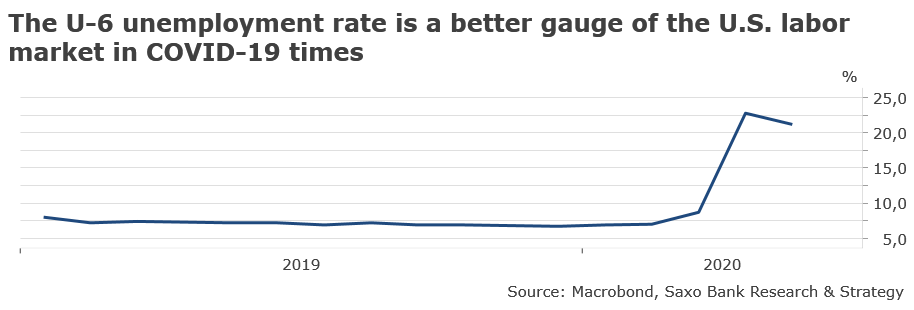

Summary: Due to data volatility, misclassification and the recent rise in new COVID-19 cases which made many States to put reopenings on hold, investors should refrain from drawing any hasty conclusions from the U.S. June Employment Report published by the Bureau of Labor Statistics today. The U-3 unemployment rate, which is the most commented, is likely to provide a truncated view of the real state of the U.S. labor market. For the time being, we prefer to refer to the U-6 unemployment rate, which better gauges labor underutilization, and the employment-to-population ratio in order to assess the evolution of U.S. employment.

Today at 8:30 GMT, the Bureau of Labor Statistics (BLS) will release the U.S. June Employment Report, just before the extended Independence Day weekend. The market consensus estimate is that the United States added 3 million new jobs in the past month, after an increase of 3.8 million in May, and that the official unemployment rate U-3 is likely to decrease from 13.3% to 12.4%. As was the case one month ago when the May Employment Report was released, it is probable that investors and analysts will interpret today’s report in a way that confirms their point of view – for the most optimistic ones it will constitute a proof that the economy is following a V-shaped recovery, for the most pessimistic ones it will prove once again that official statistics don’t reflect the real state of the U.S. labor market and they will continue to maintain the view that the economy is following an L- or W-shaped recovery.

We strongly advise investors to refrain from drawing any hasty conclusions from the report, mainly for four reasons:

- MoM statistics are extremely volatile in COVID-19 times and subject to very large revision, as was the case yesterday with the May ADP report. We also expect a very important revision of the May nonfarm payrolls today that was initially out at +2.5 million – the largest monthly increase since 1939.

- If the BLS manages to fix misclassification of out-of-work Americans in the June report – an issue that has been raised when the May report was released, it will make a comparison between May and June extremely difficult. Actually, it would even be a non-sense to try to make any comparison between the data.

- The June labor market indicators reflect a reality that does no longer exist due to the coronavirus spread in the U.S. that conducted many States to put reopenings on hold or even to reverse reopening plans. In the past twenty-four hours, the United States experienced a new record of infections at 52,898 – confirming that the health crisis is clearly not contained. Over the past few days, it has forced four states (Arizona, California, Florida, and Texas) to reverse reopenings while eleven are now on pause. Today’s statistics are unlikely to take into account the fact that a very large number of workers all over the country are getting laid off for a second time due to the spread of the virus.

- The U.S. labor market is not out of the woods yet, according to most business surveys. Based on the LendingTree small business survey (May 2020), only 50% of small businesses say they are bringing back all employees all hours once they will be able to reopen. The risk is that long-term unemployment will rise, thus increasing further preexisting social and racial tensions.

For the time being, and in the absence of a better alternative, we prefer to refer to the following indicators in order to track the evolution of U.S. employment:

- The U-6 unemployment rate which includes individuals who are marginally attached to the labor force, and better gauges labor underutilization. In May, it declined to 21.2% from 22.8%.

- The labor force participation rate which reflects the return of persons to work. In May, it jumped to 60.8% from 60.2% but still remains way below pre-COVID levels.

- The employment-to-population ratio, which shows that there is still a very long way before labor market normalization, as almost half of the U.S. population does not have a job.

We will post our comment on Twitter @Dembik_Chris when the BLS report will be released.