.6 from 87.1. US New Home Sales climbed to 623,000 units, bettering forecasts of 492,000 units, a sign that lower US interest rates are boosting Housing.

On the Lookout: Its all about risk appetite and optimism has hurt the Greenback. While yesterday’s move was a relatively big one, it is far from a game changer just yet. Markets will keep an eye on the global economic reopenings. Economic data will take on significance from here on in. While hopes for a vaccine run high, it will take time for the approval, manufacture, and distribution. Ironically, the US data released were better than forecasts. If this continues, US interest rates will edge higher and give the Greenback support. Finally, any heightening of the e US-China tensions will see a US Dollar rebound. Today’s data releases are light. The RBNZ’s Financial Stability Report, just released was optimistic and lifted the Kiwi although any rise in Sino-US tensions could weigh on the Bird.

Today’s main event is a speech from ECB President Christine Lagarde to a European Youth video conference on the ECB’s response to Covid-19. Australia kicks off with its Construction Work Done report. European data see Credit Suisse’s Swiss Economic Expectations. US Richmond Manufacturing Index and the Fed Beige Book round up today’s reports.

Trading Perspective: The Dollar Index (USD/DXY) a favoured gauge of the Greenbacks value against a basket of six major currencies fell to 98.994 from 99.792 yesterday. This is a strong support level which should hold. This coincides with the EUR/USD resistance at 1.1000 which should hold today. Last week we reported the market positioning was overall short US Dollar bets against the currencies. We look for the latest Commitment of Traders report tomorrow.

Watch the risk currencies today. While they have seen strong rallies, strong resistance levels need to be overcome. We take a look at the individual currencies.