Summary: The first quarter of 2020 ended with the Covid-19 outbreak giving no break to markets as the number of cases in the US, Italy and Spain grew. The Dollar Index (USD/DXY), a measure of the Greenback’s value against 6 major currencies ended modestly higher at 99.08, from 99.03 yesterday. For the quarter, the US Dollar was up 2.8%. In another highly volatile session, the Euro eased to 1.1025 from 1.1043, after dropping to an overnight low at 1.0927. The Aussie rose to 0.62138, a 2-week high before easing to 0.6143, belying its wild 143 pip range. Against the Yen, the Dollar fell to 107.56 from 107.86 after hitting an overnight high at 108.73. Japan’s fiscal year-end yesterday saw demand for the Japanese currency as corporates and asset managers adjusted their portfolio’s. Sterling ended little changed at 1.2416 from 1.2406 yesterday. The US Dollar slumped 0.77% against the Canadian Loonie to 1.4095 from 1.4147 as Oil prices posted small gains. Emerging Market currencies were mostly higher against the US Dollar following recent steep losses. Reuters reported that the “Federal Reserve moved to expand the ability of dozens of foreign central banks to access Dollars during the coronavirus crisis.” This will help pare Dollar gains with more supply from the US central bank for short term foreign company demand. USD/SGD eased to 1.4215 from 1.4235. Against the Thai Baht, the Dollar rose to 32.75, up 0.45% from 32.55 yesterday.

Wall Street stocks closed the quarter officially in the red. The Dow finished at 2% lower to 21,925. The S&P 500 lost 1.9% to 2,590. US bond yields were mixed. Two-year treasury yields climbed to 0.25% from 0.23% while the key 10-year rate dipped to 0.66% from 0.70%. Other global bond yields were mixed.

China’s Manufacturing PMI in March rose to 52 from 35.7, beating forecasts at 44.9. While the data showed improvement, markets were sceptical this could continue. China’s official Caixin Manufacturing PMI data is released today. The US Conference Board Consumer Confidence Index fell in March to 120.00 from an upwardly adjusted 132.6 in February although it beat forecasts at 115.1.

On the Lookout: FX carried a slight risk-off tone heading into the first day of Q2 2020 with the coronavirus crisis ever-present. Meantime the Fed and global central banks have continued to throw everything at the Covid-19 as economists expect global growth to be punished in the second quarter. Today’s spotlight is on the global Manufacturing PMI’s and US ADP Private Sector Jobs change. Australia starts off with the AIG and CBA Manufacturing PMI reports. Japan’s Tankan Manufacturing and Non-manufacturing indexes follow. China rounds up Asia’s reports with its official Caixin Manufacturing PMI. European data start off with Germany’s Retail Sales followed by Swiss, Euro-area, Eurozone and UK Manufacturing PMI’s. The Eurozone also releases its Unemployment rate. North American reports start off with Canada’s Manufacturing PMI. The US ISM Manufacturing PMI, ADP Private Non-Farms Employment Change, Construction Spending and Wards Total Vehicle Sales round up the day’s report. Huge in terms of first-tier data.

Trading Perspective: The ever-present coronavirus crisis will continue to dominate FX and all financial markets. While the US Dollar should see further short-term support, trading will continue to highly volatile. Sean Lee, founder and CEO of FXWW, a firm that sources FX talent from the retail market, observed that the discretionary traders, those with institutional experience have returned the best results in the past 8 weeks. Volatility can be your best friend if discretion is used.

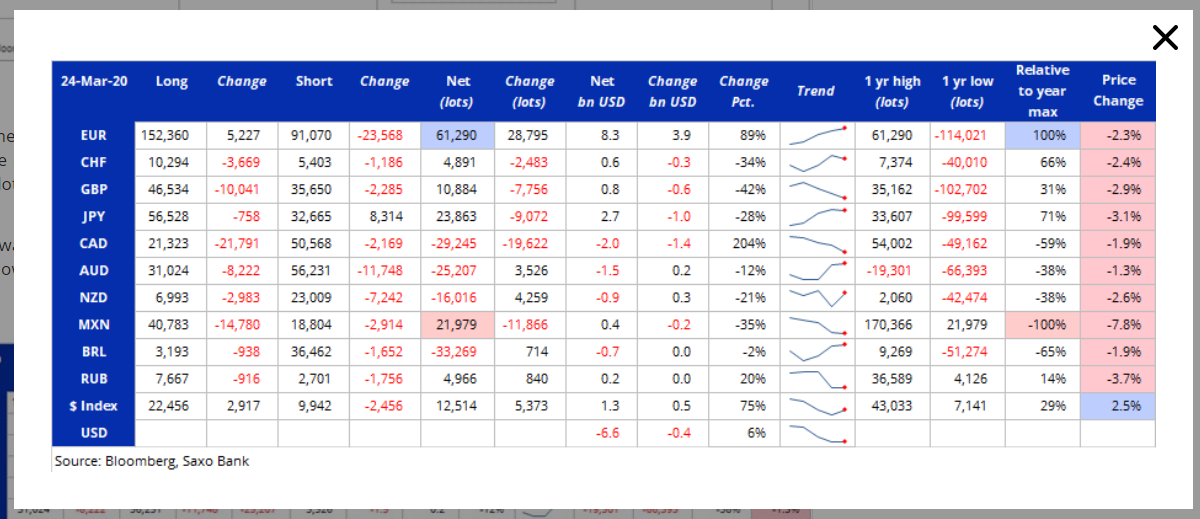

The latest Commitment of Traders CFTC report saw net speculative USD shorts climb to a total of USD 6.6 billion in the week ended 24 March. Most of the build was due to strong buying in the Euro. In the JPY and CAD the USD was bought. We look at the individual currencies in their respective reports.