Summary: Risk appetite faltered further in early Asia after New Zealand reported two new Covid-19 cases following a run of 24 days with no new infections. Mounting concerns on new lockdown measures in Beijing and a spike in coronavirus cases in several US states weighed on risk appetite. Geopolitics saw military tensions between India and China simmer over a border dispute. The US Dollar edged higher while stocks slipped. Greenback gains were capped after Fed Chair Jerome Powell told House lawmakers that the economy needed more fiscal support. The Dollar Index (USD/DXY) a favourite gauge of the Greenback’s value against a basket of 6 foreign currencies was mildly up to 97.076 (97.019). Haven sought currencies, the Yen and Swiss Franc outperformed. The USD/JPY pair slipped to 106.97 from 107.30 while USD/CHF (Dollar-Swiss Franc) finished at 0.9490 (0.9515). The Euro dipped to 1.1240 from 1.1265 while Sterling was sold off to 1.2555 (1.2575). The Australian Dollar closed 0.15% down at 0.6885 (0.6895) while the Kiwi (New Zealand Dollar) eased to 0.6459 (0.6467). Against the Canadian Loonie, the Greenback was up 0.20% to 1.3565 (1.3545 yesterday). Wall Street stocks retreated after 3 straight days of rising. The DOW slipped 0.59% to 26,167 (26,307) while the S&P 500 was 0.31% lower to 3,117 (3,129). Bond yields were little change. The key US 10-year bond yield closed at 0.74% (0.75% yesterday).

Data released yesterday saw Japan’s trade balance at -JPY 0.6 trillion, beating expectations of –JPY 0.68 trillion. UK Headline CPI matched forecasts with at 0.5% print while Core CPI slipped to 1.2% from the previous months 1.4% and forecasts of 1.3%. The Eurozone’s Final CPI was at 0.1%, matching expectations. Canada’s Headline CPI slipped to 0.3%, missing forecasts at 0.8%. US Building Permits in May were at 1.22 million, against forecasts at 1.23 million. Housing Starts saw a dip to 0.97 million against median expectations of 1.10 million.

On the Lookout: Today is a busy one and sees a pickup in events and economic data. New Zealand just reported its Q1 GDP slumped to -1.6% from the previous quarter’s 0.5% underwhelming forecasts at -1.0%. The Kiwi initially jumped to 0.6478 from 0.6458 before dropping back to its current 0.6455.

Australia reports its Employment data where a loss of 105,000 jobs are forecasts from the previous loss of 594,300. Australia’s Unemployment rate is expected to climb to 6.9% from 6.2%. Anything less than these expected number will see the Australian Dollar sold off. China reports its Foreign Direct Investment data. European reports kick off with Switzerland’s Trade Balance followed by the Swiss National Bank’s rate decision and Monetary Policy Assessment. The SNB is widely expected to keep interest rates unchanged as the relaxation of restrictions in Europe ease concerns. The Bank of England has its monetary policy announcement where traders are expecting the BOE to increase their bond buying program. Should the BOE increase their QE more than expected or introduce negative rates, the British Pound would break lower.

Canada reports its ADP Non-Farms Payrolls Change and Wholesale Sales data. Finally, the US sees its Philadelphia Fed Manufacturing Index and Conference Board’s Leading Index.

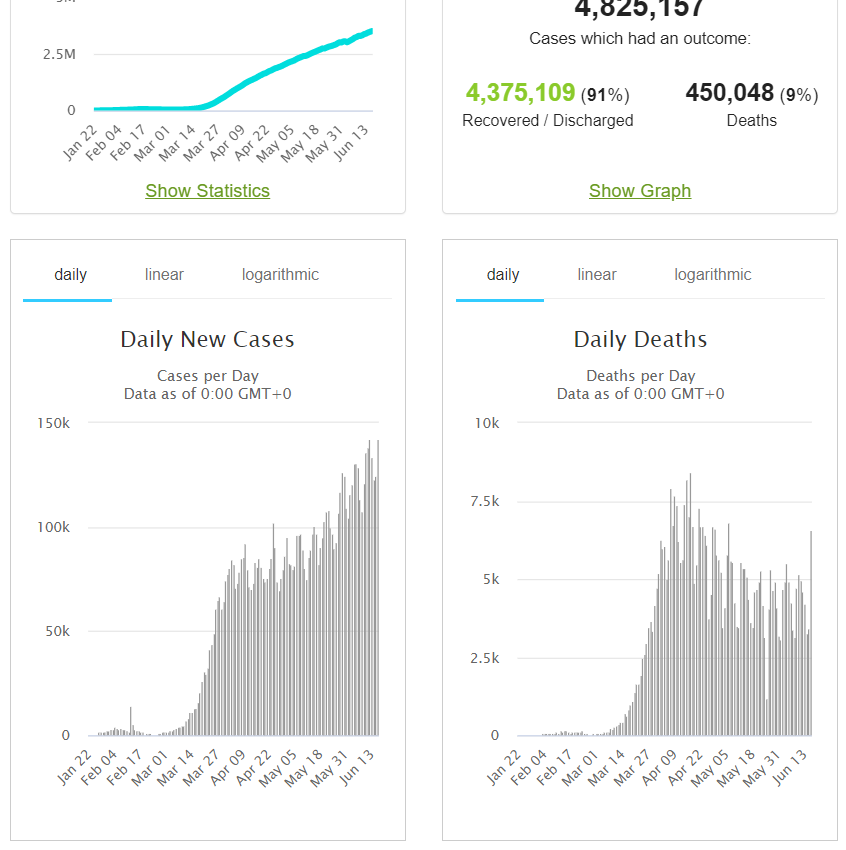

Trading Perspective: Traders will continue to monitor geopolitical tensions in the region (India and China and North and South Korea) as well as the spikes in new cases around the globe. These will weigh on risk appetite and continue to provide the US Dollar with mild support. The search for a vaccine to Covid-19 continues to intensify with pockets of bright spots in some countries. While there has been a spike in new coronavirus cases, the rise in the rate of deaths is starting to slow. Meantime central banks and governments will be looking to take more monetary and fiscal action to keep economic recoveries going which is expected to be a long road back.

Market positioning will continue to play a part in the next FX moves. We reported yesterday that the latest Commitment of Traders report saw an increase in net speculative US Dollar shorts.

Expect more consolidation initially as we await fresh data and developments. On balance, the Dollar’s support is strong, and the Greenback may be gaining momentum to climb higher.