It has been an unprecedented start to the year. With the first half of 2020 in the books and Q2 earnings season upon us once again, what can we expect in the way of earnings shocks and forward guidance? Also, what kind of stock trading environment are we likely to find ourselves encountering throughout the second half of the year?

COVID-19 impact more severe in Q2

For reasons that are now obvious to almost everyone, markets were broadly expecting Q1 to be a bad quarter for company earnings. However, it was Q2 that was expected to bear the brunt of the economic cost of COVID-19. Many companies withheld forward EPS guidance in Q1 due to the pandemic, so aside from the pains associated with reopening the economy this coming earnings season may also have a few surprises in store. According to FactSet, of the 48 companies that did provide forward EPS guidance for Q2, 27 issued negative guidance and only 21 issued positive guidance. Additionally, we saw a slew of downward revisions in the relatively few companies that did provide forward guidance at the end of Q1.

As things currently stand, total earnings for the S&P 500 are expected to fall by more than 40% in Q2, with a decline in revenues in excess of 11%. If the forecasts hold true, it will be the largest reported year-over-year decline since Q4 of 2008. The sectors that have been hit the hardest are the automotive sector, transportation and energy, all with earnings declines expected in the triple digits; a scenario that seemed outside the realms of possibility this time last year.

Tech leads recovery but utilities most resilient

Technology is expected to fare better than most, with the NASDAQ’s recent all-time high testifying to the strength of its usual subjects. In fact, out of Apple, Amazon, Facebook, Google, and Microsoft, Google is the only company to have not reclaimed its former all-time highs as of yet. Despite this, the broader tech sector is still expected to incur losses, albeit more modest ones, with revenues expected to come in around 1% lower and earnings around 13% lower than this time last year.

Healthcare and utilities are the only two sectors expected to record year-over-year revenue growth. This can be explained by these being the two sectors that have been kept the busiest during the lockdown, due to substantial numbers of the US populace sheltering at home or alternatively requiring medical attention and/or Covid-19 tests. The forecasts for these two sectors see revenues growing by 0.7% and 0.2%, respectively.

No recovery until 2021

It’s estimated that the part of the US economy represented by the stock market will not recover fully until 2021, with earnings and revenue growth broadly returning in Q1 of 2021. However, this is still expected to be below the 2019 levels. At the end of March, estimated revenue declines for Q2 of 2020 were forecasted at -1.6%. As we have seen above, the actual figures today are around -11%, which reveals the kind of climate we currently find ourselves in, as well as the difficulty in predicting a situation with so many unknown variables.

The earnings estimates for Q3 and Q4 of this year currently stand at around -25% and -13% respectively, with an expected return to earnings growth anticipated in Q1 of 2021. Whether 2021’s figures are to reveal growth when compared to 2019 (and indeed whether 2020s Q3 and Q4 forecasts aren’t as wildly off as Q2’s has been) depends largely on whether the reopening of the US economy goes as planned. This means no second wave of infections requiring a reappraisal of reopening policies or even, in a worst-case scenario, a selective return to lockdown for certain states.

Dip-buying buoying US markets

What’s becoming increasingly clear is that the persistent buy-the-dip mentality among US stock traders, coupled with the massive surge in retail trading activity during the lockdown, has contributed to US stocks not just pricing in the recovery, but also going some way beyond that. This may be unwarranted at this time, despite the Federal Reserve’s incredible amounts of stimulus, which has effectively muddied price discovery across almost all asset classes.

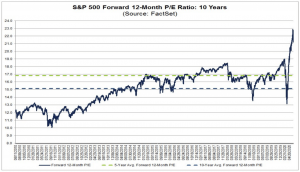

Relative to the state of the real economy, by most measures US stocks are currently overpriced. When you look at the forward 12-month P/E ratios, the S&P 500 is currently trading at more than 21 times earnings, which is significantly higher than both its 5-year (16.8) and 10-year (15.1) averages. Since the market turbulence of Q1, the price of the S&P 500 has risen by more than 16%, while its forward 12-month EPS estimate has fallen by over 13%. This leaves specific sectors of the index, and more importantly, individual stocks, ripe for a shake-up in the coming months.

What to look out for

So, what can we expect? Aside from the broader picture of all US stock markets having bounced enthusiastically from their recent lows, and a general feeling that they are overpriced, the story of Q2’s earnings season may very well be about separating the stocks that have bounced too aggressively, from the ones that may not have bounced aggressively enough. For instance, it’s no secret that tech has led the bounce we’ve seen recently. With P/E ratios currently at multi-year highs, you have to wonder whether some of these companies, great as they may be, could be looking at corrective moves.

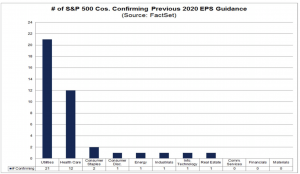

On the other hand, the utility and health sectors, which we’ve already discussed above, don’t seem to have been given the bump they deserve. The disparity between the number of companies belonging to these sectors that have actually managed to meet their 2020 forward guidance targets (provided pre-coronavirus) is impressive. This is particularly true of utilities, which have seen a year-to-date decline of over 9%, while the broader S&P 500 index has seen a year-to-date increase of around 7%.

Finally, the financial sector. It recorded the fourth largest downward revision in expected earnings since the beginning of the quarter, from around -14% to over -50%. Of the ten sectors soon to report their earnings, financials are currently lagging behind most other sectors. As far as year-over-year earnings declines are concerned, only energy, consumer discretionary and industrials are expected to have performed worse than financials in Q2. This leaves the financial sector in an interesting situation. If history is anything to go by, it’s likely to be one of the main benefactors of the Fed’s outsized stimulus package. Perhaps it may be a little early for this influx of capital to register on the price of some of the main players in this sector; however, it’s possible that we’ll see a bump in their performance as the benefits of all this “free” money begin to be felt.

by Giles Coghlan, Chief Currency Analyst at HYCM

About HYCM

HYCM is the global brand name of Henyep Capital Markets (UK) Limited, HYCM (Europe) Ltd, Henyep Capital Markets (DIFC) Ltd and HYCM Ltd, all individual entities under Henyep Capital Markets Group, a global corporation founded in 1977, operating in Asia, Europe, and the Middle East.

High Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

References:

https://www.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_061220.pdf

https://www.zacks.com/commentary/939095/looking-ahead-to-a-coronavirus-damaged-q2-earnings-season

https://finance.yahoo.com/news/strong-stocks-ahead-q2-earnings-204308646.html

https://finance.yahoo.com/news/q2-earnings-season-preview-210109053.html