Summary: More promising Covid-19 vaccine trials and hopes for further government stimulus measures sparked optimism and boosted risk. Wall Street stocks rallied after drugs from AstraZenica, and a partnership between Pfizer Inc and German biotech firm BioNTech were safely administered and induced immune responses The US Dollar slipped against all its major rivals with the British Pound outperforming in FX, up 0.92% to 1.2660 (1.2570 yesterday). Bank of England chief economist Andy Haldane said he believed the UK economy hit its floor around the middle of April and has recovered almost half of its losses since then. The Euro advanced 0.26% to finish at 1.1450 (1.1427) in late New York on expectations of a likely agreement by the EU on a recovery fund despite continued opposition from hardliners, the Frugal Four (Austria, Netherlands, Sweden, and Denmark). Finland has also resisted the package. Risk leader the Australian Dollar managed to gain 0.38% to 0.7017 (0.6995 yesterday) even as New South Wales, the country’s most populous state saw a further rise in coronavirus infections and the likelihood that tighter restrictions could be imposed. Risk-on sentiment saw the Dollar climb against the Japanese Yen, up 0.31% to 107.30 from 107.00 yesterday. The USD/CAD pair eased to 1.3535 from 1.3585 yesterday. Emerging Market currencies saw modest rallies against the Greenback. The DOW finished up 0.41% to 26,737 (26,670) while the S&P 500 gained 0.93% to 3,252 (3,225 yesterday).

Data released yesterday saw Japan’s Trade Deficit at -JPY 42 trillion, missing forecasts at -JPY 33 trillion. Germany’s PPI missed expectations with a 0.0% print against 0.2%.

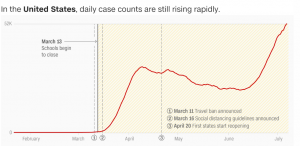

In the US, total daily cases of the virus continued to rise rapidly. Daily deaths also increased by a total of 347. The state of Texas reported 62 people had died, lifting its total to 4,020 due to the pandemic.

On the Lookout: There is little in the way of economic data and events out today. Australia sees the RBA’s release of its June monetary policy meeting minutes (11.30 am Sydney time). Shortly after, (12.30 pm Sydney) RBA Governor Philip Lowe speaks at a video conference event on Covid-19 and the Labour situation. Japan releases its annual National Core CPI data for July followed by New Zealand’s Credit Card spending report. Switzerland kicks of European data with its Trade Balance. The UK sees its Public Sector Net Borrowing released. North America kicks off with Canada’s Headline and Core Retail Sales report for June. There are no major US economic reports due out today.

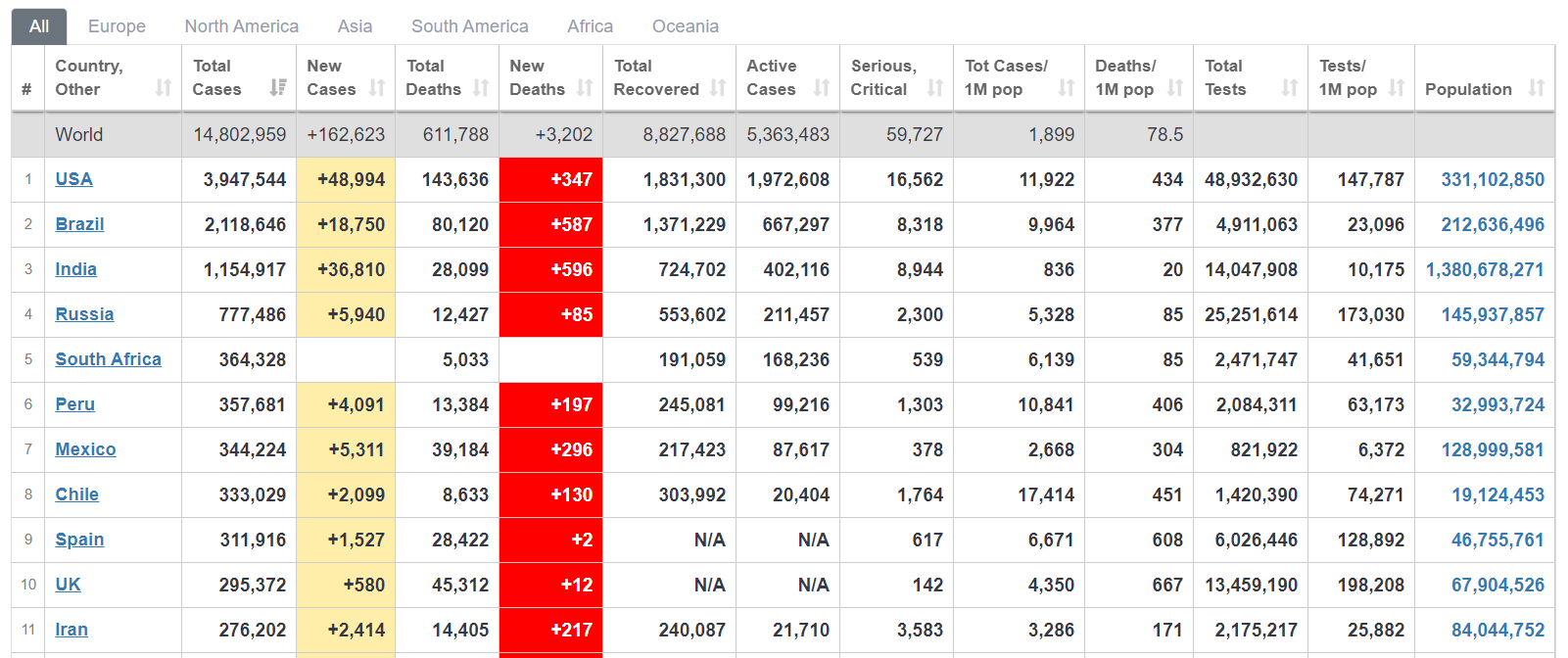

The spotlight will continue to fall on the recent promising vaccine trials and further stimulus measures to quell a spiralling of new virus infections all around the globe. The US is headed to hit a total of 4 million cases (3,948 million as at today). India, the world’s new hotspot recorded the unfortunate rise of 596 new deaths at latest count with total cases at 1.155 million, currently in third spot. Total global Covid-19 cases are approaching the 15 million mark, currently at 14.803 million.

Markets paid little heed to these statistics pinning hopes on a successful virus vaccine and expectations that the global governments will provide more stimulus measures to boost their economies. Optimism outweighs pessimism as the battle for risk continues.

Trading Perspective: The Dollar continued to head south against most of the major currencies as risk appetite improved. Virus woes seem to have been thrown out of the window for now. Expect Asia to continue the trend of a weaker Greenback at the outset. Asian stocks look set for gains following Wall Street’s lead. The caveat for markets to open their eyes to the risks to the spiralling new virus cases may be the resulting deaths (unfortunately). On the coronavirus global worldometer, last updated a few hours ago, total deaths hit close to 612,000. New deaths in the US, Brazil and India totalled 1,530. A hit to risk appetite will see demand flow back into the Greenback.

The EU is expected to agree its much-awaited rescue package but with a watered-down version. Which may take away some of the Euro’s recent shine. We look at a couple of currencies below.