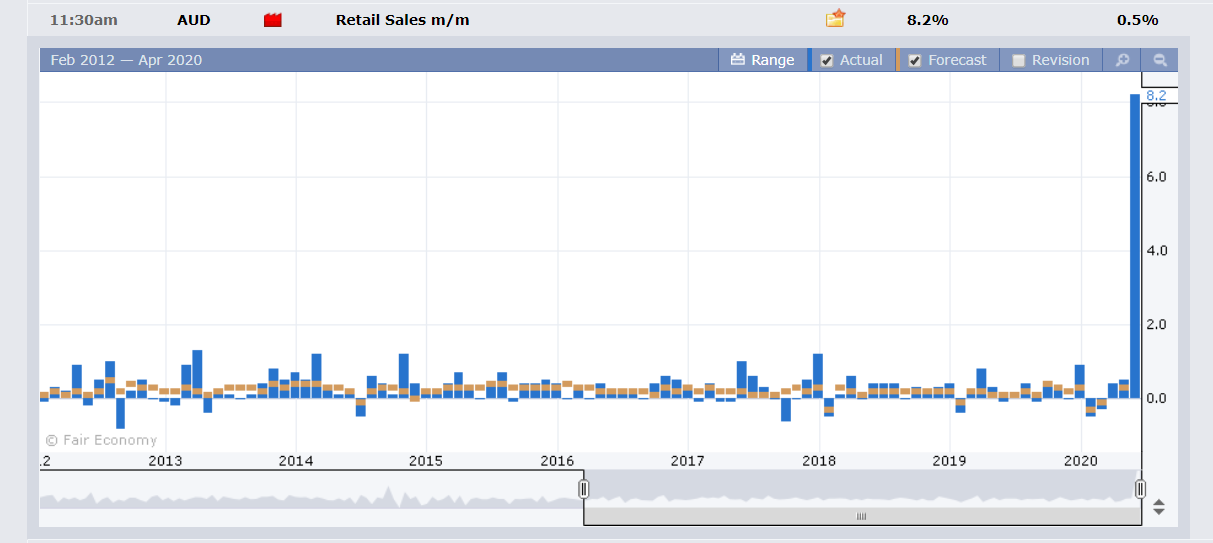

Summary: Risk appetite stabilised as oil prices recovered following two days of furious losses. Equities rebounded with the US House of Representatives set to pass a new coronavirus stimulus package worth around USD 500 billon. FX was cautious in muted trade. The Dollar finished mixed against its rivals with the Euro underwhelming, down 0.35% against the Greenback at 1.0822 (1.0859). European Union leaders meet today to try and come up with a plan to help economies recover from the coronavirus outbreak amid major disagreements. Sterling was up modestly to 1.2330 from 1.2300. The Australian Dollar finished as best performing currency, up 0.38% to 0.6322 (0.6286). Preliminary Australian Retail Sales in March (pre-lockdown) climbed 8.2% on a surge in hygiene products. Against the oil sensitive Canadian Loonie, the US Dollar eased to 1.4162 from 1.4200. The USD/JPY pair ended flat at 107.75. Asian and EM currencies halted 2 days of losses against the Greenback. USD/THB (US Dollar/Thai Baht) retreated t0 32.38 (32.52) while the Dollar fell 0.7% against the Indian Rupee to 76.45. Wall Street stocks closed higher. The DOW was up 2.2 % to 23,485 (23,035) while the S&P 500 added 2.3% to 2,801 (2,740). Bond yields climbed with the benchmark US 10-year rate up 4 basis points to 0.62%. Germany’s 10-year Bund yield ended at -0.41% from -0.48%.

Other data released yesterday saw UK Annual CPI in March match forecasts at 1.5%. Core PPI rose 1.6%, also matching expectations. Canada’s March CPI (monthly) fell to -0.6% from February’s +0.4%, missing forecasts at -0.4%. Eurozone March Consumer Confidence fell to -23.0 from -12 in February, underwhelming forecasts at -20.0.

On the Lookout: The data front picks up today with global Manufacturing and Services PMI’s. Australia kicks off with its Commonwealth Bank Preliminary Manufacturing and Services PMI’s for April. March’s PMI data were both revised lower. Australia’s Trade Balance (March) will also be released. Japanese Flash Manufacturing PMI’s and Leading Economic Indicators follow. New Zealand reports on its Annual Credit Card Spending for March. European reports start off with the Eurozone GFK Consumer Climate followed by UK Public Sector Net Borrowing. French, German and Eurozone Flash Manufacturing and Services PMI’s follow. The UK reports its Flash Manufacturing and Services PMI’s and CBI Industrial Trends Survey. The US Initial Weekly Unemployment Claims, Flash Manufacturing and Services PMI’s round up the day’s reports.

Markets will look carefully into the data. The US Initial Jobless Claims will take the limelight with a smaller loss forecast at 4.35 million from the previous 5.245 million. Amidst all of this, the US economy inches closer to a re-opening.

Expectations are for a deterioration in the overall data as the world economy faces a contraction by -2% in 2020. It becomes a battle with the relief packages and the gradual opening from lockdowns of different countries.

Trading Perspective: The Dollar Index, (USD/DXY) saw a modest rise to 100.353 from 100.207 mainly due to the 0.38% fall in the Euro (which takes almost 60% of the weight in the USD/DXY). Commodity currencies, the Aussie, Loonie and Kiwi all advanced after oil prices stabilised and the CRB Index rebounded. Against the Yen, the US Dollar was flat. All this is saying is that we can expect consolidation at current levels with the Euro looking particularly vulnerable. Equity gains were modest. Expect further consolidation with volatility just around the corner.